- Bitcoin is up more than 1%, approaching the $125,000 mark.

- Ethereum gains nearly 3.5%, moving toward $4,700 — its highest level since September 18.

- A stronger U.S. dollar isn’t stopping the rally.

- Bitcoin is up more than 1%, approaching the $125,000 mark.

- Ethereum gains nearly 3.5%, moving toward $4,700 — its highest level since September 18.

- A stronger U.S. dollar isn’t stopping the rally.

Cryptocurrencies are trading higher today, and the latest CryptoQuant analysis points to rising Bitcoin demand along with a declining share of unrealized profits among investors, which helps to limit selling pressure.

One of the main drivers behind this trend is spot market demand, which has been growing since July and now exceeds 62,000 BTC per month. Such expansion is considered a key prerequisite for larger market rallies, a pattern previously observed in late 2020, 2021, and 2024.

Large wallets (so-called “whales”) are also contributing to this upward momentum. Their combined holdings are now increasing at an annual rate of 331,000 BTC, compared with 255,000 BTC in Q4 2024 and 238,000 BTC at the beginning of Q4 2020. Data suggests that accumulation remains above the long-term trend and is far from exhaustion levels. This situation contrasts sharply with 2021, when whale balances declined by around 197,000 BTC. On-chain data from CryptoQuant indicates that selling pressure from large addresses has weakened.

Source: xStation5

Net inflows into cryptocurrencies are also increasing, while institutional demand via U.S.-based ETFs could further support the market in the coming months. During the same quarter last year, ETFs expanded their holdings by 213,000 BTC, marking a more than 70% year-over-year increase.

Source: CryptoQuant

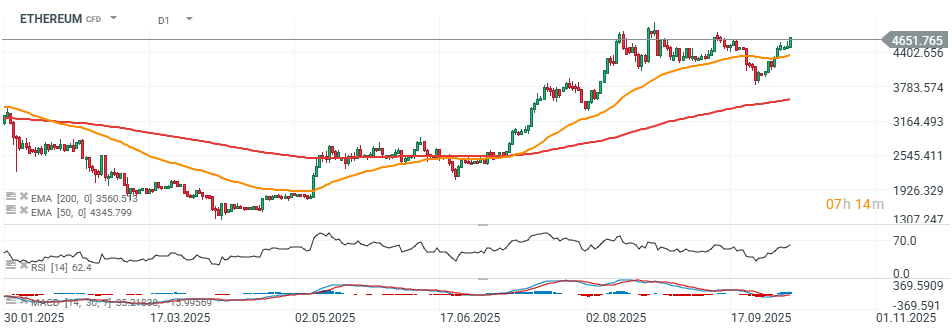

Ethereum (D1 timeframe)

The ETH price is rising today to levels not seen since the second half of September. If the upward move continues, the next key target could be around $4,800, matching this year’s highs.

Source: xStation5

Daily summary: US100 surges almost 1% 📈Crypto and precious metals on the rise

NATGAS gains amid colder US weather forecasts📈Oil near the resistance zone

EURUSD muted after Lagarde's status quo remarks 💶 📌

COCOA up 2% from 20-month low🍫