-

Data Reliability Concern: September's CPI is an exception to the economic data freeze caused by the 24-day government shutdown, but there are reliability concerns for future reports if the shutdown persists.

-

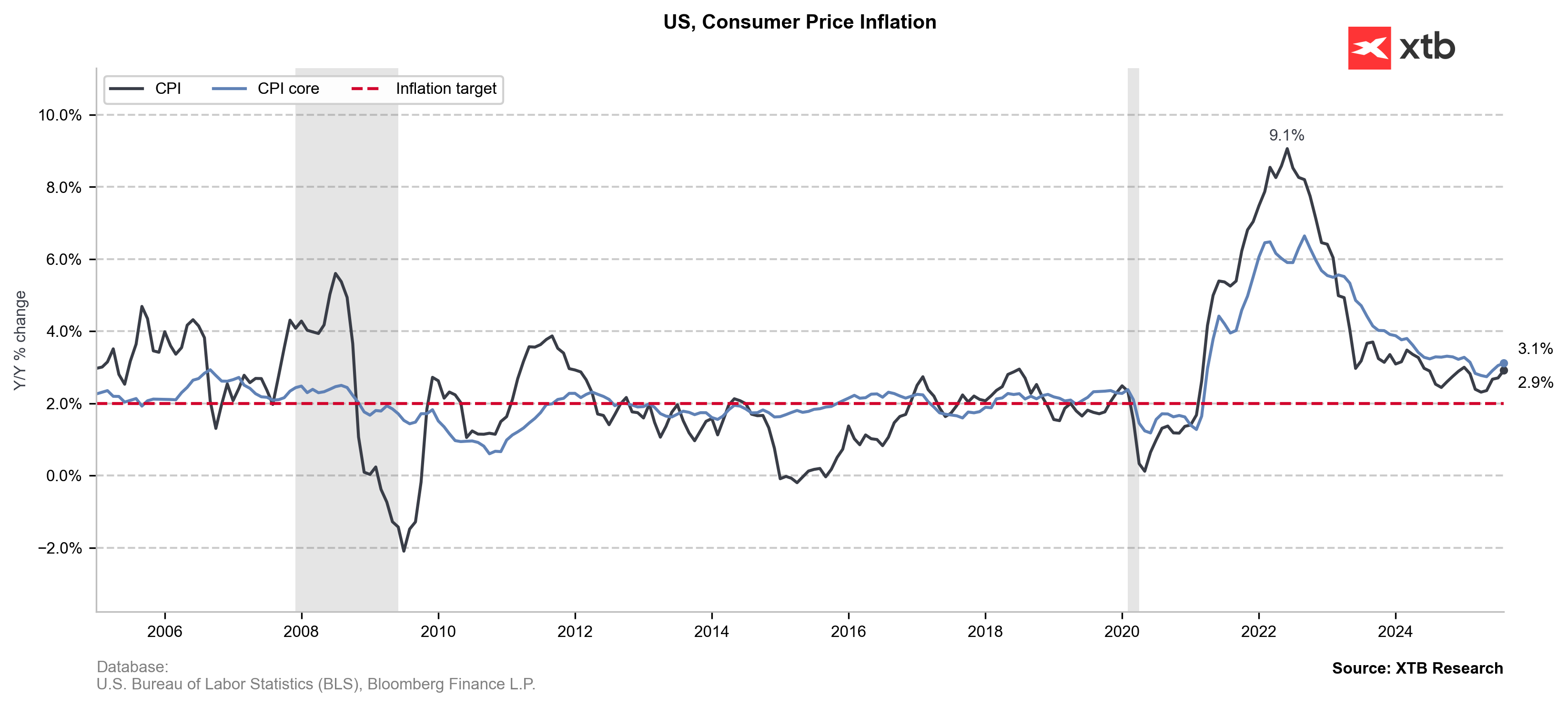

Forecasted Core Inflation: Markets anticipate a 0.3% monthly increase in the core CPI, which translates to an annual growth of 3.1%—well above the Federal Reserve’s 2% target.

-

Market Impact Prediction: If monthly core inflation lands exactly at the 0.3% forecast, the S&P 500 is expected to see slight increases, potentially up to 0.5%.

-

Data Reliability Concern: September's CPI is an exception to the economic data freeze caused by the 24-day government shutdown, but there are reliability concerns for future reports if the shutdown persists.

-

Forecasted Core Inflation: Markets anticipate a 0.3% monthly increase in the core CPI, which translates to an annual growth of 3.1%—well above the Federal Reserve’s 2% target.

-

Market Impact Prediction: If monthly core inflation lands exactly at the 0.3% forecast, the S&P 500 is expected to see slight increases, potentially up to 0.5%.

Today we will finally have some insight into the U.S. economy, as the inflation data for the month of September will be released despite the government shutdown, which in recent weeks has limited the publication of economic data for the country.

Due to the shutdown, the main metrics of the U.S. economy are not being published, but inflation data are an exception. So far, the government shutdown has lasted 24 days, making it the second longest in history after the 35-day shutdown in 2018 during Donald Trump’s first term. This time, it does not appear likely to be resolved in the short term.

While September’s inflation data are expected to be released without major issues, there is growing concern that October’s reports may be less reliable, since the statistical agency has stopped collecting, processing, and disseminating data during the shutdown.

This means there could be accuracy issues. When the 16-day government shutdown in 2013 affected CPI data collection, the Bureau of Labor Statistics (BLS) reported that the sample of prices used to calculate the index was smaller—about 75% of the usual amount.

What to expect from the CPI?

Friday’s CPI report carries enormous importance for investors. This data will be one of the few clear signals about the state of the economy before the interest rate meeting and will likely set the tone for the markets for the rest of the year.

Markets are forecasting a 0.3% increase in September’s core CPI—which excludes the more volatile food and energy components—compared with the previous month. On an annual basis, growth of 3.1% is expected, in line with the previous month but well above the Federal Reserve’s 2% target.

As for the overall CPI, it is also expected to rise to 3.1%. If confirmed, this would mark the first time since the beginning of the year that it exceeds 3%, up from 2.9% the previous month. However, the impact of inflation has been more moderate than expected, likely due to a combination of margin compression, early inventory accumulation, and trade diversion.

For this month, a decline is expected in used car prices and housing costs, which rose more than expected in August in smaller southern cities but have since stabilized. However, one of the main concerns lies in the services sector such as rent, car insurance and auto repair, with a decline in airfare. Ironically, just as the business environment appears calmer and the trade war—except in the case of China—has faded into the background, American consumers have decided to spend more on items such as travel, clothing, food, and entertainment. Surveys show greater optimism regarding key areas like wages and employment, both of which have improved significantly.

Other key prices to watch include energy and food. In September, a possible increase in gasoline prices is anticipated, along with a slight rise in food costs.

Oil, in particular, could be one of the factors that changes the market’s direction in the short term. In recent days, oil prices have posted double-digit gains due to U.S. sanctions on Russian oil companies, which could call into question the upcoming interest rate cuts by central banks.

US CPI for September is expected to increase to 3.1% YoY and core reading should stay untouched at 3.1% YoY. Market is expecting slightly higher monthly reading so it should be closely watched by investors. Source: Bloomberg Finance LP, XTB

Market Impact

Gasoline prices, in particular, can exaggerate inflationary trends, which is why core inflation is considered a better measure of future inflation. It is analyzed on a monthly basis to assess how short-term economic conditions may have evolved. According to data provided by JPMorgan, the impact of today’s core monthly inflation release on the S&P 500 could be as follows:

- If inflation is below 0.25%, we could see gains of up to 1.5%.

- If inflation is between 0.25% and 0.3%, we could expect gains of 0.75% to 1.25%.

- If inflation remains as forecasted at 0.3%, we could see slight increases of up to 0.5%.

- If monthly inflation exceeds 0.3%, the market could fall by as much as 1.25%.

- If monthly inflation reaches 0.4%, the market could drop by up to 2.25%.

The highest probability lies within the third and fourth scenarios, meaning that any variation of a tenth of a percentage point above or below 0.3% will set the tone for financial markets.

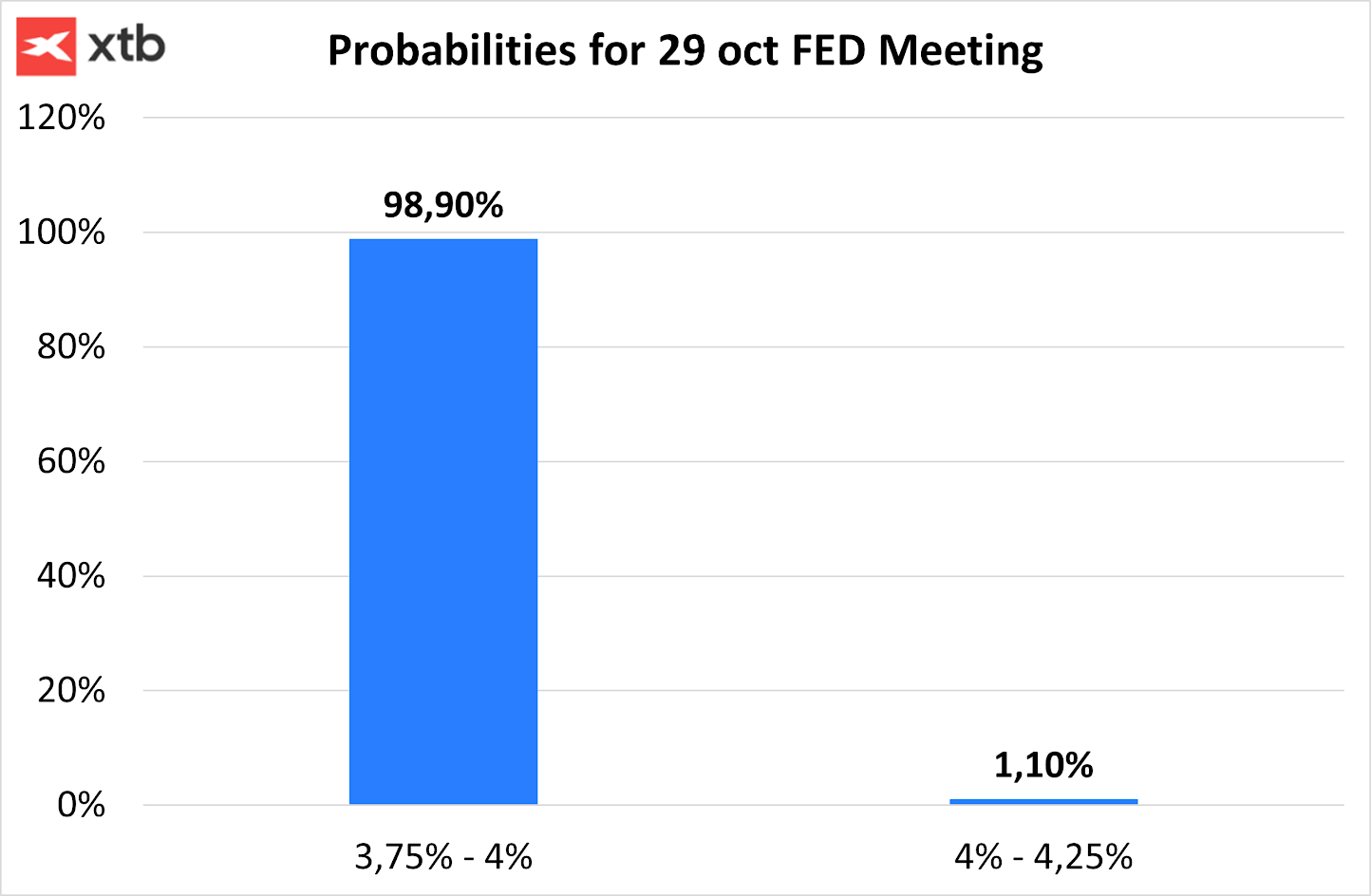

Given that the Federal Reserve is likely more focused on the labor market, we do not expect the CPI to have much influence on next week’s Fed decision, although it could alter the course of the December meeting.The market is pricing in a very high probability that the impact on financial markets will be smaller than usual, as there is a 98.9% probability that the Fed will cut interest rates by 25 basis points next week. To drastically change this expectation, price growth would need to be historically high.

BREAKING: Final US UoM consumer sentiment drops🗽Inflation expectations higher

BREAKING: US PMI above expectations! 📈🔥EURUSD declines!

BREAKING: US CPI data lower than expected 📈US100 gains

BREAKING: US CPI lower than expected! 🚨EURUSD climbs higher!🔥

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.