US100 loses more than 0.5% today, and the index decline is mostly fuelled by declining Meta Platforms shares, pressuring the 'AI theme' as investors reacted cautiously for the company huge AI CAPEX. Deutsche Bank has lowered the price target for the stock to $880 from $930 (still maintaining a Buy rating). Meta was seen by Wall Street as one of the biggest winners of 'AI trend', monetizing digital ads and implementing AI into the 'Family App': Facebook, Instagram and WhatsApp.

Deutsche Bank Warns About AI CAPEX?

-

Analysts cited larger-than-expected AI and infrastructure investments, which will weigh on short-term cash flow.

-

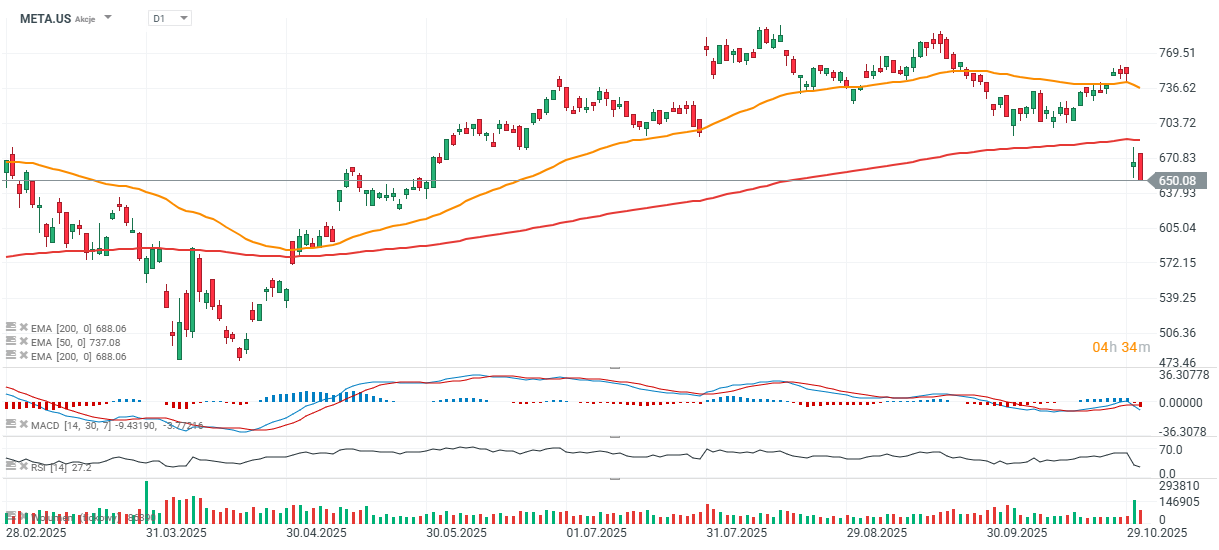

Meta trades at $650, with a $1.6 trillion market cap and a P/E ratio of appx. 23.5, considered low relative to its strong near-term earnings potential.

-

Meta shares fell after revealing plans for accelerated AI investments. Analysts from Deutsche Bank noted that these initiatives will drive much higher capital expenditures in the coming quarters.

-

Deutsche Bank trimmed its free cash flow estimates by 40% for FY2026 and 30% for FY2027, reflecting the surge in AI-related spending.

Strong core business and growth potential

-

Despite near-term cash flow pressure, Deutsche Bank reaffirmed that Meta’s advertising engine remains “fundamentally very strong.”

-

AI investments are boosting engagement and enhancing ad platform performance, making Meta “the fastest-growing large-scale ad platform.”

-

Over the past 12 months, Meta generated a huge $50.1 billion in free cash flow and grew revenue by 19.4% to $178.8 billion.

-

Analysts expect another 19% revenue increase in FY2025, underscoring sustained growth momentum.

AI investments seen as strategic, not risky

-

Deutsche Bank defended Meta’s capital allocation, arguing that AI and infrastructure spending is already showing returns through higher user engagement and ad efficiency.

-

The bank highlighted long-term opportunities in business messaging, Meta AI, and wearables, though it acknowledged a longer payback period for these projects.

Deutsche Bank remains optimistic on Meta’s long-term AI-driven growth, viewing the current pullback as a temporary cost of scaling the next phase of digital advertising and innovation.

Source: xStation5

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

CHN.cash under pressure despite positive Trump remarks 🚩

⏬EURUSD the lowest in 3 months

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.