- The European session opens with negative sentiment, influenced by political uncertainty in France and disappointing macroeconomic data from Germany, leading to a cautious investor outlook.

- Investors are eagerly awaiting statements from European and U.S. central bankers for guidance on future monetary policy, following mixed signals from the Fed.

- Factory Orders from Germany below expectations

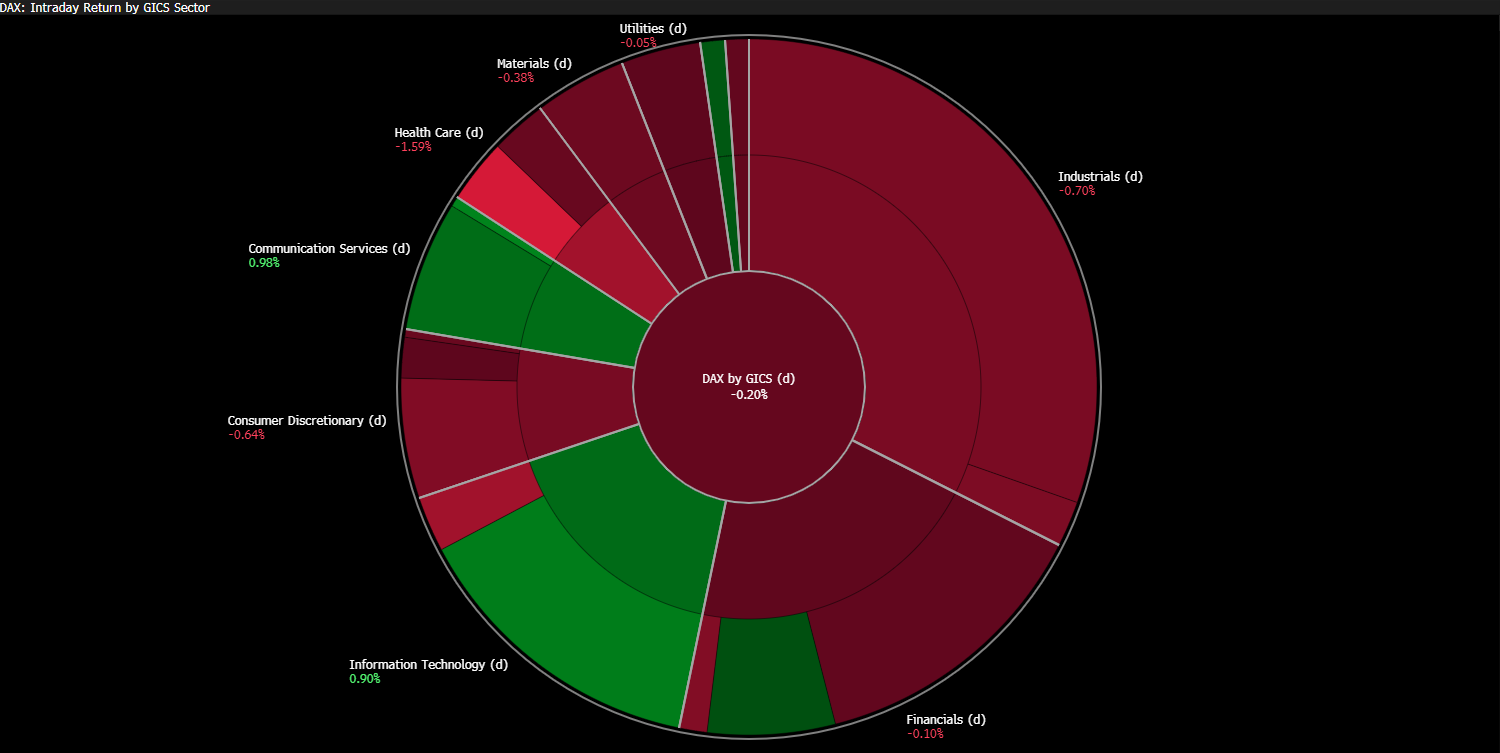

- Industrial and healthcare sectors are dragging down the European market, while technology and luxury brands provide limited support, insufficient to lift main indices into positive territory.

- LVMH sees a 2.6% rise due to positive sentiment from Morgan Stanley

- The European session opens with negative sentiment, influenced by political uncertainty in France and disappointing macroeconomic data from Germany, leading to a cautious investor outlook.

- Investors are eagerly awaiting statements from European and U.S. central bankers for guidance on future monetary policy, following mixed signals from the Fed.

- Factory Orders from Germany below expectations

- Industrial and healthcare sectors are dragging down the European market, while technology and luxury brands provide limited support, insufficient to lift main indices into positive territory.

- LVMH sees a 2.6% rise due to positive sentiment from Morgan Stanley

The European session is not starting too optimistically. The main indices of the Old Continent open in the negatives, and investor sentiment remains clearly cautious. They are still burdened by political uncertainty in France, where prolonged tensions around the government situation and fiscal reforms weaken the appetite for risk. Additionally, fresh macroeconomic data from Germany does not inspire optimism. DE40 and FRA40 contracts are down by 0.4%.

Today's session will be marked by anticipation of statements from central bankers from Europe and the United States. Investors are hoping for guidance on the direction of monetary policy in the coming months, especially after recent mixed signals from the Fed.

Source: Bloomberg Finance Lp

The broad European market is being dragged down today, primarily by industrial companies and the healthcare sector. There is slight support from technology companies and luxury brands, but at the moment, it is not enough to pull the main indices into the positive.

Macroeconomic Data:

The most important data from the Old Continent today concerns factory orders from Germany for August. The reading turned out to be a clear disappointment.

- Factory Orders M/M: -0.8% (Expected 1.1%, Previously -2.9%)

- Factory Orders Y/Y: 1,5% (Previously -3.5%)

These data confirm that the industrial sector has not yet regained full momentum after last year's slowdown. The decline in new orders suggests limited activity both in the domestic market and in exports. However, a positive signal is that the reading was noticeably better than last month's.

DE40 (D1)

Source: xStation5

From a technical point of view, the chart confirms the deteriorating condition of the market. The index made another unsuccessful attempt to break above the resistance zone, then fell lower again, marking the third consecutive day of declines today. The weakness of the quotations is clear, and the lack of demand in the area of recent highs suggests that buyers are losing momentum.

The base scenario is a descent to around 24,100 points, where the nearest technical support runs. Maintaining this level could lead to a transition into a consolidation phase. A quick breakout above the resistance zone, however, could negate the current downward trend, which seems unlikely at this moment.

Company News:

LVMH (MC.FR) - Morgan Stanley highlighted the strength of luxury companies at its conference. The company's valuation is up by 2.6%.

Novo Nordisk (NOVOB.DK) - The Danish pharmaceutical giant is losing 1.7% today amid a broad negative sentiment towards medical companies.

RedCare Pharmacy (RDC.DE) - Following recent results, the company received a positive recommendation from an investment bank, resulting in a 1.5% increase in price today.

B&M (BME.UK) - The British retailer warns of a decline in sales related to weak consumer conditions. The company opened down 20% but reduced losses to 8% during the session. This is yet another significant British company expressing similar concerns in recent months.

Morning Wrap (07.10.2025)

Daily summary: US100 surges almost 1% 📈Crypto and precious metals on the rise

NATGAS gains amid colder US weather forecasts📈Oil near the resistance zone

EURUSD muted after Lagarde's status quo remarks 💶 📌