A lot of attention at the start of a new week is paid to oil, which launched today's trading with a big bearish price gap amid signs of potential de-escalation in the Middle East. However, there is also another group of commodities that is standing out today - precious metals. Gold continues to rally even in spite market expectations for Fed policy moves becoming less dovish after Friday's strong jobs data.

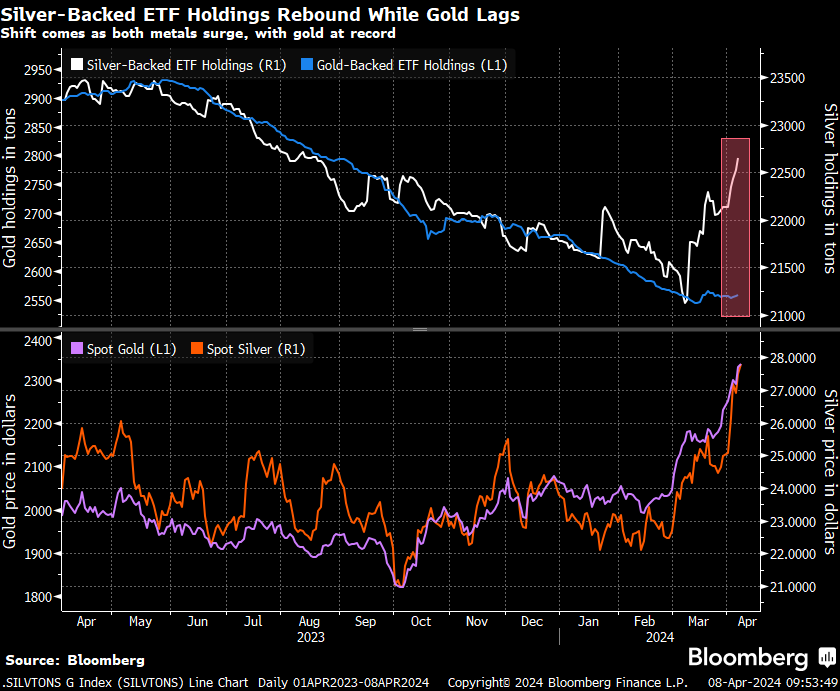

While gold is drawing the most attention among precious metals as it is trading at record highs, silver also deserves a note. SILVER is the best performing precious metal today, gaining around 1.7% at press time. Gold seems to be driven mostly by expectations of easier monetary policy from major central banks, especially Fed, as data on ETF holdings does not show any increase in demand for gold from such institutions. The situation looks different when it comes to silver, with ETFs noticeably increasing their physical silver holdings since the beginning of March.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

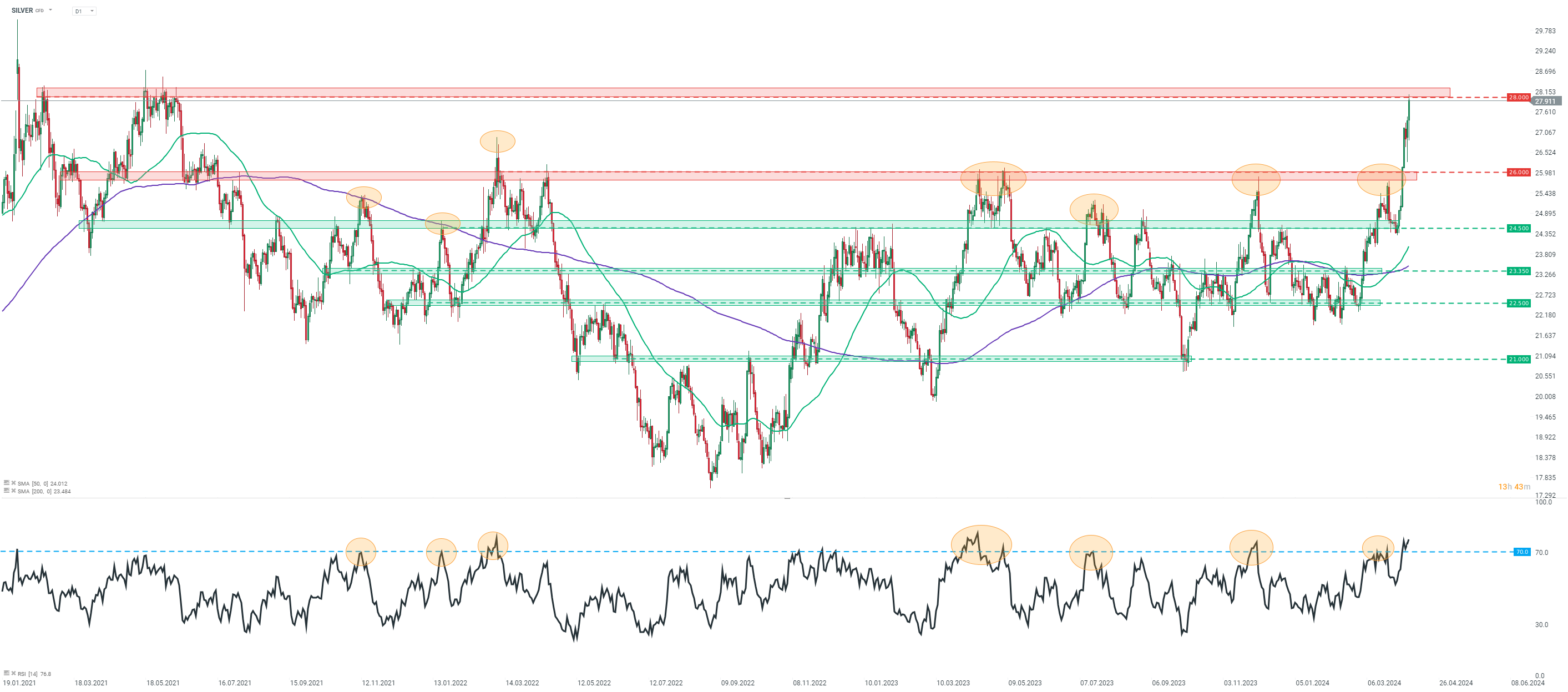

Taking a look at SILVER chart at D1 interval, we can see that the commodity broke above the $26 resistance zone last week and continued to rally afterward. Precious metal tested resistance zone ranging above $28 mark today and reached the highest level since June 2021. However, bulls were unable to break above the area and a small pullback occurred. Nevertheless, price remains nearby and another attempt to break above the $28 area cannot be ruled out. However, it should be noted that 14-day RSI indicator sits above 70.0 level, which was associated with local highs in the past, so bulls should stay on guard.

Source: xStation5

Source: xStation5

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.