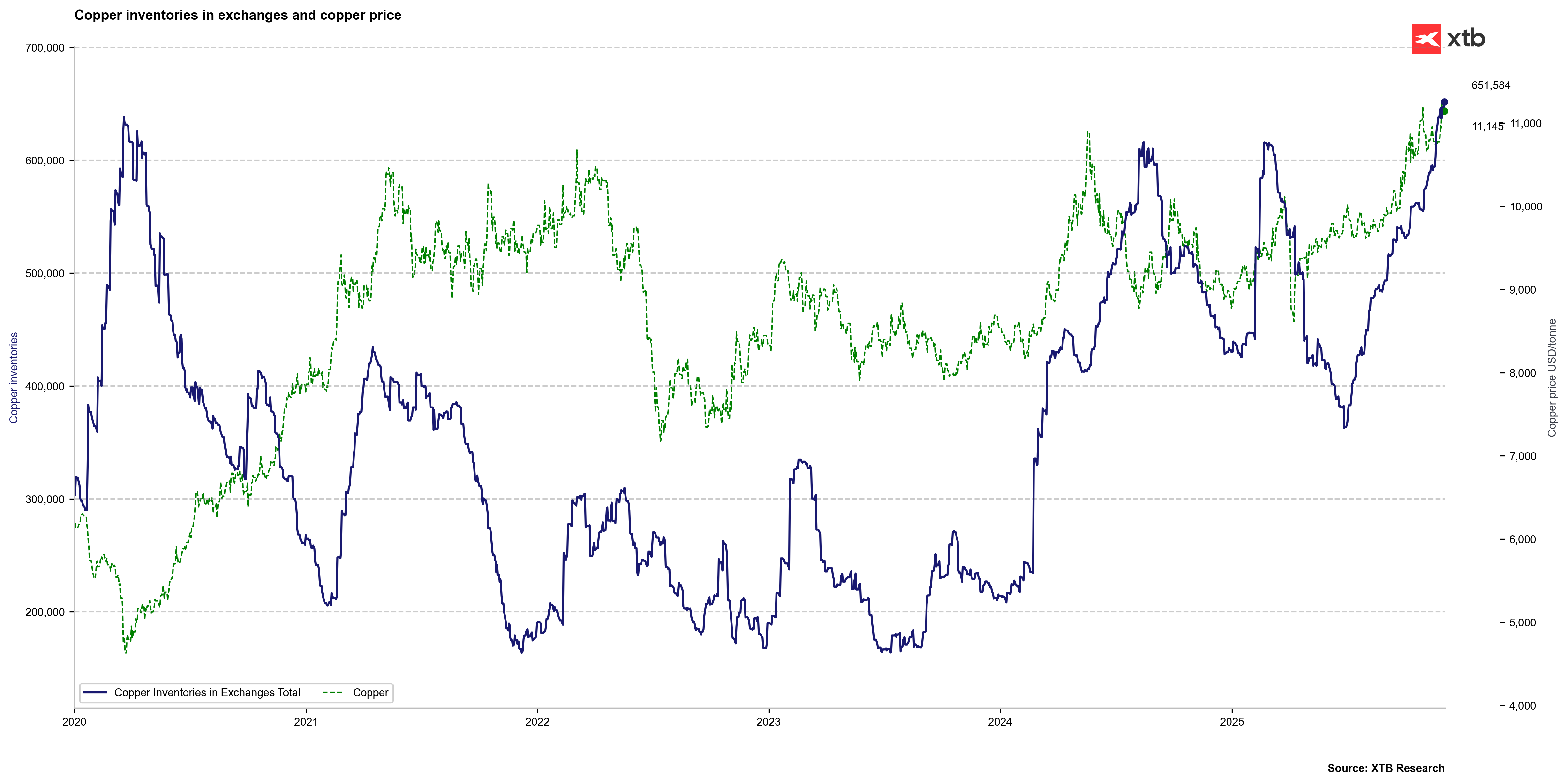

Copper continues its upward trend, reaching a new ATH with a level of over $11,400 per ton.

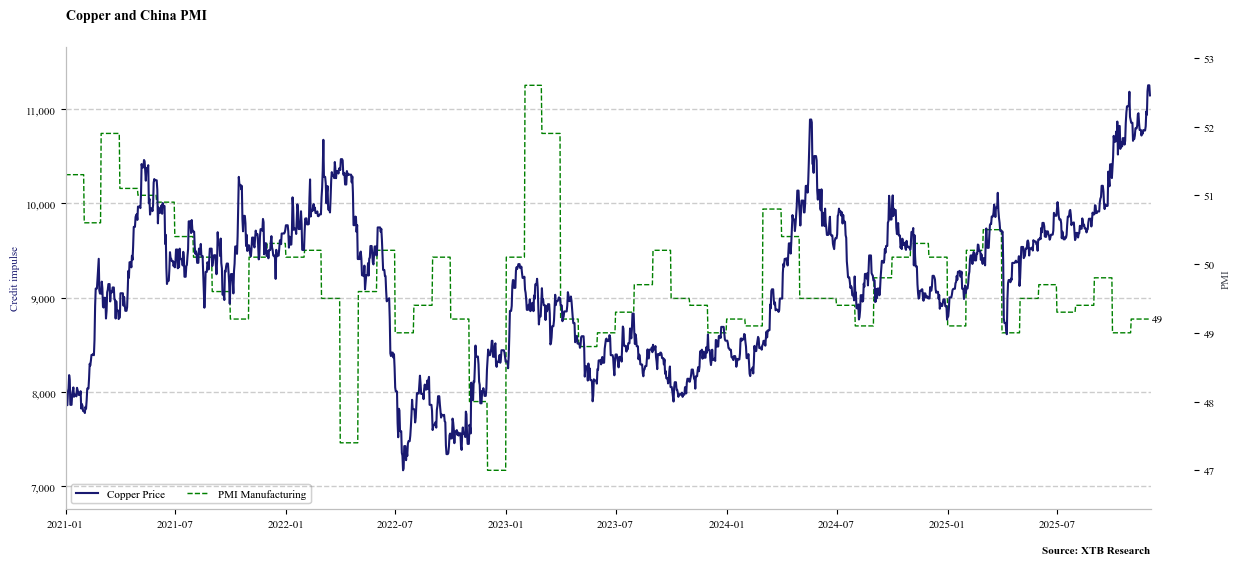

The recently concluded "Asia Copper Week" conference saw analysts clearly pointing to an impending copper shortage.

Chinese refineries are reducing production, and a series of accidents in mines over the past few months have significantly reduced the supply of the raw material. Producers and importers are massively stockpiling the metal, preparing for long-term availability challenges and the forecasted increase in demand, driven by the construction of data centers and energy infrastructure, positioning the metal in a strong and long-term upward trend.

COPPER (D1)

Source: xStation5

Daily summary: Dollar loses ground after NFP; OIL.WTI at its lowest since 2021 💡

OIL.WTI loses 2.5% 📉

From Euphoria to Correction: CoreWeave and the Future of AI Infrastructure

EU Fines for Tech Giants — Their Role in EU/USA Competition