- German index tests the historic high

- Will German stock index rise even higher?

- Technical analysis of the DE40 with Overbalance metodology

- German index tests the historic high

- Will German stock index rise even higher?

- Technical analysis of the DE40 with Overbalance metodology

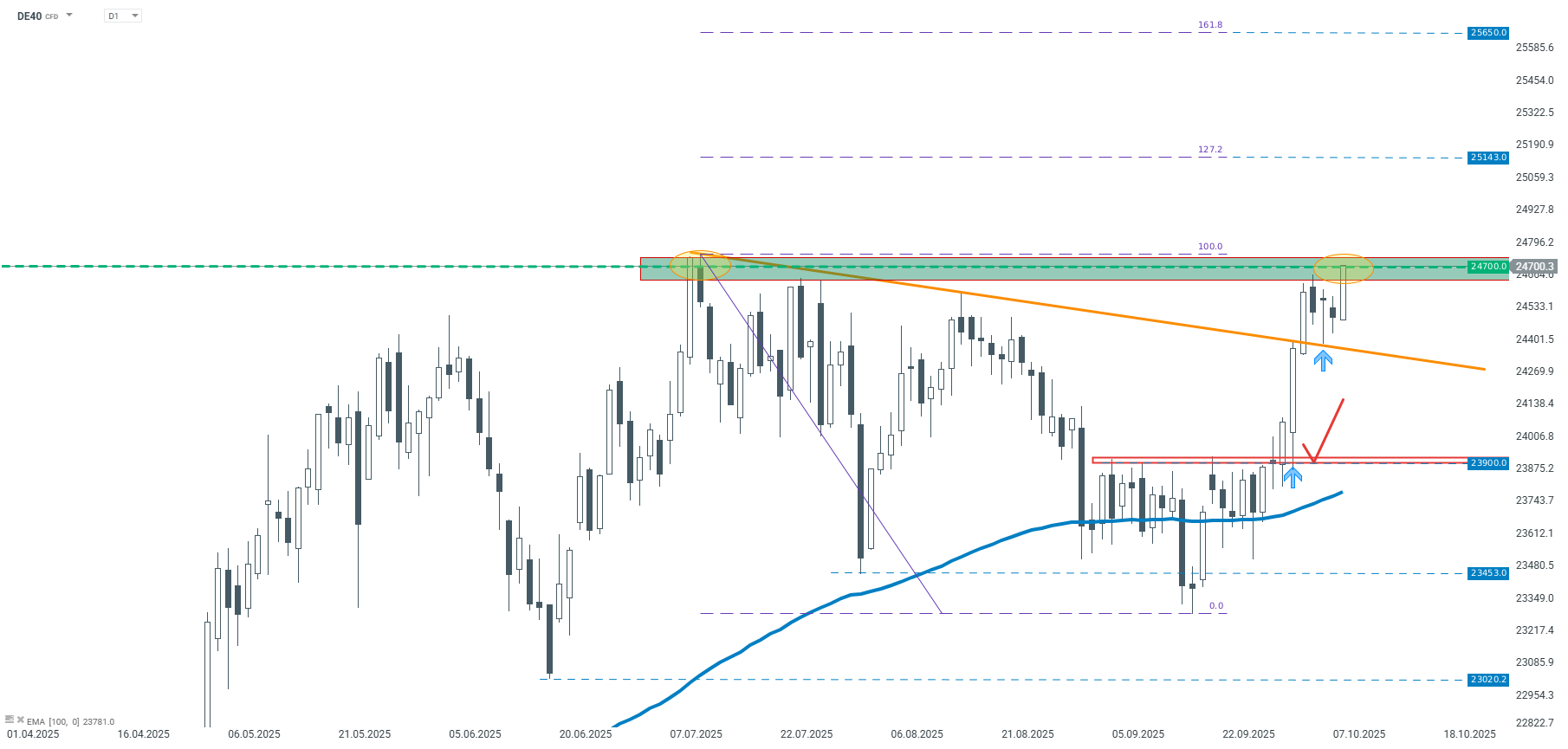

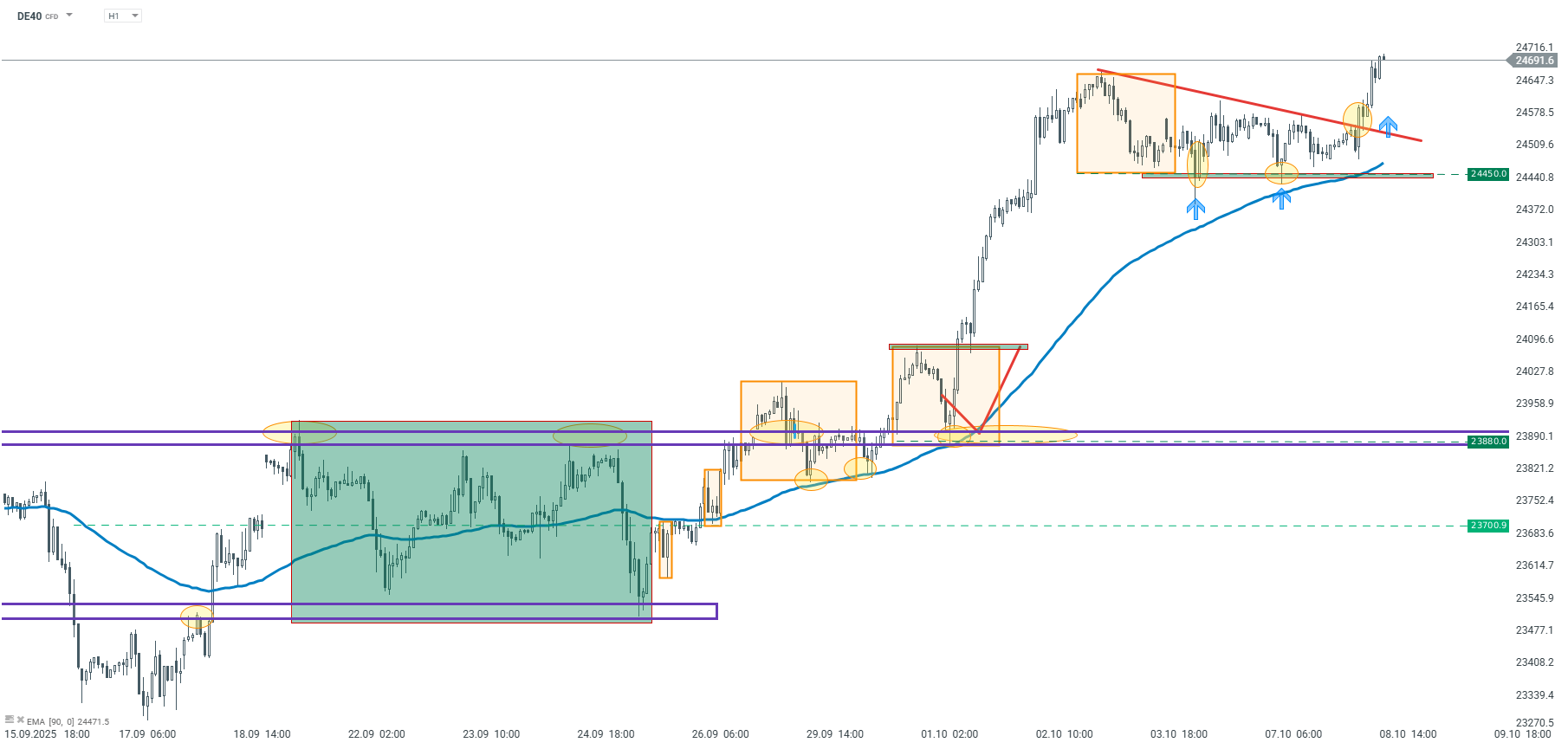

The German stock index DAX 40 remains in a long-term upward trend. On the daily (D1) timeframe, the price has managed to break above the 100-period moving average, marked by a blue line, following a period of consolidation. Moreover, it has surpassed the resistance zone around 23,900 points, which accelerated the upward move, pushing the index above a line drawn through recent highs.

Currently, the price is stuck just below the resistance area near 24,700 points — a level that has already been tested in recent days and is being tested again now. If the market manages to break above this zone, the upward trend could continue toward the external Fibonacci extension levels, measured from the last major correction — specifically, near the 127.2% and 161.8% ratios. On the other hand, if a bearish signal emerges, a corrective move toward the previously broken trendline drawn through the recent highs (marked in orange) cannot be ruled out. However, this is not the base-case scenario, given the prevailing dominant long-term uptrend.

Source: xStation5

Source: xStation5

Source: xStation5

UBS raises Micron’s price target. Shares are rising!

New ATH on Palladium📈🚨

BREAKING: Oil stocks grow more than expected!🔥

US OPEN: Wall Street not afraid of Shutdown 📈💲