Across Europe, both markets and consumers are asking questions about the comprehensive and controversial Mercosur agreement. What are the facts? Who will benefit, and who will lose from the new trade initiative?

The agreement to remove trade restrictions between the EU and Latin American countries is an extremely complex document. However, despite negotiations lasting 25 years, it has only attracted public attention at the very last stage.

Mercosur vs. farmers

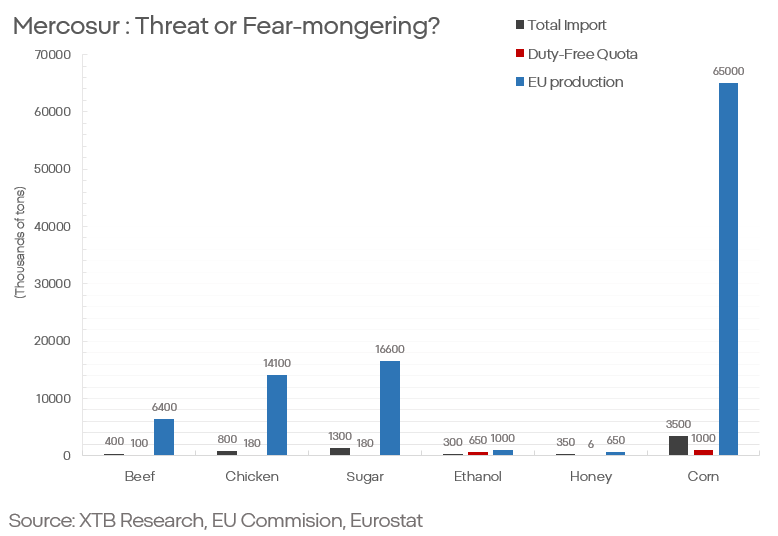

Before discussing the agreement’s impact on the economy and markets, it is necessary to address the avalanche of controversy and misinformation about the deal itself. Mercosur does not mean the destruction of agriculture in Europe or a decline in food quality in Europe. Mercosur is a strategic and non-negotiable initiative, essential to maintaining the competitiveness of the European economy. Moreover, its main areas are mining as well as the machinery and automotive industries - not agriculture.

Currently, beef imports into the EU amount to about 0.5 million tonnes, and poultry to about 0.3 million tonnes. Europe itself produces about 6–7 million tonnes of beef and 14 million tonnes of poultry. The projected duty-free quota is only 100–200 thousand tonnes.

On the other side, the situation looks completely different for lithium, niobium, rare earth metals, or copper. Europe has negligible extraction and reserves of these raw materials, and demand will grow exponentially to power advanced factories in Europe. Necessary imports will have to increase 2–3 times, while in Latin America a number of countries have huge deposits and unused mining capacity.

Farmers and the food-processing sector will lose from the agreement due to the obvious increase in market competition. European consumers may expect a slowdown in price growth dynamics (or even local price declines) for poultry and beef, which will be the main agricultural imports into the EU. This is not at the expense of quality: all food standards binding EU producers also apply to imported goods. The agreement concerns tariffs, not standards. Moreover, losses resulting from lower commodity prices will be curbed not only by restrictive quotas but also compensated through subsidies under the CAP (Common Agricultural Policy), so even for most farmers this agreement does not pose a threat.

Europe can afford to sabotage strategic initiatives in order to protect the ad hoc and loosely defined interests of a fraction of the population, with a negligible contribution to the economy and often negative impact on the budget.

Who will lose the most from the Mercosur agreement?

However, the ones who will lose the most from Mercosur will not be farmers. The losers will be the US, China, and Russia. The agreement is primarily intended to secure Europe’s access to strategic mineral raw materials. Europe suffers from a lack of geological deposits of many key elements. The US, China, and Russia use this dependence against Europe by all available means. Diversifying supplies from Latin America, fabulously rich in resources but poor in technology, will solve this problem.

In the other direction, Europe will be able to export its industrial and high-tech products to Latin American countries. Europe’s automotive, chemical, optical, electronic, and machinery industries, industries for which there is less and less room both in Europe and in the US or Chinese markets, will be able to spread their wings across an entirely new continent, where competition is still limited and opportunities are enormous.

What does this mean for companies and markets?

In Europe, there is no shortage of listed companies waiting with bated breath for the opening of a new chapter in Europe’s economic history. The biggest winners will be European car manufacturers such as Volkswagen, BMW, and Stellantis. Opening a new market will help halt the sector’s further decline.

BMW.DE (D1)

On the chart, one can observe a rebound from the bottom, a crossover of the 100 and 200 EMAs, and a return to an uptrend. Source: xStation5

Machinery and defence manufacturers will also benefit. Industrial giants such as Siemens, BASF, ZF, and ABB will gain from new sales markets. The defence sector—represented, among others, by Rheinmetall, BAE Systems, Hensoldt, and Leonardo—will benefit from new, strengthened supply chains for rare raw materials.

SIE.DE (D1)

The company has maintained a strong uptrend for many years. Source: xStation5

Among the potential losers are food producers, although here the problem mainly concerns smaller companies and those with a predominance of meat products. Larger producers such as Nestlé, Danone, Lindt, or Kerry have low exposure to the sectors discussed, and at the same time they have a range of mechanisms allowing them to defend themselves against competition.

Naturally, this is not an exhaustive list of all economic and market entities. The agreement is set to become the largest free trade zone in the world and will encompass countless projects, industries, companies, and initiatives.

In a world of trade negotiations conducted through threats and blackmail, a European initiative from which all sides benefit is a positive exception. The agreement is at the final stage, but its entry into force is not certain. Both Europe and South America are struggling with a period of heightened political instability, and the US and China are watching closely and may try to influence the negotiations and the legislative process.

Kamil Szczepański

Junior Financial Markets Analyst, XTB

BoJ maintains rates despite hawkish shift in outlook. What next for the USDJPY?

US OPEN: Trump pivot lifts Wall Street sentiment

Daily Summary: "Sell America" pushes US assets off the cliff (20.01.2026)

Banks fear Trump📉Central planning in the USA?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.