US100 loses more than 0.5% today, and the index decline is mostly fuelled by declining Meta Platforms shares, pressuring the 'AI theme' as investors reacted cautiously for the company huge AI CAPEX. Deutsche Bank has lowered the price target for the stock to $880 from $930 (still maintaining a Buy rating). Meta was seen by Wall Street as one of the biggest winners of 'AI trend', monetizing digital ads and implementing AI into the 'Family App': Facebook, Instagram and WhatsApp.

Deutsche Bank Warns About AI CAPEX?

-

Analysts cited larger-than-expected AI and infrastructure investments, which will weigh on short-term cash flow.

-

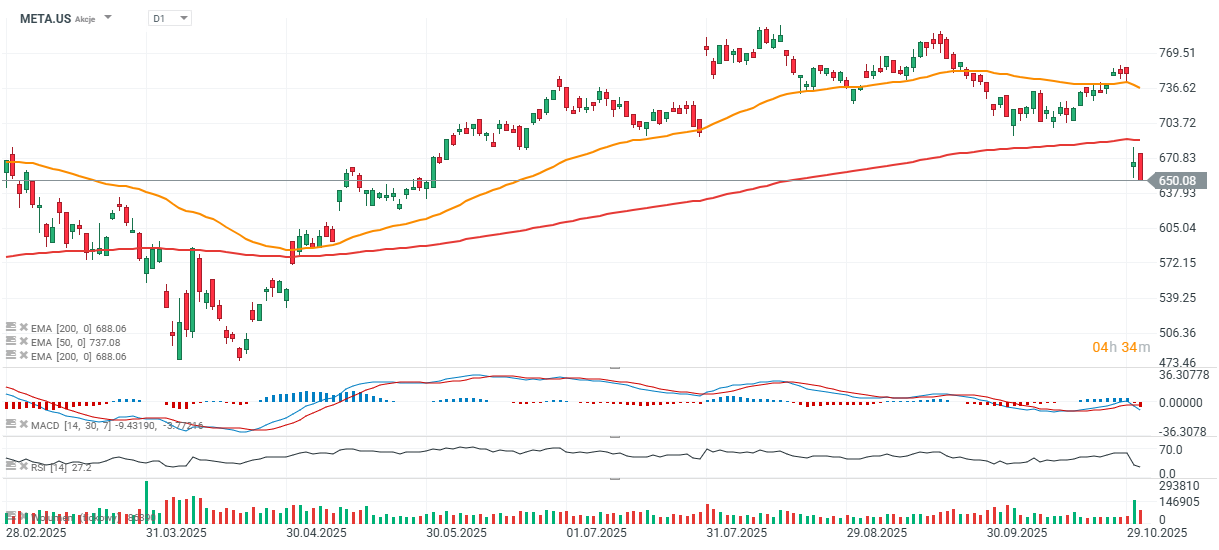

Meta trades at $650, with a $1.6 trillion market cap and a P/E ratio of appx. 23.5, considered low relative to its strong near-term earnings potential.

-

Meta shares fell after revealing plans for accelerated AI investments. Analysts from Deutsche Bank noted that these initiatives will drive much higher capital expenditures in the coming quarters.

-

Deutsche Bank trimmed its free cash flow estimates by 40% for FY2026 and 30% for FY2027, reflecting the surge in AI-related spending.

Strong core business and growth potential

-

Despite near-term cash flow pressure, Deutsche Bank reaffirmed that Meta’s advertising engine remains “fundamentally very strong.”

-

AI investments are boosting engagement and enhancing ad platform performance, making Meta “the fastest-growing large-scale ad platform.”

-

Over the past 12 months, Meta generated a huge $50.1 billion in free cash flow and grew revenue by 19.4% to $178.8 billion.

-

Analysts expect another 19% revenue increase in FY2025, underscoring sustained growth momentum.

AI investments seen as strategic, not risky

-

Deutsche Bank defended Meta’s capital allocation, arguing that AI and infrastructure spending is already showing returns through higher user engagement and ad efficiency.

-

The bank highlighted long-term opportunities in business messaging, Meta AI, and wearables, though it acknowledged a longer payback period for these projects.

Deutsche Bank remains optimistic on Meta’s long-term AI-driven growth, viewing the current pullback as a temporary cost of scaling the next phase of digital advertising and innovation.

Source: xStation5

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

CHN.cash under pressure despite positive Trump remarks 🚩

⏬EURUSD the lowest in 3 months

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.