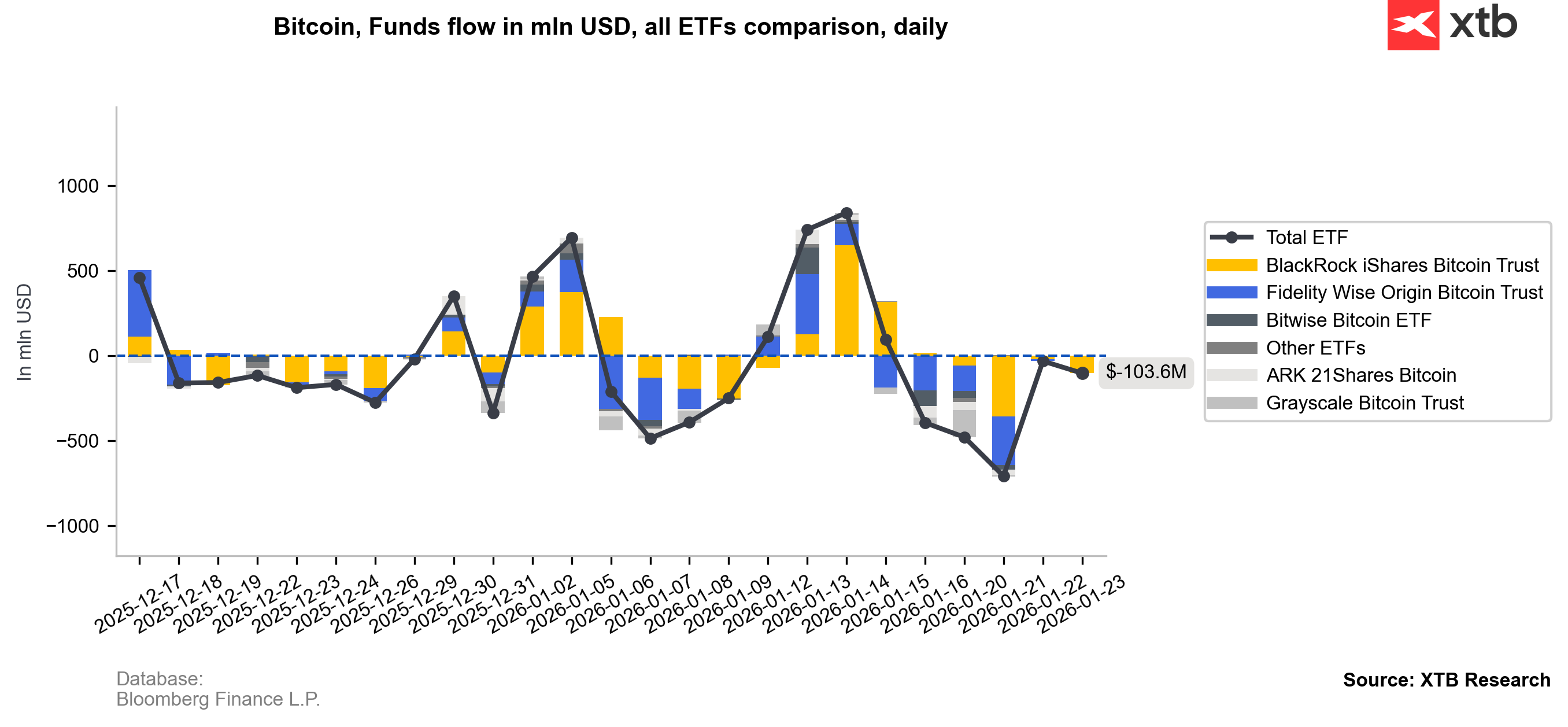

Bitcoin is sliding toward the $87,000 area today after liquidations totaling hundreds of millions of dollars, while ETFs recorded last week the largest weekly outflow since mid-November 2025 — $1.73bn in total. This marks a sharp reversal from the week ending January 17, when crypto funds saw more than $2.17bn in inflows. This time, Ethereum alone posted around $630m in outflows (the second-largest weekly outflow on record).

So far, the main exceptions have been ETFs linked to Solana (about +$17m) and Chainlink (nearly +$4m). A clear “risk-off” tone dominates: the breadth of outflows suggests investor confidence has not fully recovered from earlier shocks, while the macro backdrop continues to weigh on the sector. According to CoinShares, the bulk of the selling pressure came from US-based investors. Fragile sentiment has persisted since the October 2025 “flash crash.”

The declines have been driven by, among other factors:

-

Weaker expectations for Fed rate cuts: markets are pricing a very low probability of a cut (around 3% according to the CME FedWatch tool).

-

Lack of a sustained rebound after the October drawdown, keeping trend-following and risk-managed strategies cautious.

-

Disappointment with the “debasement hedge” narrative: despite large deficits and rising government debt, crypto has not convincingly reclaimed its role as protection against currency debasement, prompting some investors to cut exposure in the near term.

The market is still searching for a catalyst — and failing to find one. Unless macro expectations shift, price momentum improves, or crypto rebuilds a strong narrative, pressure on fund flows may persist, increasing the risk of a deeper bear phase.

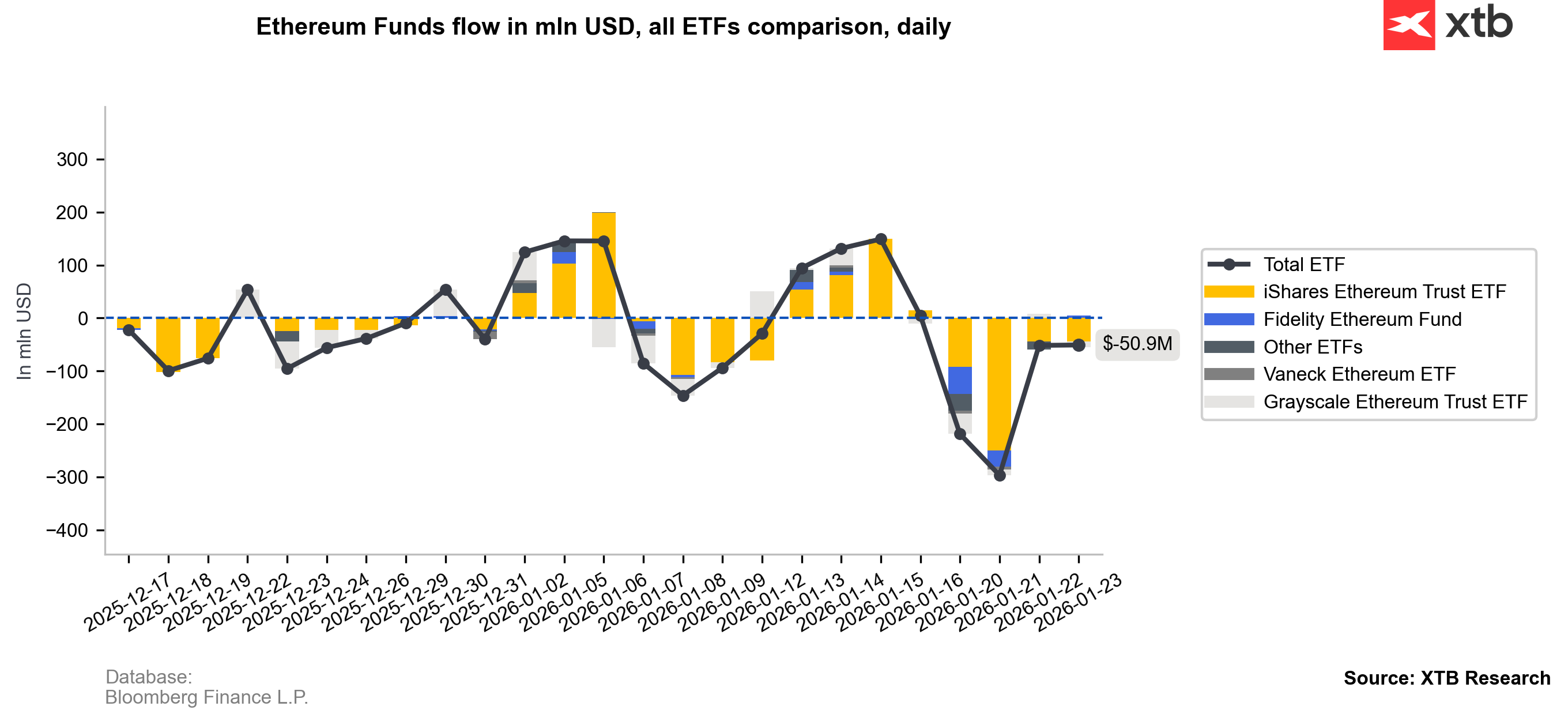

ETF flows

Looking at recent crypto fund flows, the last five sessions show clearly negative flows into ETH, suggesting reduced fund activity and fading retail demand — not only for Ethereum, but also for Bitcoin.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

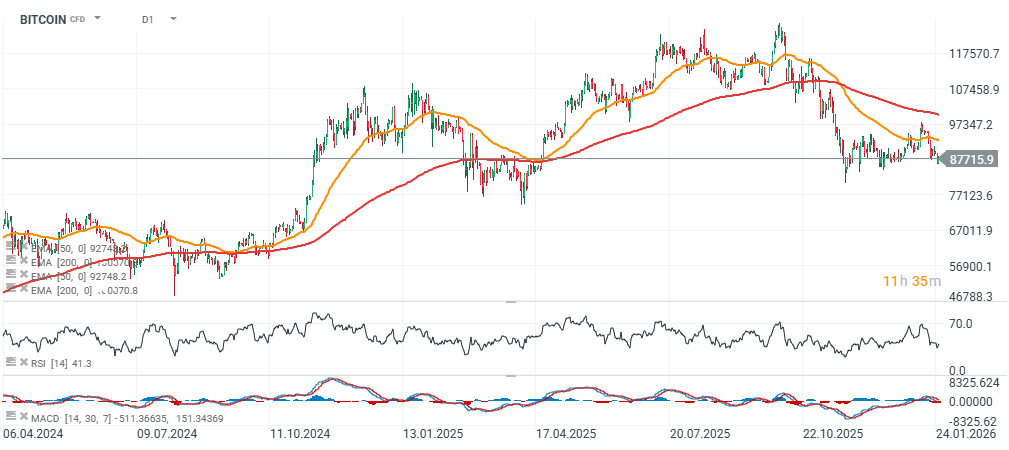

Bitcoin and Ethereum chart (D1 interval)

Bitcoin is now down more than 30% from its all-time high, while Ethereum is down over 50%. BTC’s RSI stands at 41, still relatively far from the “oversold” levels typically seen after major capitulation events; Ethereum shows a similar setup — despite the steep decline, there are still no clear signs of capitulation.

Key on-chain reference levels for Bitcoin currently include $96.5k (short-term holders’ cost basis), $87.5k (active investors’ mean), and two major cyclical benchmarks: $81k (True Market Mean) and $56k (Realized Price). True Market Mean is a more “realistic” market-wide average level that often reflects the actively traded portion of supply, while Realized Price is the average cost basis of the entire BTC market — a classic cycle benchmark. Historically, Bitcoin has traded below Realized Price during major bear markets, including in 2020 and 2022.

Source: xStation5

Source: xStation5

US Open: Big Tech, Fed and Politics in Action. A Test Week Ahead for the Markets!

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

🔝Gold breaches $5100 as silver tests $110

Gold surges over 2% and is approaching $5,100 on the back of a weaker dollar 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.