The global uranium market is on the edge of a potentially unprecedented expansion, driven by the mounting demand for nuclear power as a solution to climate change concerns. With uranium prices soaring to their highest in over a year, investors are eying a gold rush in this once-overshadowed sector. But with the world's hunger for clean energy intensifying, is the uranium market truly poised for a long-term boom?

The global uranium market is witnessing significant interest due to the rising demand for nuclear power as a clean energy source. Recent developments indicate the potential for the most substantial expansion of nuclear power in decades. Prices for uranium have surged to their highest in over a year, with the weekly spot price of uranium reaching more than $58 marking an approximate increase of 23% year to date. This surge is attributed to the combination of heightened demand and a production deficit resulting from reduced investments after Japan's Fukushima nuclear disaster in 2011. The total world uranium production was 49,000 metric tons in 2022, showcasing a slow recovery from past curtailments due to oversupply and impacts of the COVID pandemic. With current uranium production lagging behind global consumption by more than 50 million pounds annually, there is a pressing need for new mines.

Top Uranium companies operating in the mining sector or related industry.

Nuclear power is now perceived differently in global energy markets, especially in light of the ongoing concerns over climate change and the need for clean energy. The United States recently witnessed the operational commencement of its first newly-constructed nuclear unit in over 30 years. There's also a budding interest in innovative technologies such as small modular reactors in North America. Eastern European countries are progressively turning to nuclear power, with Poland planning a significant nuclear energy program and nations like Czech Republic and Romania aiming to expand their existing nuclear initiatives. At present, nuclear power contributes to around 10% of global electricity, with projections indicating potential growth in nuclear power capacity by at least 40% by 2040. In the investment sphere, uranium stocks and ETFs have observed remarkable growth, with some like Cameco Corp. witnessing an increase of nearly 60% year to date. However, despite these gains, there's a belief that the uranium market is still in its early stages of recovery.

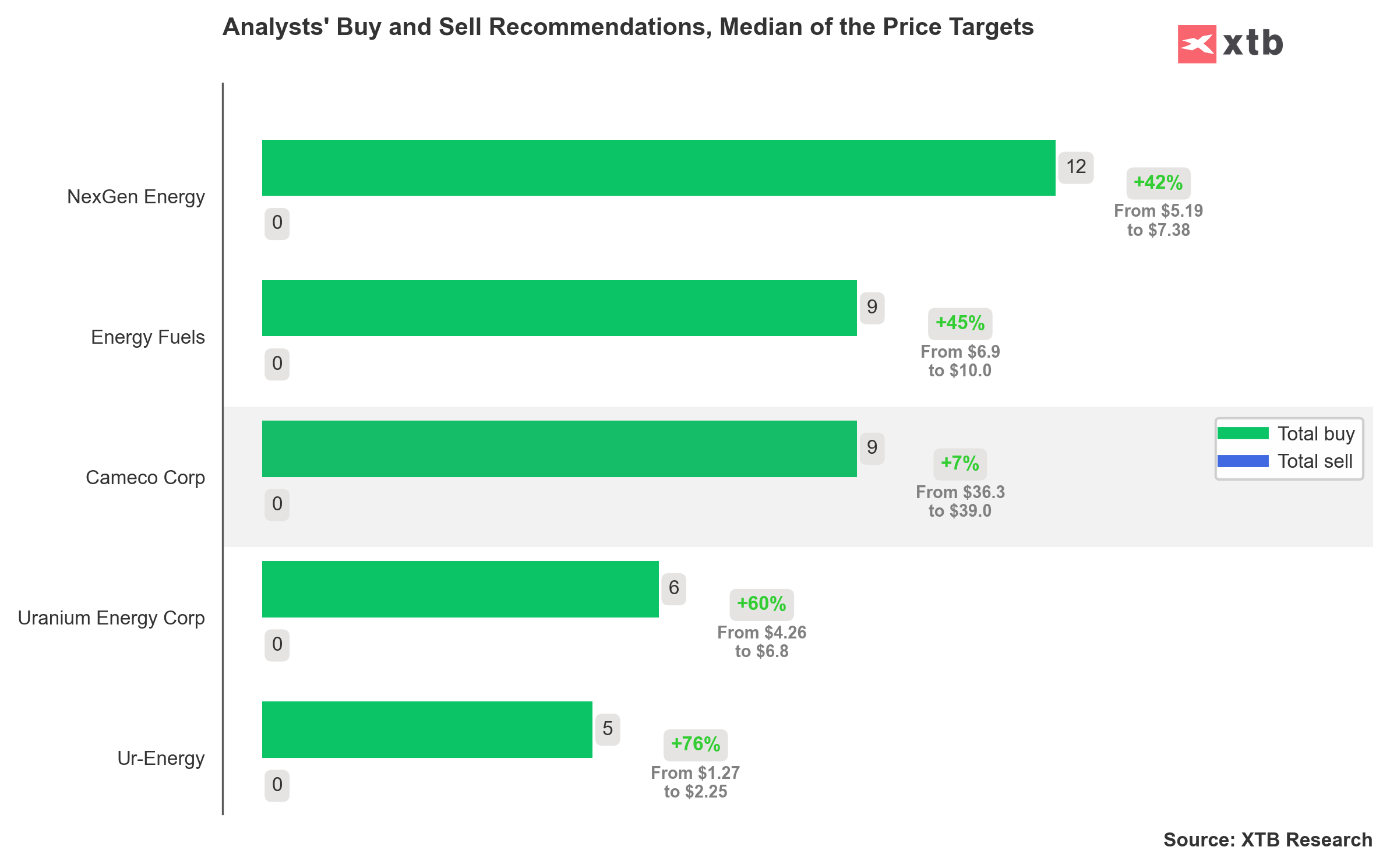

All analyst recommendations are positive, with no recommendations indicating a sell signal

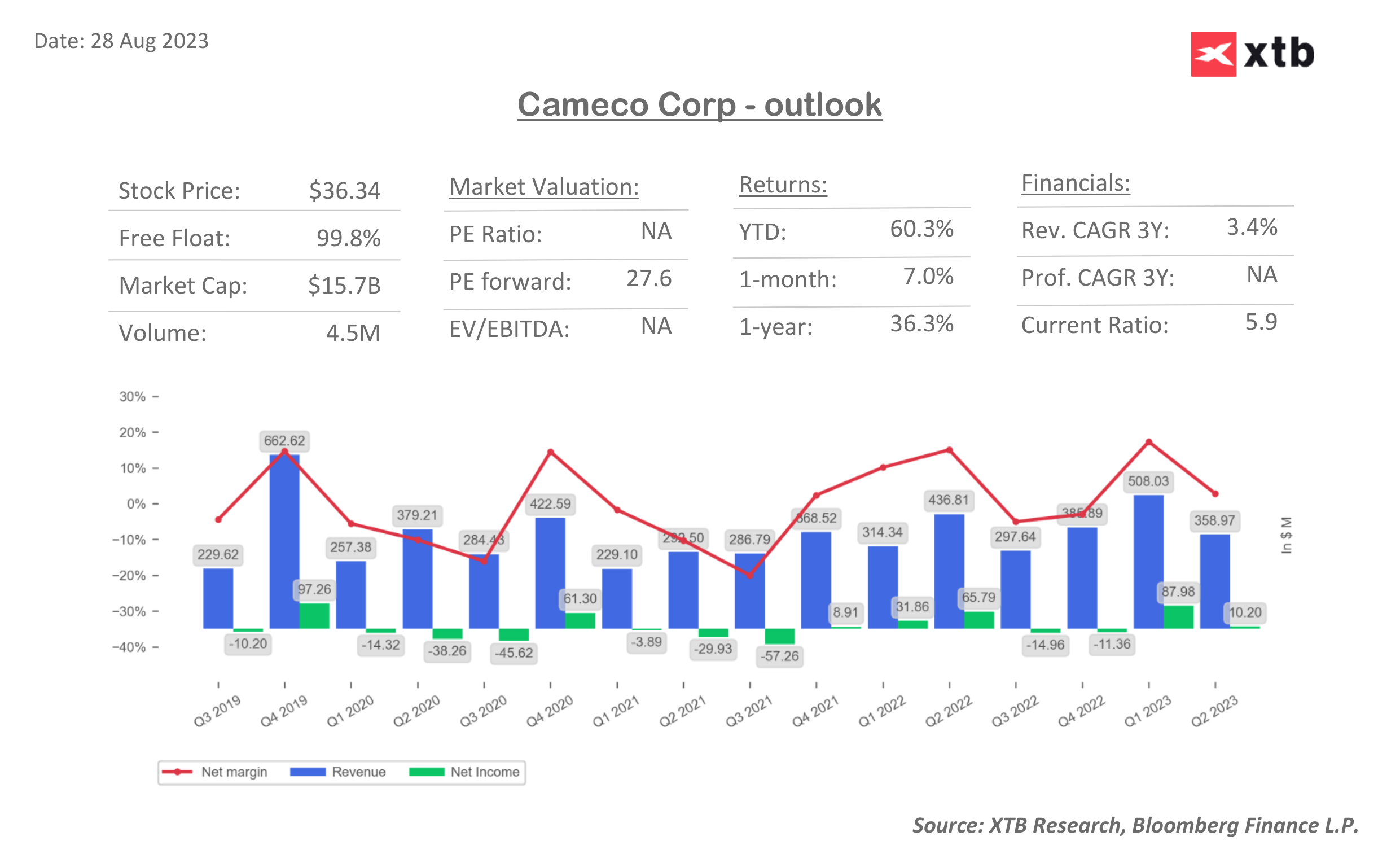

On August 2, 2023, Cameco, based in Saskatoon, Saskatchewan, unveiled its Q2 results revealing an EPS of ($0.01), falling short of estimates by ($0.17), and generating $360 million in revenue, marking a 13.6% revenue decline year-over-year. Despite challenges company benefits from the uptrend in the nuclear energy industry, the demand for uranium is projected to surge. Cameco, as one of the primary suppliers, is set to witness a rise in demand for its products, especially with improving uranium market fundamentals.

On August 2, 2023, Cameco, based in Saskatoon, Saskatchewan, unveiled its Q2 results revealing an EPS of ($0.01), falling short of estimates by ($0.17), and generating $360 million in revenue, marking a 13.6% revenue decline year-over-year. Despite challenges company benefits from the uptrend in the nuclear energy industry, the demand for uranium is projected to surge. Cameco, as one of the primary suppliers, is set to witness a rise in demand for its products, especially with improving uranium market fundamentals.

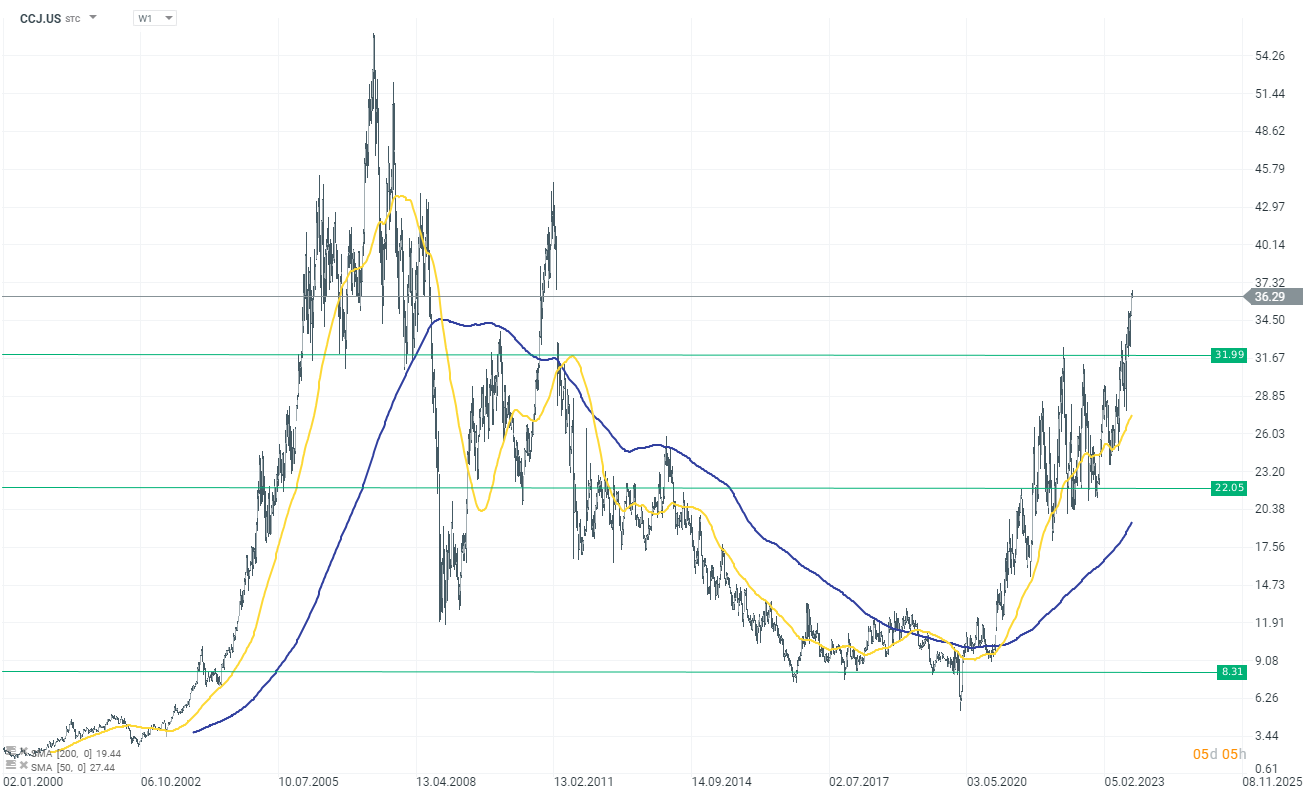

Cameco (CCJ.US) shares experienced significant gains starting in 2020. The rise in the company's stock price reflects the immense potential of the uranium market and the anticipated growth in demand.

Cameco (CCJ.US) shares experienced significant gains starting in 2020. The rise in the company's stock price reflects the immense potential of the uranium market and the anticipated growth in demand.

📉 Microsoft Q1 2026 Earnings: Strong Numbers Mask Investor Anxiety Over AI Spending

🚀 Alphabet Soars on AI-Driven Results, Shares Rally 7% in After-Hours Trading

Meta drops 8% despite strong revenue growth 🔎

Upcoming Meta earnings: will the AI transformation be well received by the market? 🔎

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.