Donald Trump is ramping up pressure on the Supreme Court ahead of a pivotal ruling that could invalidate his tariffs, warning that such an outcome would trigger “complete chaos” for the U.S. economy and public finances. There is a real possibility that a decision striking down the tariff regime would inject fresh volatility into markets, hit the U.S. dollar in particular, and weaken demand for U.S. government debt amid fears of broader, systemic instability in the world’s largest economy. For now, markets appear to be somewhat underpricing the legal risk, while the Trump administration signals it already has fallback options designed to keep its trade policy in place even in the event of an adverse ruling. This scenario may raise wider questions about institutional credibility in the United States and, more broadly, the resilience of the rules-based capitalist and legal system in the long term.

- The central risk revolves around refunds. Trump argues that if the tariffs are deemed unlawful, the government could be forced to roll them back and potentially repay enormous sums—an outcome he says would entail a multi-year, highly complex administrative and legal process.

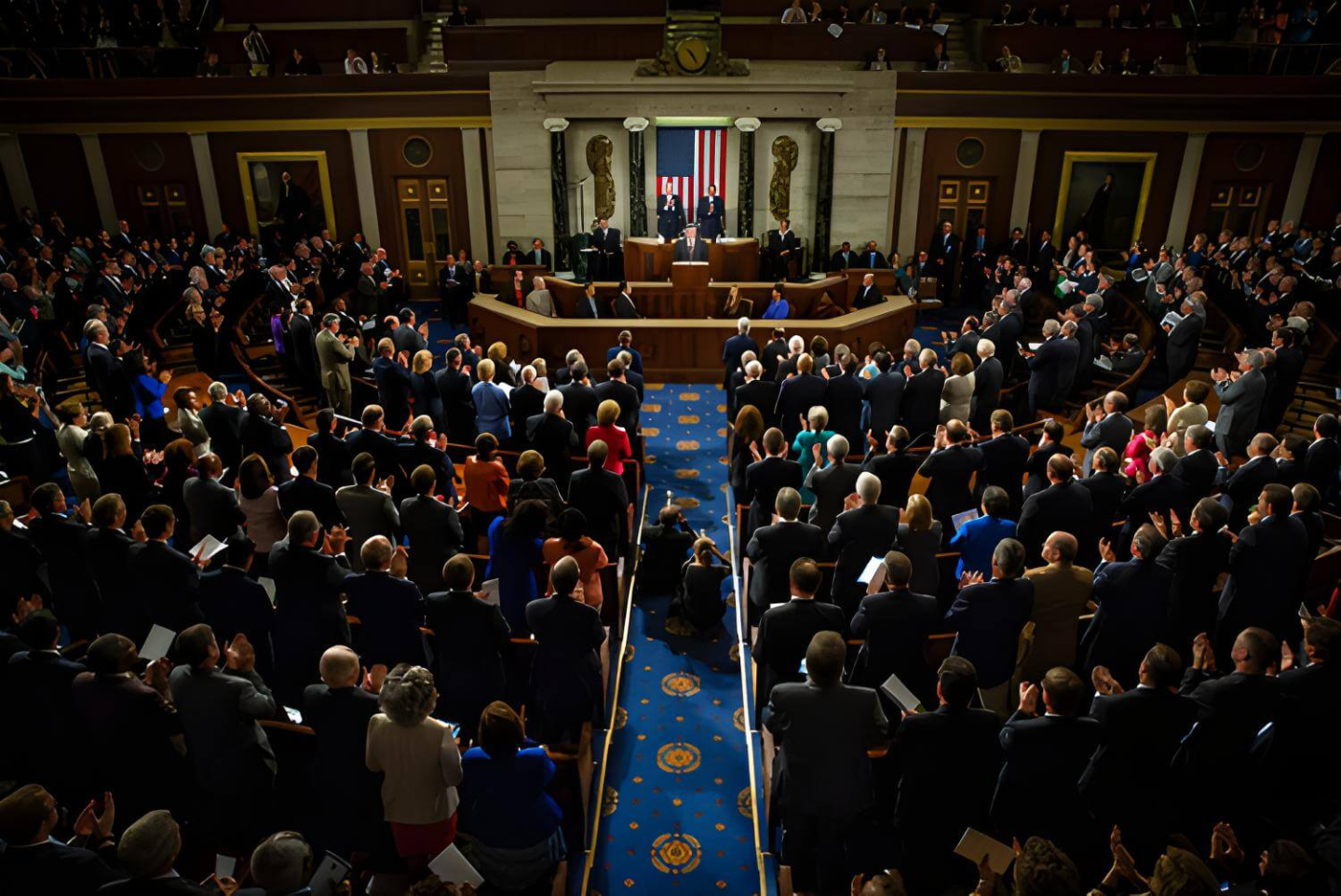

- The tariffs face broad legal challenges from small businesses and a group of U.S. states, which claim the president exceeded his authority by imposing sweeping duties without congressional approval.

- The legal basis is the 1977 International Emergency Economic Powers Act (IEEPA), which grants the president extraordinary powers in emergency situations; opponents counter that IEEPA does not even mention “tariffs,” and that under the Constitution, Congress holds the exclusive power to levy taxes.

- The financial stakes are substantial: tariffs imposed under IEEPA have generated more than $130 billion in revenue, meaning any cancellation or large-scale refunds would be both financially and politically fraught.

- Lower courts have already ruled against Trump on the question of authority, paving the way for a Supreme Court decision that investors and businesses are watching closely.

- Judges have signaled skepticism. During the November hearing, several conservative justices reportedly questioned the White House’s reasoning, including the notion that the trade deficit constitutes an “emergency.”

- The White House is also floating a Plan B. If the court rules against it, the administration is considering alternative legal pathways, including provisions that could allow tariffs of up to 15% for 150 days.

Which stocks could benefit?

As uncertainty builds, tariff-exposed companies—especially large importers—are hoping the duties are ruled unlawful, while the prospect of refunds, new regulations, or prolonged litigation could keep market volatility elevated (though not necessarily in equities). Which sectors and companies could stand to gain if the Supreme Court finds the tariffs illegal?

Retail could benefit, including:

-

Walmart (WMT): significant exposure to imports from China

-

Target (TGT): similar profile, high sensitivity to tariffs

-

Home Depot (HD) and Lowe’s (LOW): building materials, appliances, and home improvement goods

-

Costco (COST): large-scale import footprint

For these companies, tariffs are a direct cost that pressures margins and can only be partially passed on to consumers.

Apparel (low margins, Asia-based production)

-

Nike (NKE)

-

VF Corp (VFC)

-

Levi Strauss (LEVI)

-

Under Armour (UAA)

-

Gap (GPS)

For these firms, refunds would effectively mean a one-off cash inflow and improved cash flow dynamics.

Manufacturers and technology

Tariffs affected components as well as finished goods, lifting production costs. Refunds could improve financial results, reduce cost pressure, and support EBIT margins.

Potential names include:

-

Ford (F) and General Motors (GM)

-

Tesla (TSLA) (components, batteries, electronics)

-

Caterpillar (CAT)

-

Deere (DE)

-

Apple (AAPL)

-

HP (HPQ)

-

Cisco Systems (CSCO)

Source: xStation5

The L3Harris Technologies rollercoaster ⚔️Nearly 13% gains wiped out despite a billion-dollar government investment❓

US CPI inline with expectations

BREAKING: EURUSD spikes on lower-than-expected Core CPI in the US❗️

DE40: European equities overbought❓All eyes on US CPI💡

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.