-

European indices open Friday with cautious gains; DE40 up 0.05%.

-

Siemens and MTU Aero Engines are the weakest DAX names; Mercedes-Benz and Continental lead the advance.

-

Brenntag shares come under pressure after a UBS downgrade; ArcelorMittal falls following a rating change and commentary from Goldman Sachs.

-

European indices open Friday with cautious gains; DE40 up 0.05%.

-

Siemens and MTU Aero Engines are the weakest DAX names; Mercedes-Benz and Continental lead the advance.

-

Brenntag shares come under pressure after a UBS downgrade; ArcelorMittal falls following a rating change and commentary from Goldman Sachs.

European indices opened with cautious gains, locally partly supported by hopes of an easing in France’s political crisis. Volatility may pick up around 16:00 when U.S. University of Michigan data on consumer sentiment and inflation expectations are released.

DE40 (H1 interval)

The German DAX (DE40) futures contract is oscillating around 24,750 points and testing the 50-period EMA (orange line) on the hourly chart, additionally supported by prior price reactions from early July.

Source: xStation5

Most active stocks in the German DAX. Source: Bloomberg Finance L.P.

Brenntag cut by UBS

UBS downgrades Brenntag to “Sell” and cuts the target price to €45 (from €56), citing a deterioration in the outlook. Shares are down almost 4% today.

- Weak end-market demand and overcapacity in the chemical industry are expected to pressure volumes and margins for chemical distributors at least through H1 2026, wrote analyst Nicole Manion.

- Earnings forecasts for 2025–2027 have been lowered well below consensus, as UBS sees heightened risk to sales and profitability; the call suggests a longer downcycle than the market is currently pricing in.

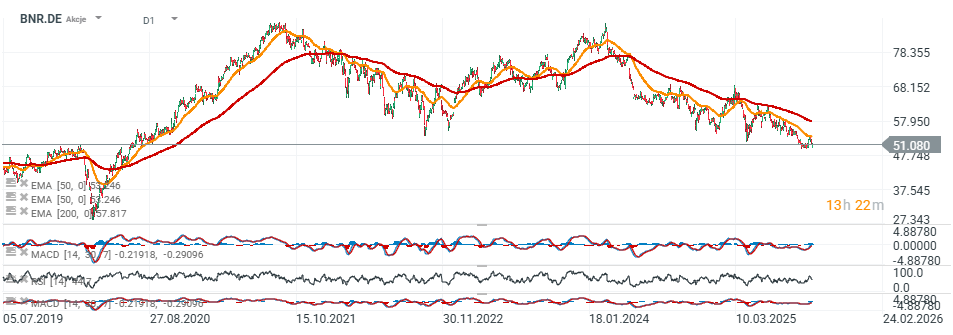

Brenntag (D1)

Brenntag shares have been falling for some time and are hovering near levels last seen in August 2020. Even so, the chemical group’s P/E valuation remains in the high double digits.

Source: xStation5

Steel giant under pressure

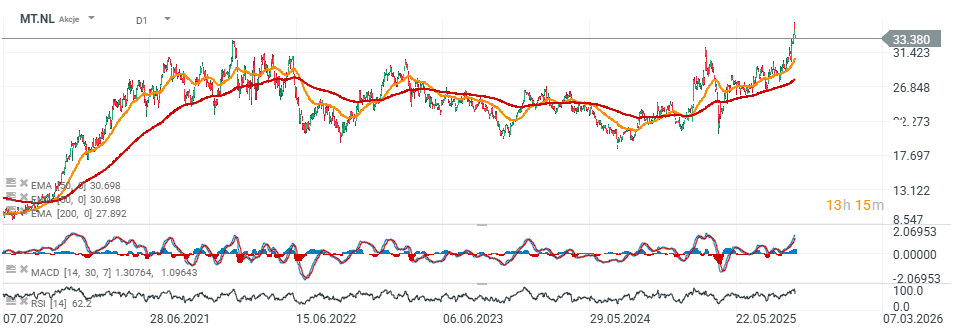

Goldman Sachs downgrades ArcelorMittal (MT) to “Neutral” from “Buy”, while raising the target price to €30 (from €29). As a result, the shares are down over 2% today, extending a pullback from multi-year highs.

- According to GS, the bullish thesis has largely played out: raw-material deflation supported margins and prospects for effective safeguards in key markets buoyed sentiment. After a ~55% gain since being added to the Buy list, the stock now looks fully valued.

- Risk-reward is balanced: upside depends on sustained cost tailwinds and consistent EU policy implementation; downside risks include a reversal in iron-ore/met coal or higher energy costs compressing spreads, weaker safeguard enforcement, tariff uncertainty, and risks to India JV profitability.

Arcelor Mittal (D1)

Source: xStation5

Crude Oil Drops on Ceasefire in Gaza Strip

BREAKING: USDCAD slips following Canadian employment data 📌

⏫🔝Silver is up 4%

ECB Not Gearing Up for Changes. Is EURUSD Undervalued?