- A crucial decision by the Bank of Japan lies ahead

- What does the market expect?

- How will the Japanese yen and the USDJPY pair react?

- A crucial decision by the Bank of Japan lies ahead

- What does the market expect?

- How will the Japanese yen and the USDJPY pair react?

We have seen decisions from two important central banks, namely the European Central Bank, which decided to keep interest rates unchanged, and the Bank of England, which made its first 25 bp cut since August. However, the week of central banks is not over yet – tomorrow morning between 4:00 and 6:00 CET, the Bank of Japan will make its decision on monetary policy. Let's take a look at what we can expect from this event.

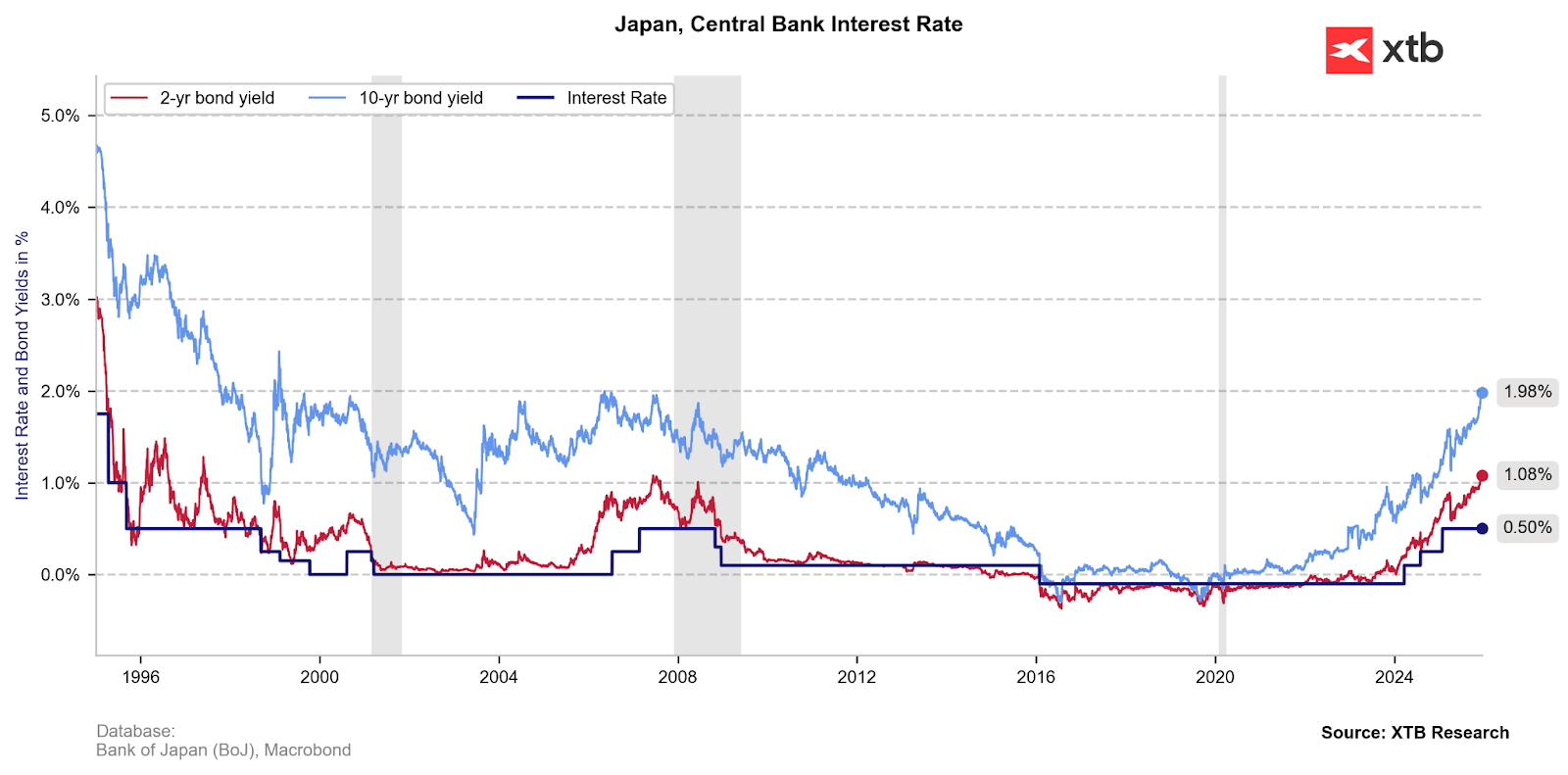

Yields on Japanese bonds are at their highest since 2007, reflecting strong expectations of a return to interest rate hikes in Japan. Source: XTB Research

Markets give a 90% chance of a rate hike

The Bank of Japan is likely to raise interest rates by 25 basis points at tomorrow's meeting, for the first time since January and to the highest level since 1995.

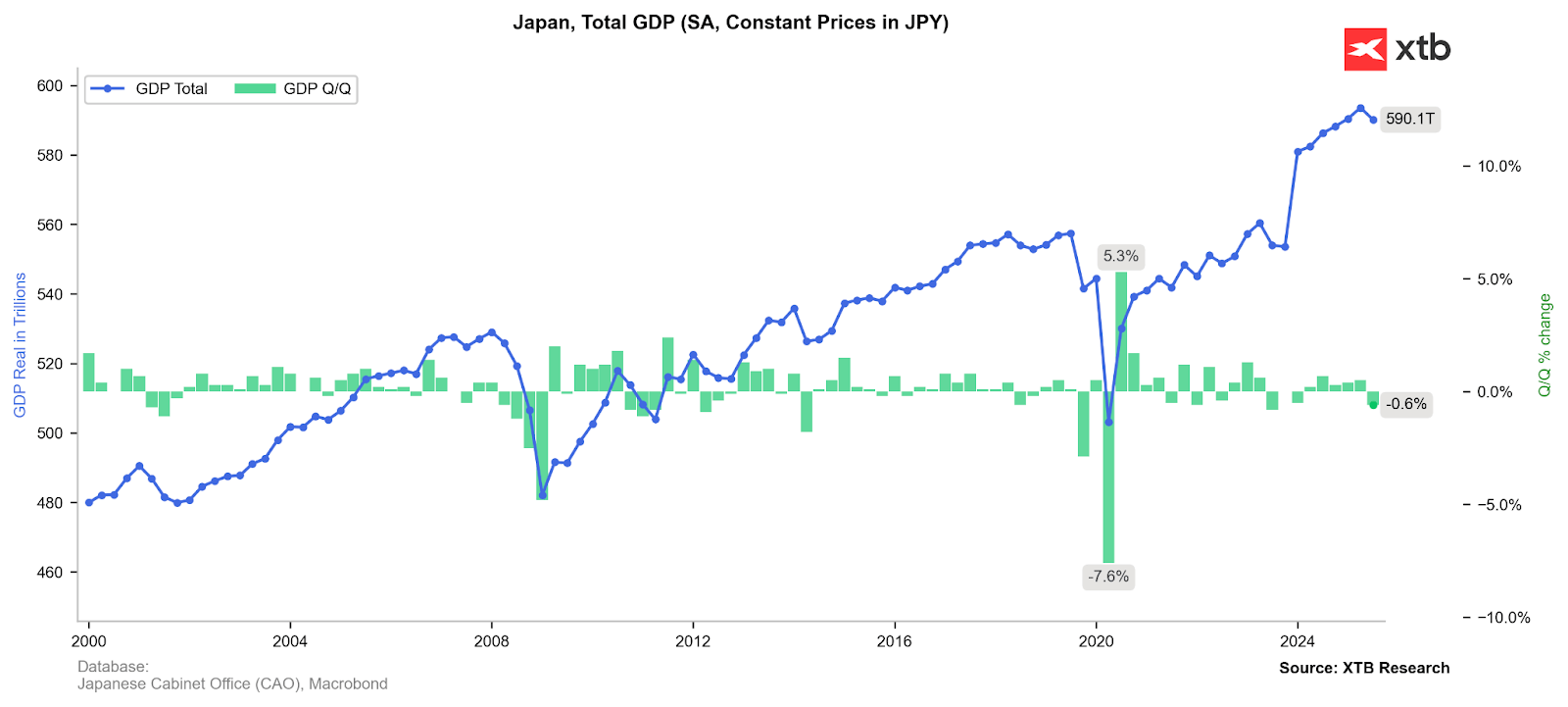

The pause that has lasted since the beginning of the year was mainly motivated by uncertainty about economic growth as a result of Donald Trump's tariffs. At the center of concerns for years have been flat GDP growth and negligible activity largely concentrated around the production of exported cars. industry. At the same time, however, we observed a further increase in inflationary pressure, which increasingly reinforced the feeling that the Bank of Japan was lagging behind with its response, especially in the face of increasingly expansionary fiscal policy in the country.

The latest GDP reading was revised downward (from -0.4% to -0.6%), indicating a stronger-than-expected decline in economic activity in Japan. However, the main culprits in this case were weaker exports and corporate investment, while inflationary consumption (private and public) remained positive. Source: XTB Research

Macro data confirms expectations

The latest series of monthly data has provided the BOJ with a number of reasons to fear further inflationary pressure in the coming months.

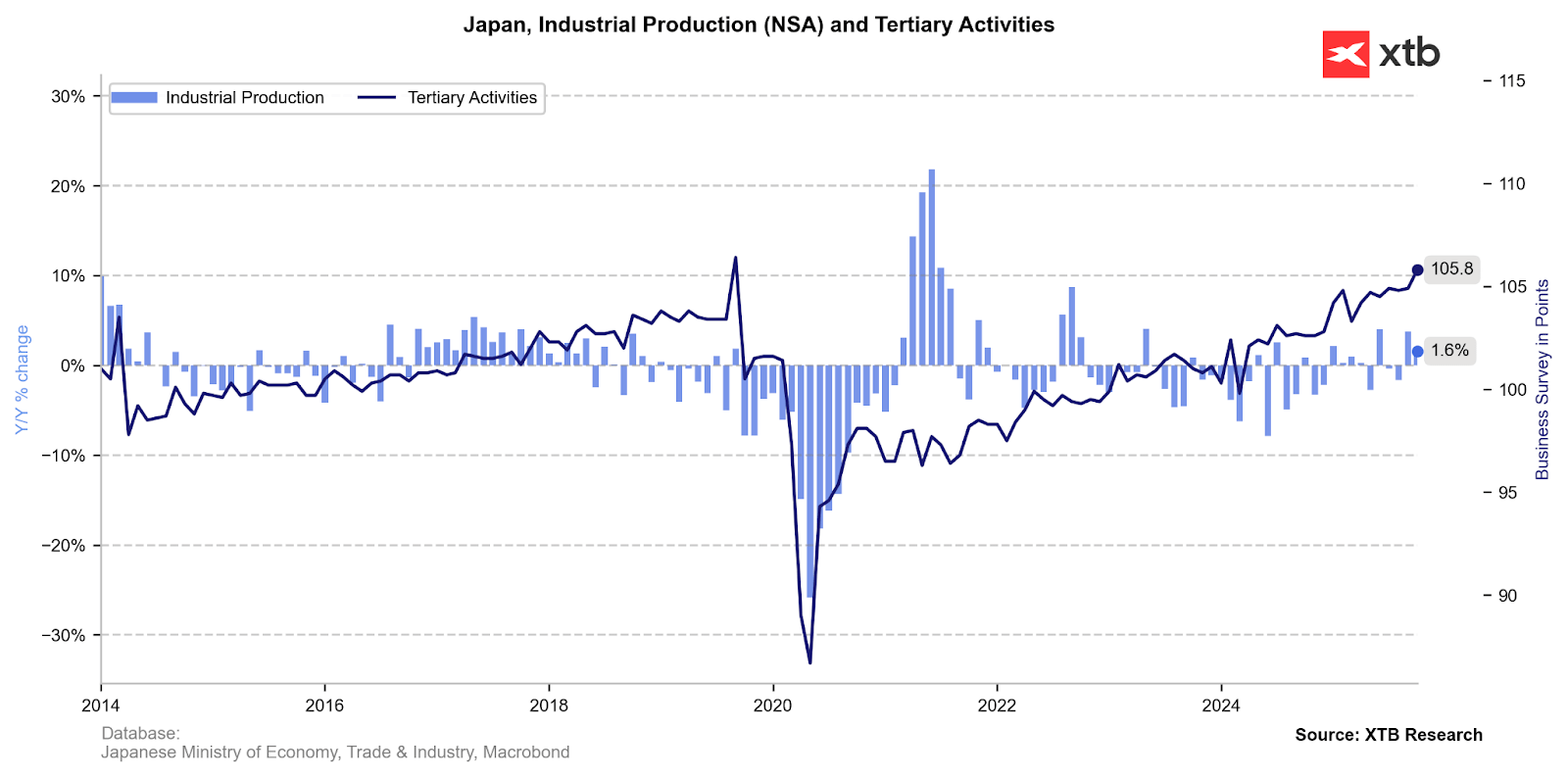

The Tankan survey showed a third consecutive improvement in sentiment among large companies and higher-than-expected capital investment (12.6% vs. Bloomberg consensus of 12.1%). In addition, core orders for machinery rose above expectations to their highest level since September 2022 (+12.5%, forecast 3.6%, previously 11.6%), sending another signal of rising capital expenditure among Japanese companies. The increase in business activity should therefore make the BOJ sensitive to the scenario of further economic heating up, and thus increase its readiness to normalize monetary policy.

While industrial production data remains volatile, a consistent improvement in business sentiment according to survey data suggests an imminent increase in industrial activity. Source: XTB Research

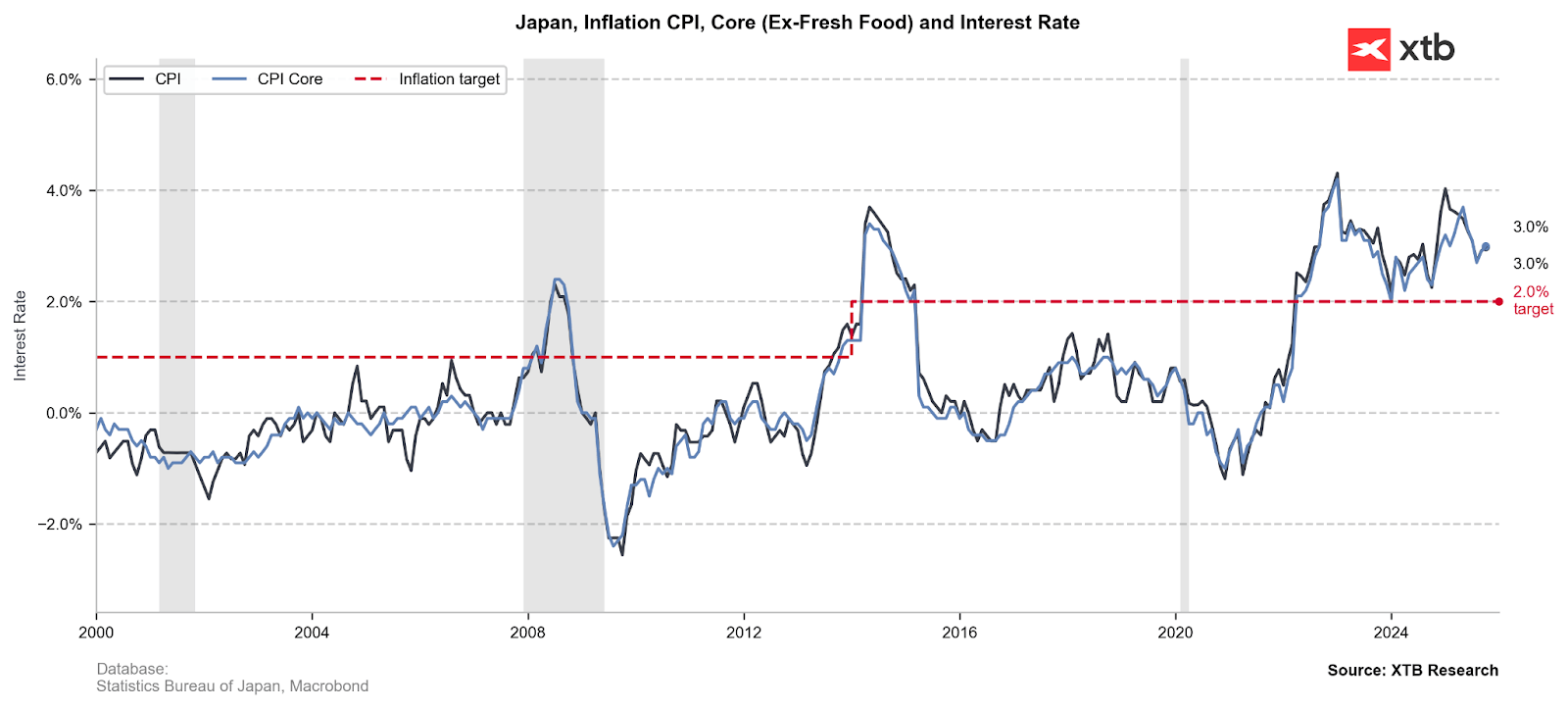

Inflation remains below zero in real terms, and mounting price pressures should generate more hawkish sentiment at the BOJ despite pro-growth pressure from Prime Minister Sanae Takaichi. According to the latest data, inflation in Tokyo remained at 2.8%, above the expected decline to 2.7%. In addition, the latest PMI report highlighted the fastest increase in input prices in five months, which may soon be passed on to consumers. CPI is currently at 3%, well above the BOJ's 2% target, which, with rates at 0.5%, still points to a deeply negative real rate.

Inflation in Japan is well above target, keeping real interest rates at deeply negative levels. Source: XTB Research

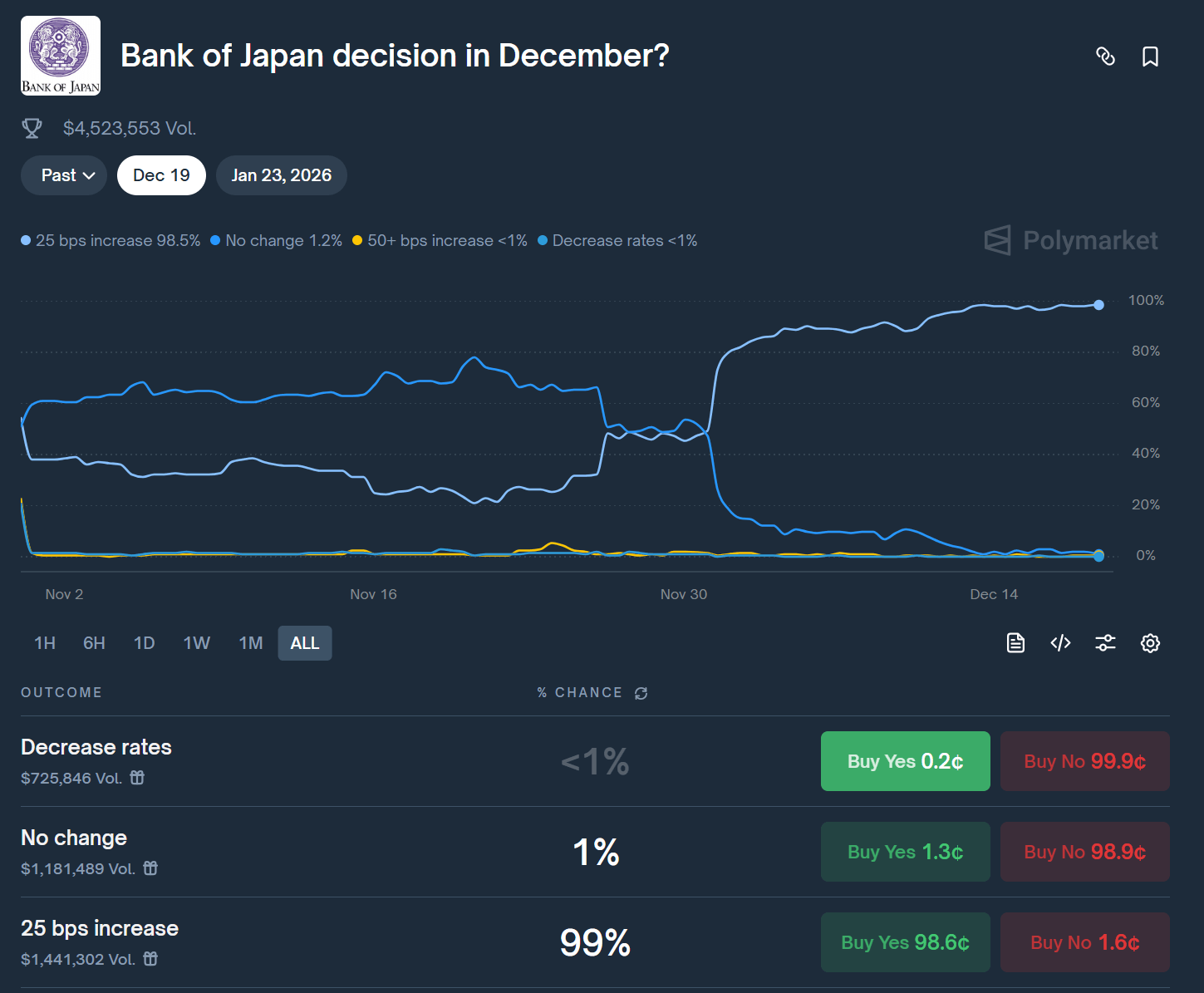

According to Polymarket data on bets for tomorrow's decision, public opinion puts the probability of a 25 bp hike at 99%. Source: Polymarket

Interest rate changes are one thing; ETF sales are another

However, the rate hike itself does not seem to be the most interesting element of this decision-making puzzle – much more is happening behind the scenes in the relationship between the government and the central bank. It appears that Governor Ueda and Prime Minister Takaichi have entered into a pragmatic "pact" in which giant ETF portfolios play a key role.

A political masterpiece: "Stealth Fiscal Aid"

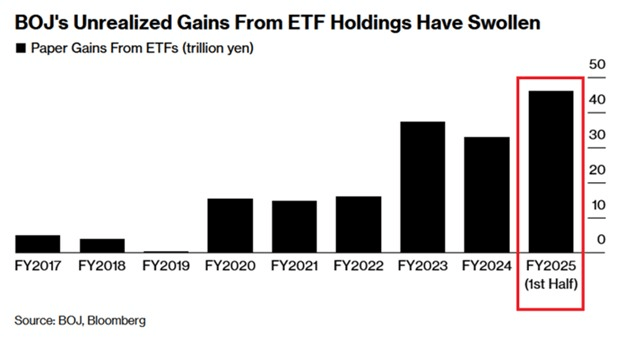

Why is Prime Minister Takaichi, a supporter of loose monetary policy ("Abenomics"), suddenly softening her resistance to interest rate hikes? The answer lies in the BOJ's balance sheet. The central bank holds huge unrealized gains from years of buying Japanese stocks (ETFs).

The plan is brilliant in its simplicity:

- The BOJ normalizes its policy (raises interest rates, which is necessary with inflation at ~3% and a weak yen).

- At the same time, the BOJ is slowly beginning to sell its ETFs (realizing profits).

- These profits go to the state budget, creating a financial cushion for the Takaichi government.

This gives the prime minister cash for his stimulus programs without having to issue new debt (the servicing of which is becoming more expensive due to higher interest rates). It is a classic example of a "have your cake and eat it too" arrangement.

The market value of ETF assets held by the Bank of Japan rose by +18.5% y/y in the first six months of this year, reaching a record level of ¥83.2 trillion. Most interestingly, however, the cumulative profits alone already amount to 46 trillion yen, which means a return on the capital invested by the BoJ of over 55%. Source: BoJ via Bloomberg Financial Lp

What does this mean for the stock market (Nikkei 225 / TOPIX)?

The news that the BOJ is starting to sell shares could theoretically trigger a nervous reaction and short-term supply pressure on the indices. The Nikkei 225 is particularly sensitive, as the BOJ indirectly holds huge stakes in Japan's largest companies. The greatest risk concerns technology and export companies with a large weighting in the Nikkei 225, which have been the main beneficiaries of ETF purchases over the last decade. However, it seems that the resale process will proceed very slowly, which in itself should not push prices down so sharply. The BoJ announced the resale back in September.

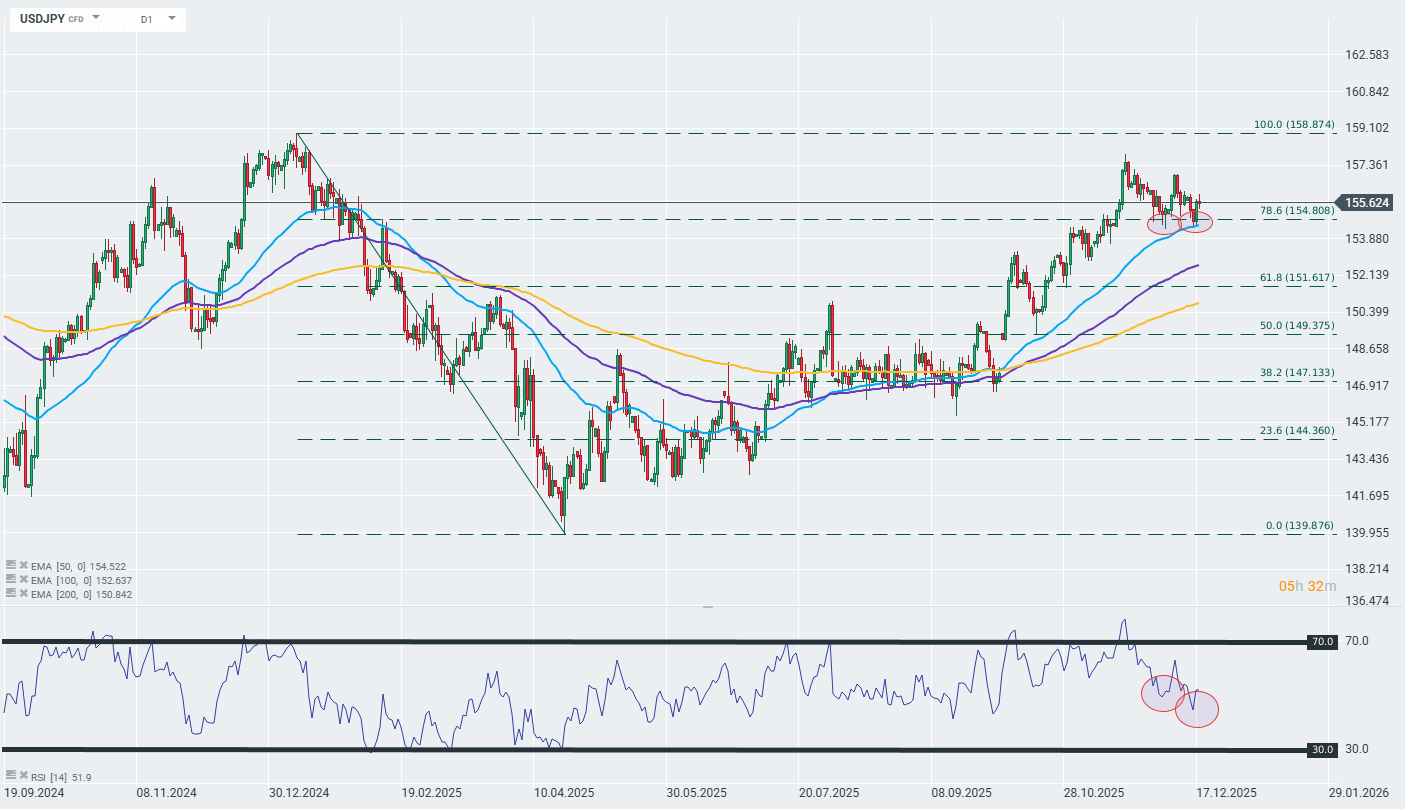

USDJPY chart (D1 interval)

Looking at the USDJPY pair chart in the long term, we can see that despite growing speculation about monetary policy tightening in Japan, the yen itself is performing relatively poorly and maintaining a technical downtrend. Interestingly, looking at the candlestick pattern from the last two weeks, we can see a divergence between the price and the RSI indicator, which may mean that the uptrend indicated by the 50-day EMA is coming to an end. Source: xStation

Mateusz Czyżkowski

XTB Research

Daily summary: US100 gains after CPI print; markets await BoJ decision 🏛️

BREAKING: NATGAS ticks down afer lower than expected EIA inventory draw

A tale of three central banks

ECB conference (LIVE)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.