-

50 bps Risk Rises: Significant GDP contraction boosts probability for a 50 bps RBNZ rate cut, though 25 bps is still the official consensus.

-

Dovish Outlook: Expect a strongly dovish statement to signal that rates are heading below 2.5% next year.

-

NZD Under Pressure: The Kiwi is vulnerable to further declines against the USD, especially with a surprise large cut or dovish guidance.

-

50 bps Risk Rises: Significant GDP contraction boosts probability for a 50 bps RBNZ rate cut, though 25 bps is still the official consensus.

-

Dovish Outlook: Expect a strongly dovish statement to signal that rates are heading below 2.5% next year.

-

NZD Under Pressure: The Kiwi is vulnerable to further declines against the USD, especially with a surprise large cut or dovish guidance.

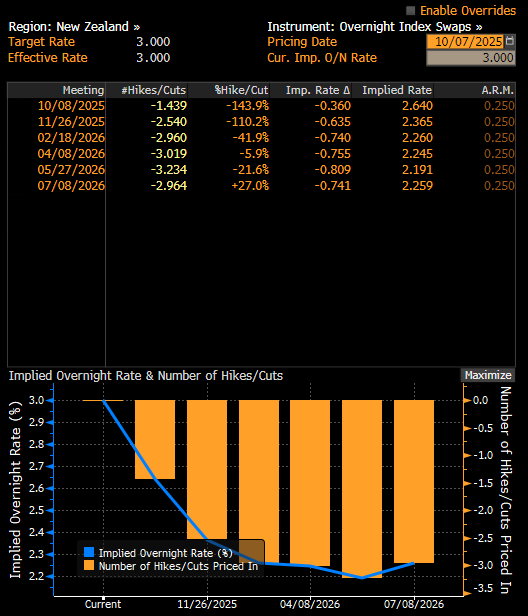

The Reserve Bank of New Zealand (RBNZ) is set to announce its official cash rate (OCR) decision tomorrow at 02:00 AM (BST). Ahead of the announcement, market expectations are heavily tilted toward further monetary policy easing. While the majority of analysts forecast a 25 basis point (bps) rate cut, chances are rising for a more decisive 50 bps move, fuelled by significantly disappointing GDP figures and weakness in the labour market.

It is worth noting that the RBNZ has previously enacted 50 bps cuts multiple times (twice in 2024 and once earlier this year). The previous reduction in August was 25 bps, suggesting the central bank may favour a similar step this time.

Expectations Ahead of the Decision

-

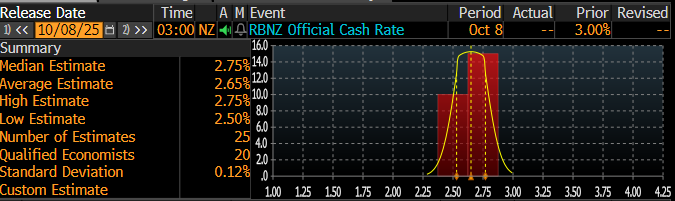

The market consensus forecasts a 25 bps cut to the OCR, bringing it to 2.75%, consistent with the RBNZ’s previous guidance and its own August model projections.

-

Simultaneously, the risk of a deeper 50 bps cut to 2.5% has clearly increased, reflected both in comments from some economists and in market pricing, where the probability of such a move is assessed at approximately 50%.

-

The latest disappointing data, including a 0.9% quarter-on-quarter contraction in GDP (three times weaker than the central bank’s own forecast), and a deteriorating labour market are increasing pressure for bolder action. As most key New Zealand data is published quarterly, the central bank must rely heavily on its internal forecasts.

-

Personnel changes within the RBNZ—the departure of the most hawkish Monetary Policy Committee (MPC) member and the addition of a new, potentially more dovish individual—may also favour greater easing. The governorship of the central bank is also due to change in December.

Market-implied probability suggests up to a 50% chance of a 50 basis point cut. Source: Bloomberg Finance LP

Consensus points to a 25 basis point cut, but a significant number of economists are advocating for a 50 basis point reduction. Source: Bloomberg Finance LP

Macroeconomic Context

-

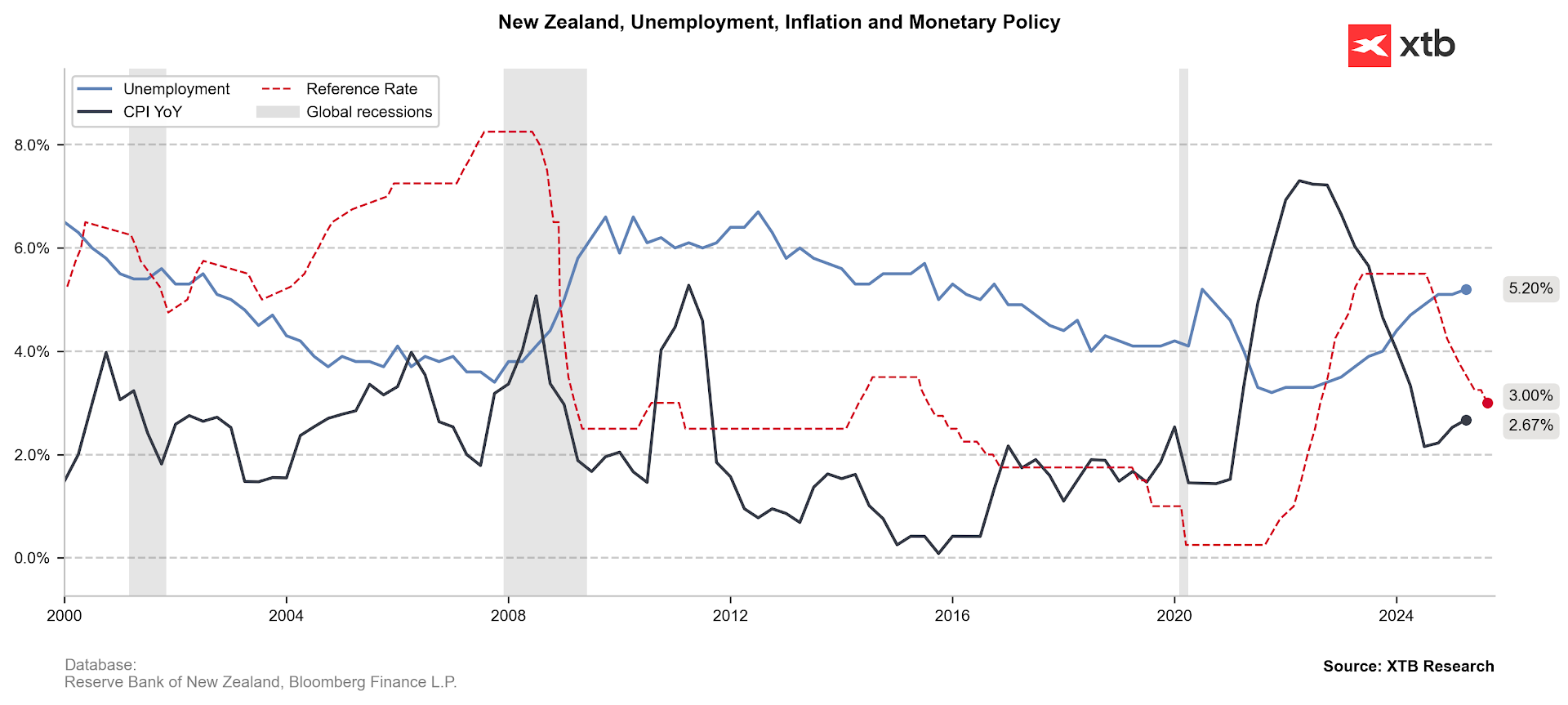

The labour market remains a source of risk: monthly employment indicators are consistently being revised downwards, and unemployment has risen to 5.2%, with forecasts suggesting values as high as 5.5% by 2026.

-

Hours worked and weekly wages remain lower than in 2023 and 2024, indicating a fairly deep slowdown in economic activity.

-

While inflation is expected to have accelerated in Q3, it is projected to fall back closer to the RBNZ’s 2% target midpoint in 2026.

The labour market poses an increasing risk, although we are simultaneously observing an inflation rebound. Source: Bloomberg Finance LP, XTB

Forward Outlook

-

The decision and subsequent communication are expected to be dovish: even if the bank opts for a smaller cut, the message should be clear that there remains room for further reductions (including at the next meeting in November). Indications suggest that interest rates could fall below 2.5% next year.

-

A policy of rapidly moving below the "neutral" rate level (2.9%) may be necessary to stimulate economic activity ahead of the crucial Christmas and summer period in New Zealand.

What to Expect for the Kiwi (NZD)

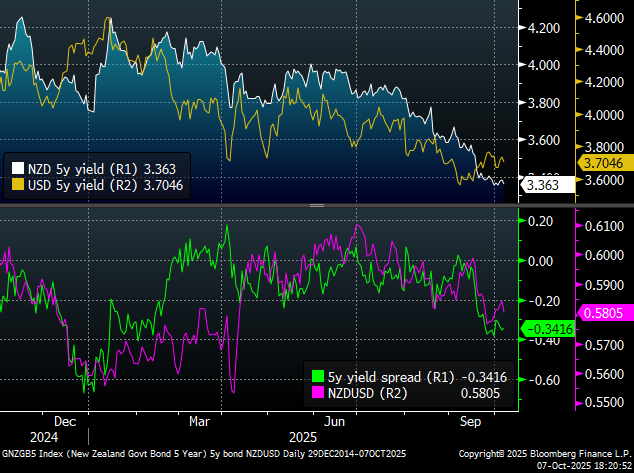

The New Zealand Dollar (NZD) is broadly weak. Against the US Dollar (USD), only the Canadian Dollar has gained less this year than the NZD. The NZD/USD pair is currently testing the 50.0 Fibonacci retracement of the last major upward wave. All signs indicate that continued declines should follow in the event of a surprise larger cut or a dovish statement. Nevertheless, if the lows from September 29th are not breached soon, the existing downtrend sequence may be jeopardized. The two-year yield spread suggests that the pair should decline in the near term.

Source: xStation5

Source: Bloomberg Finance LP

Daily summary: Oracle drags indexes lower, gold tests $4,000 💰

⏬US100 is down 0.5% on Oracle news

FOMC officials see structural shifts driven by AI; Kashkari and Miran back two rate cuts this year 🔎

New York Fed releases new forecasts showing higher 1-year inflation expectations 🔔