📈 New week brings continuation NATGAS rebound

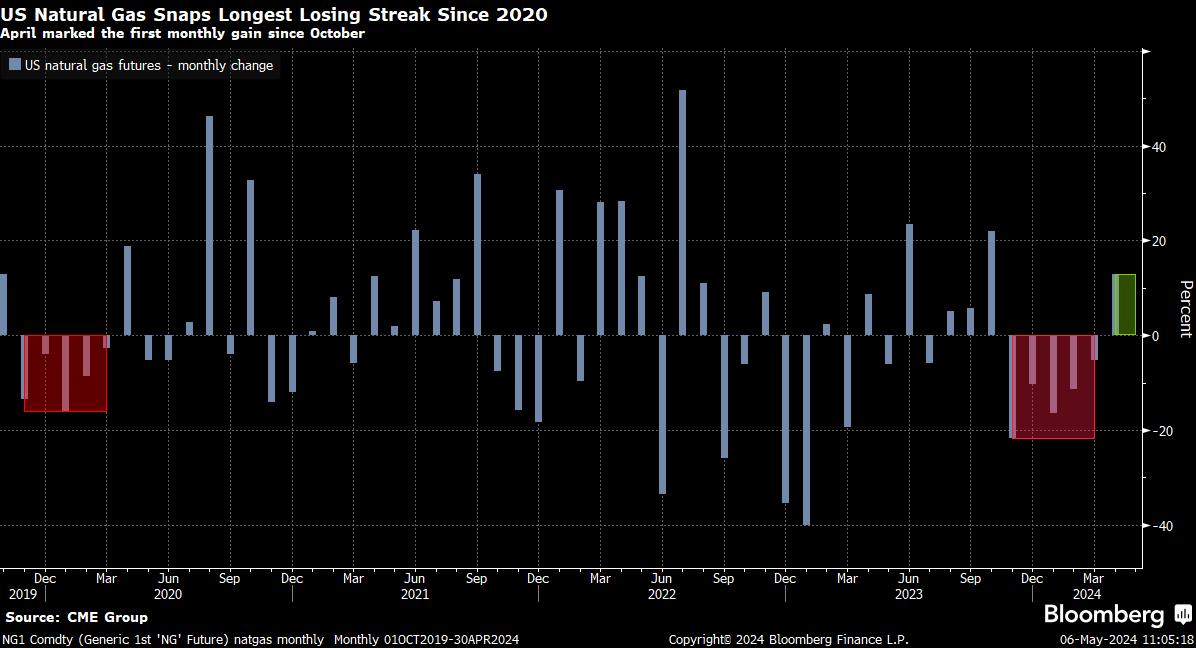

April was the first month of gains for US natural gas prices (NATGAS) since October last year. The earlier period from November to March was the longest period of declines in at least 4 years. Gas remained at a low level due to the sustained high production and low demand during the heating season in the US. However, the situation is starting to change now.

Production in the US is falling from high levels, even nearly from 106 bcfd per day to levels of 100 or lower, due to a significant decrease in drilling rigs in the US. Earlier, US producers indicated that the price was too low to continue investments, resulting in low drilling activity. Although oversupply in the US gas market is huge, the upcoming summer period, when demand for electricity produced from gas increases, could lead to a significant rebound in gas consumption. Additionally, demand for American gas from Europe may increase along with further problems in the Middle East, which could lead to a reduction in the regularity of LNG gas deliveries from Arab countries. US exports have been declining in recent months, but there are grounds to believe that demand will rebound again during the summer period, when stocks are being rebuilt before winter.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appNATGAS rebounded to its highest levels since January 26th. Moreover, the recent candles suggest a return of greater volatility, which may indicate that in the coming weeks, in line with seasonality, we will see a rebound even to the range of 2.5 USD/MMBTU, where the 200-period moving average is located. Seasonality indicates that buying pressure should persist until mid-month.

Source: xStation5

NATGAS has had a very long period of declines. Source: Bloomberg Finance LP

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.