- Wall Street deepens sell-off after news of significant federal layoffs as a result of the government shutdown

- Wall Street deepens sell-off after news of significant federal layoffs as a result of the government shutdown

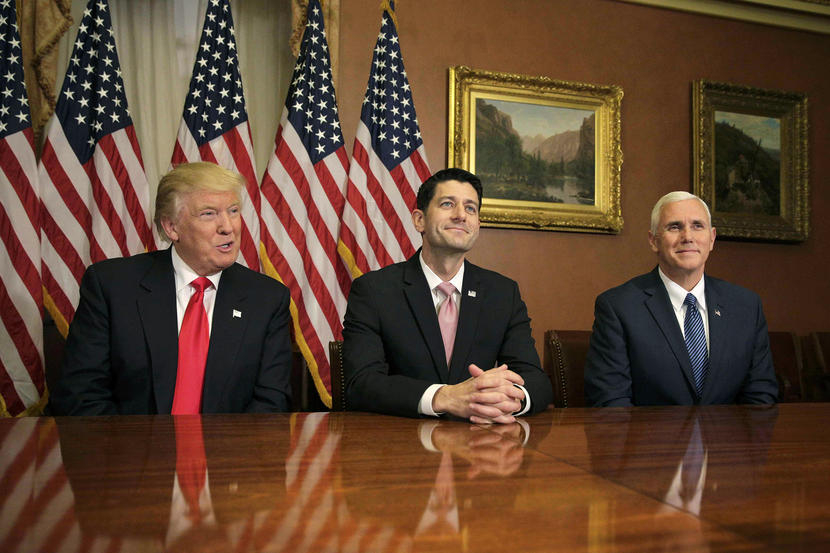

U.S. indexes extended their declines following reports that the White House has begun large-scale federal worker layoffs amid the prolonged government shutdown. Budget Director Russ Vought confirmed that “reductions in force” have started, marking the first mass firings during a funding lapse in modern history. The move is seen as an attempt to pressure Democrats in Congress. Markets reacted to the news with a renewed wave of selling. At the time of publication, the US100 was down 2.40%, the US500 fell 1.80%, and the US2000 dropped 2.10%, reflecting broad-based weakness across nearly all sectors.

Meanwhile, Fed Governor Christopher Waller reiterated that tariff-related inflation pressures are likely temporary, emphasizing the importance of upcoming CPI data for guiding future monetary policy decisions. Also today, the Bureau of Labor Statistics (BLS) confirmed that the CPI report will be released with a delay on October 24, while all other economic data will remain suspended until normal government operations resume.

Daily Summary: U.S.-China Tensions Trigger the Sharpest Sell-Off Since “Liberation Day” ✂️

US100 down 1.10% ✂️

ECB Not Gearing Up for Changes. Is EURUSD Undervalued?

Chinese Gambit: Raw Materials as a Weapon in the Tech War