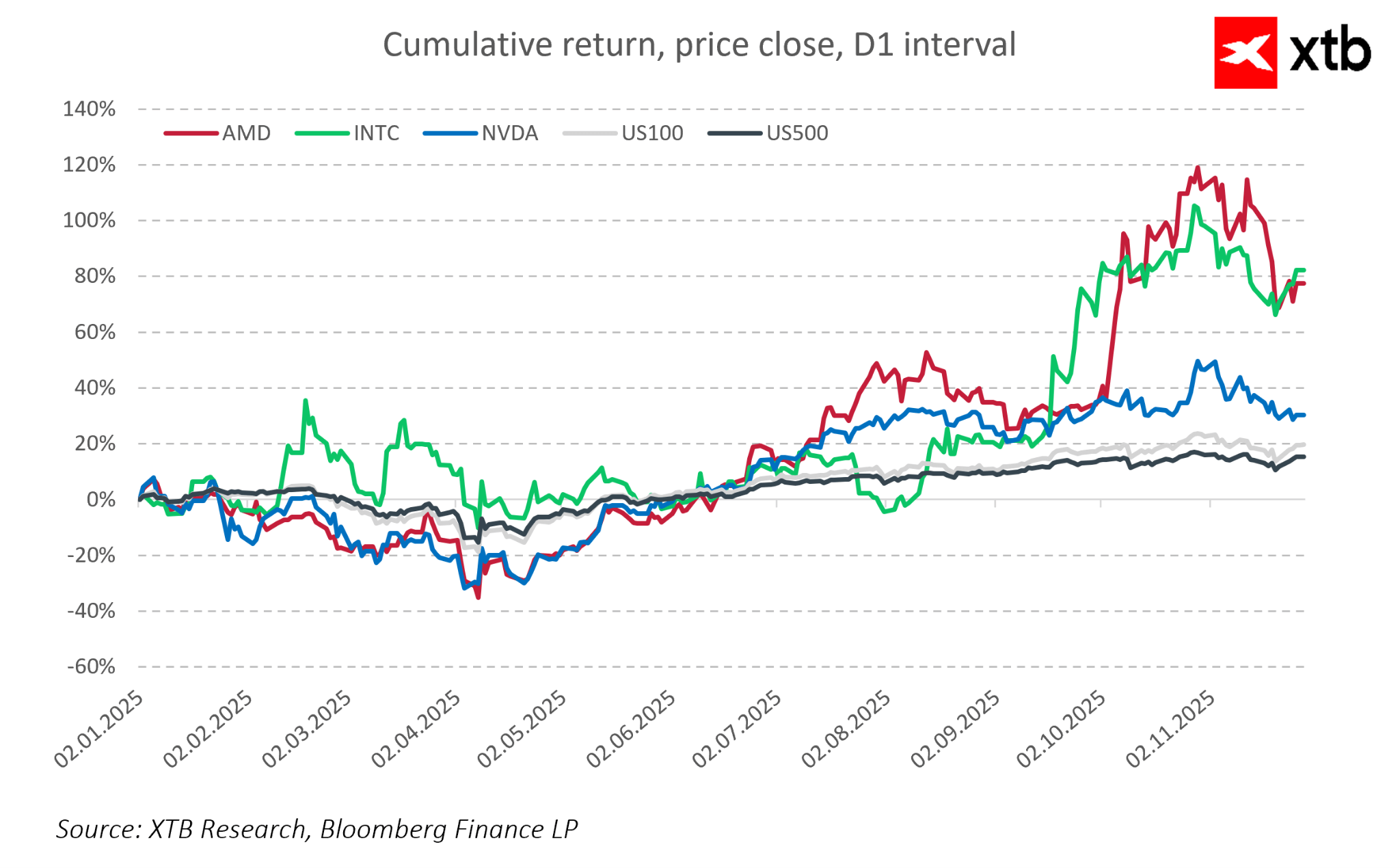

During today’s trading session, Intel shares are rising by more than 7% following reports that the company could become a manufacturer of some of Apple’s M-series chips. The market interprets the potential collaboration as an opportunity to strengthen Intel’s position in the semiconductor industry and to rebuild its production capabilities, which is a significant factor in the current geopolitical context.

At this stage, discussions between the companies are still at a very early phase, and there is no certainty that they will result in a finalized agreement. Intel would reportedly produce the lower-end Apple chips starting in 2027, while the more advanced and high-performance chips would continue to be manufactured by the current partner, TSMC. Introducing Intel as an additional supplier allows Apple to diversify its supply chain and aligns with the strategy of promoting domestic production in the United States.

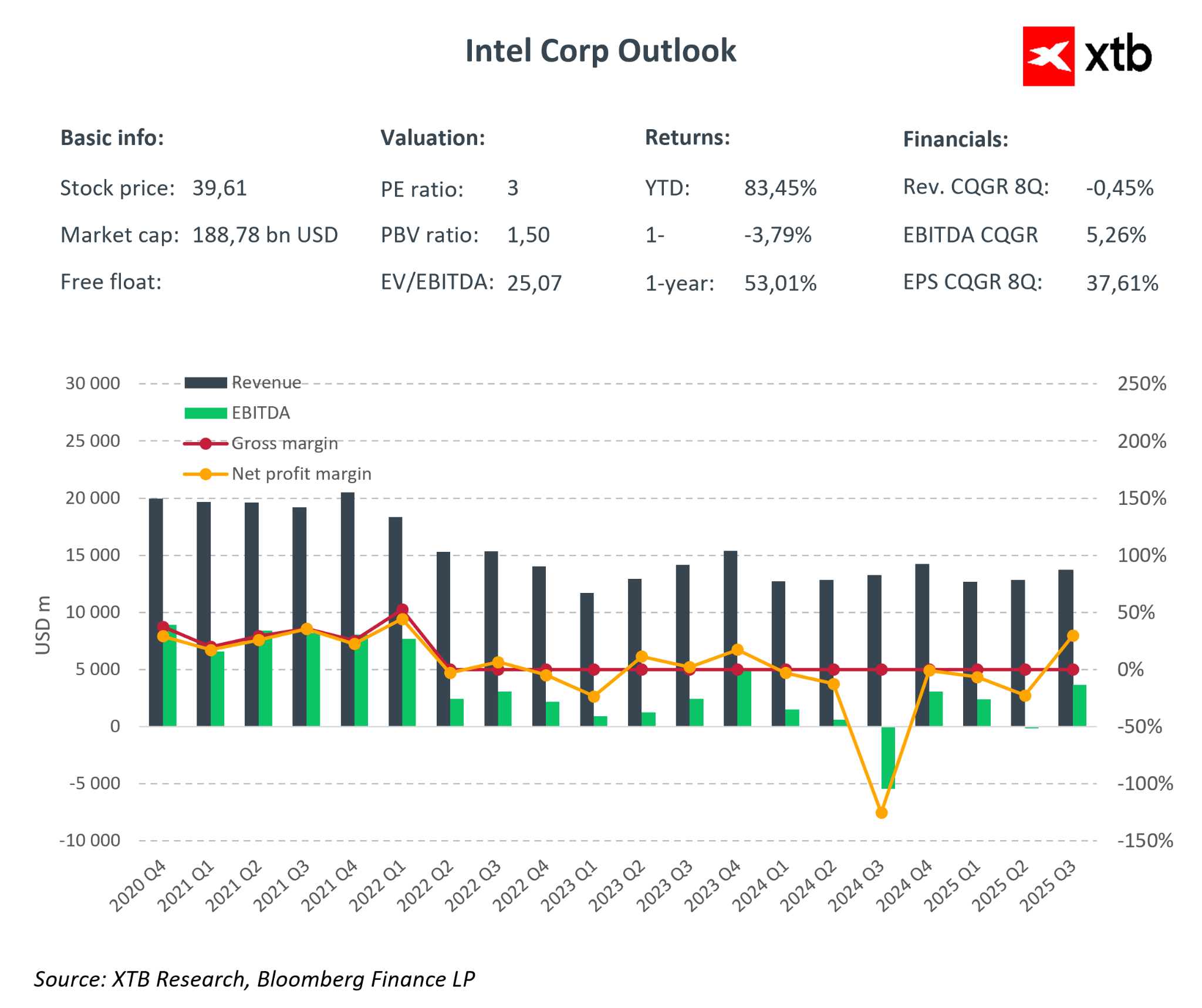

The current rise in Intel’s share price reflects the market’s reaction to the reports about a possible collaboration with Apple and the company’s potential role in producing M-series chips. Following the principle of “buy the rumor, sell the news,” the market reacts to unconfirmed information, while the further development of the situation remains uncertain and could affect the company’s valuation at any time.

Daily summary: Dollar loses ground after NFP; OIL.WTI at its lowest since 2021 💡

OIL.WTI loses 2.5% 📉

From Euphoria to Correction: CoreWeave and the Future of AI Infrastructure

EU Fines for Tech Giants — Their Role in EU/USA Competition