Silver prolongs the bull market in precious metals as the situation in the Middle East becomes tense 💡

Silver has tested the area of $29 per ounce today after gold reached new historic highs above $2,400 per ounce. For precious metals, we are talking about a bull market driven by concerns over the situation in the Middle East. The United States indicated this week that there is a very high probability of a retaliatory attack by Iran against Israel, following an earlier attack on an Iranian diplomatic facility in Damascus, Syria. On the other hand, Iran itself has indicated that it will limit its retaliatory actions against Israel so as not to escalate an overly tense situation.

Silver found its highest since January 2021, when it tested the area around $30 per ounce. It's worth noting that on silver we very often see around $7-8 down and up waves. At the moment, such a range has been filled from the local low in February. On the other hand, in the medium term, seasonality continues to point to increases, while net speculative positions are still far from the extreme overbought of 2016 or 2019. It is also worth mentioning the recent inflows of funds into silver ETFs.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Source: xStation5

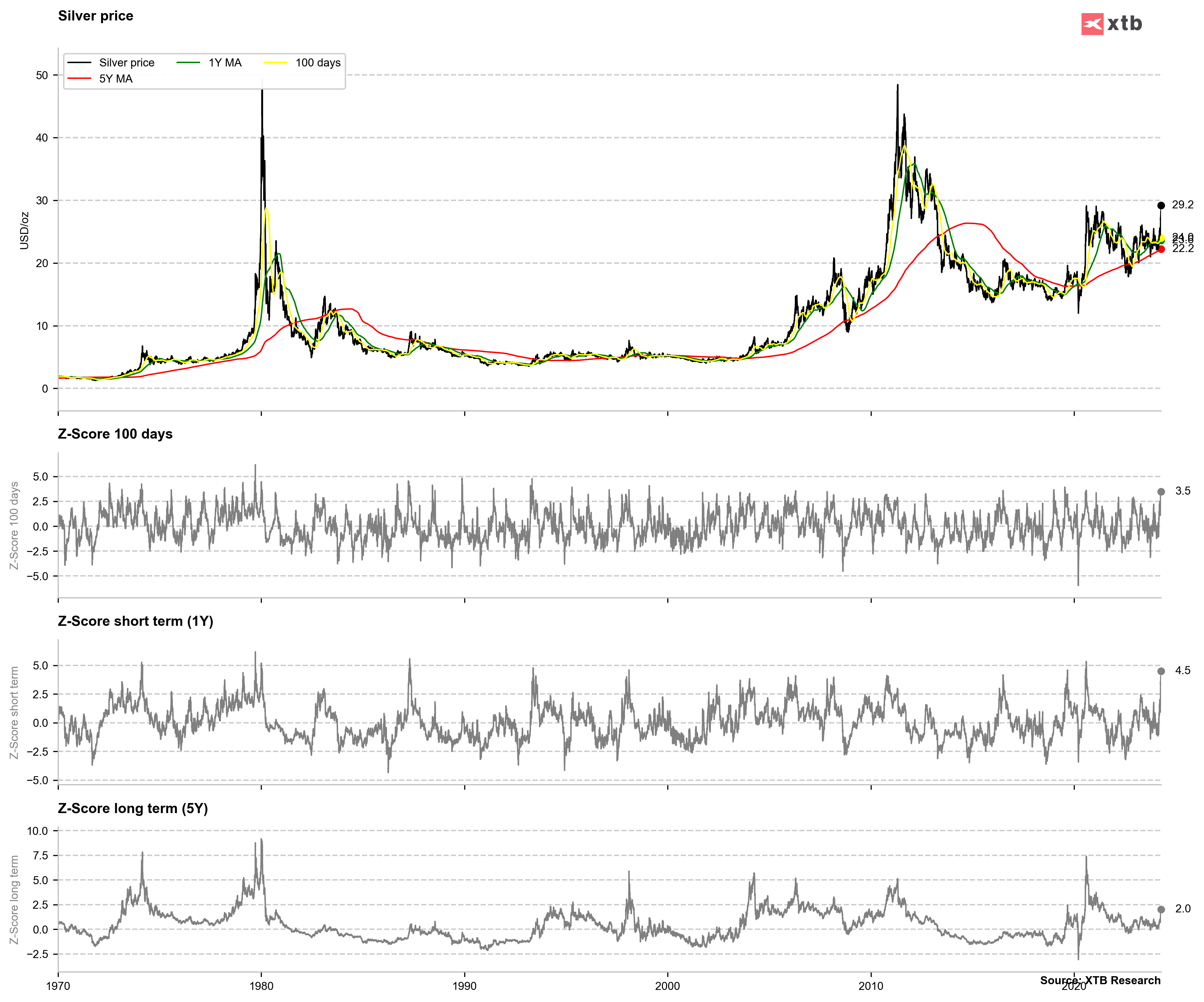

Analyzing the historical situation, it is worth noting that we may be experiencing a short-term overbought condition. We observe a 3.5 times standard deviation from the 100-session average, which seems extremely high, looking at the history of the last 20-25 years. In addition, we observe a 4.5 times standard deviation from the 1-year average, which has generated signals of short-term overboughtness over the past 20 years. At the same time, if we look at the deviation from the 5-year average, here it is far from extreme levels. In view of this, if there is no escalation of the conflict in the Middle East over the weekend, a gap down at the opening on Monday cannot be ruled out, but in the long term, gains are further possible, looking also at the fundamental situation, which suggests one of the largest deficits in the silver market in history.

Source: Bloomberg Finance LP, XTB

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.