Futures on CBOT Corn (CORN) are rising today as Pro Farmer’s crop tour projected output below USDA estimates, with added concerns over disease risks. Here are the most important highlights from the corn market. Chicago corn futures closed higher also yesterday session, supported by strong export sales.

-

Pro Farmer crop tour pegs 2025/26 US corn output at 16.204 billion bushels, well below USDA’s 16.742 billion.

-

Managed money reduced net short positions to a 12-week low of 144,650 lots; long reached a 16-week-high.

-

USDA reported US corn conditions at 71% good-to-excellent, slightly above trade expectations (70%).

-

7% of corn crop reported mature vs 10% last year; 44% dented, in line with average.

-

US weekly corn export inspections rose 24% to 1.31 million tonnes, led by Mexico and Japan.

-

Total export inspections for 2024/25 now at 65.53 million tonnes, 28% ahead of last year’s pace.

-

Taiwan’s MFIG issued a tender for up to 65,000 tonnes of corn from US, Argentina, Brazil or South Africa.

-

Russia kept corn export duty at zero; FOB index edged higher to $218.80/tonne.

Corn (D1 interval)

Source: xStation5

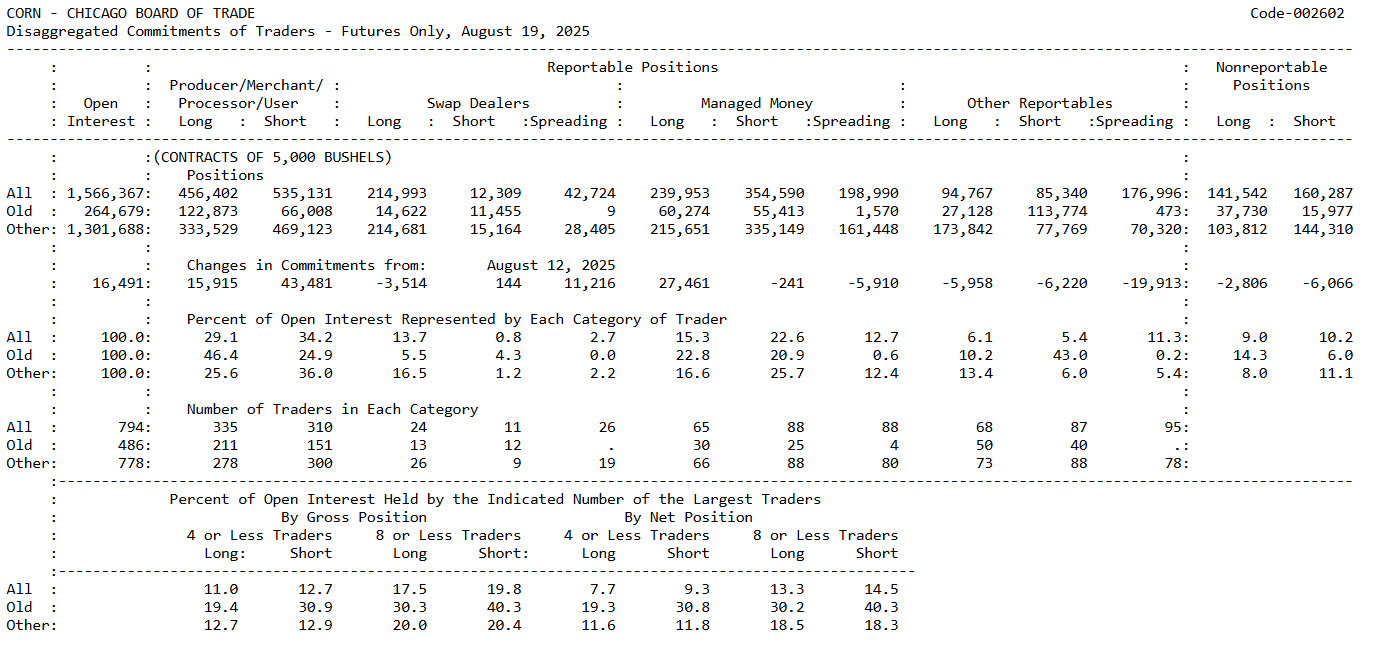

Commitment of Traders (CoT CFTC) Report

Managed Money (Large Speculators)

-

Strong build-up in long positions: +27.5k contracts, the highest level in 16 weeks.

-

Short positions were virtually unchanged (-241), while spreads declined (-5.9k).

-

Net short positions reduced to a 12-week low of 144.7k, marking a clear shift toward a less negative sentiment.

Commercials (Producers/Merchants)

-

Significant increase in short positions: +43.5k, acting as a hedge against potential price gains.

-

Commercial longs rose by +15.9k, but the scale of shorts continues to dominate.

-

In practice, commercials are hedging production while funds are trimming shorts and adding longs.

Summary

-

Managed money is reducing its previous pessimism, which technically provides support to prices.

-

Commercials are expanding short hedging, indicating that producers view the current market strength as an opportunity to lock in sales.

-

The market is at a point of tension: funds are starting to “play long” while commercials increase selling pressure.

Source: CFTC

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

CHN.cash under pressure despite positive Trump remarks 🚩

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.