Yesterday's speech by Fed Chairman Jerome Powell cooled investor sentiment. His remarks that asset prices are "relatively high" and that the central bank will be cautious with further rate cuts pushed indices down. As a result, the S&P 500, Nasdaq, and Dow ended the session slightly weaker. However, today the market is trying to recover some losses, with futures contracts slightly up at the opening, but unable to maintain the growth.

Markets are still analyzing yesterday's comments from Jerome Powell and other Fed members, which reminded investors of the central bank's cautious approach to further policy easing. As a result, sentiment remains volatile, and market participants are looking for further impulses, both from new macroeconomic readings this week and from data that will arrive next week. These are the ones that may set the direction for further index movements and expectations for the Fed's next decisions.

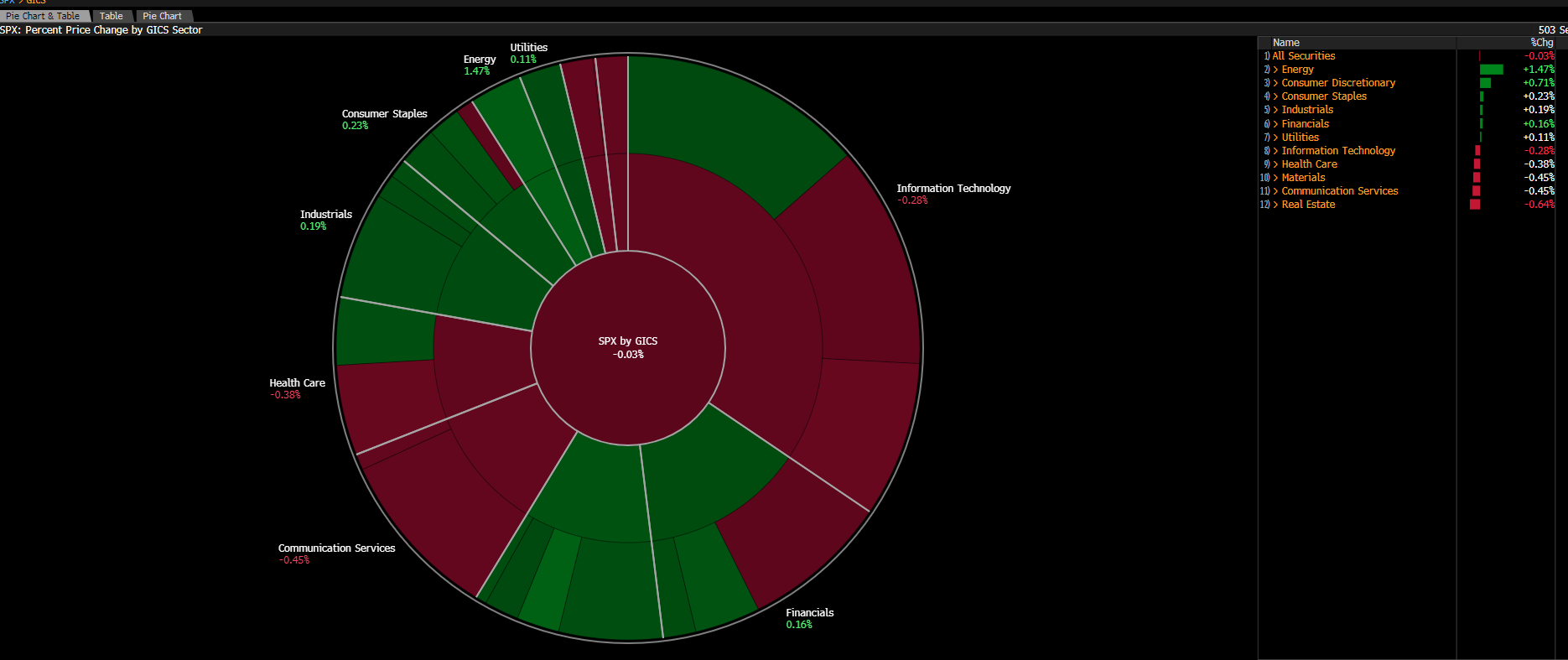

Source: Bloomberg Finance LP

Today, the real estate, health, and technology sectors are clearly losing ground. Indices are being pushed up by mining and consumer goods companies.

Macroeconomic Data:

Today at 4:00 PM, we learned about new home sales data in the USA:

-

Home sales in September: 800k (Expected: 650k, Previous: 652k)

Today's new home sales data in the USA surprised the market. Housing demand remains high despite still costly mortgage loans. This is a signal that consumers have a relatively strong financial position, and the economy continues to show resilience.

Such a strong reading may reinforce concerns about persistent inflationary pressure and put further Fed cuts into question, which may exert pressure on markets but support the dollar.

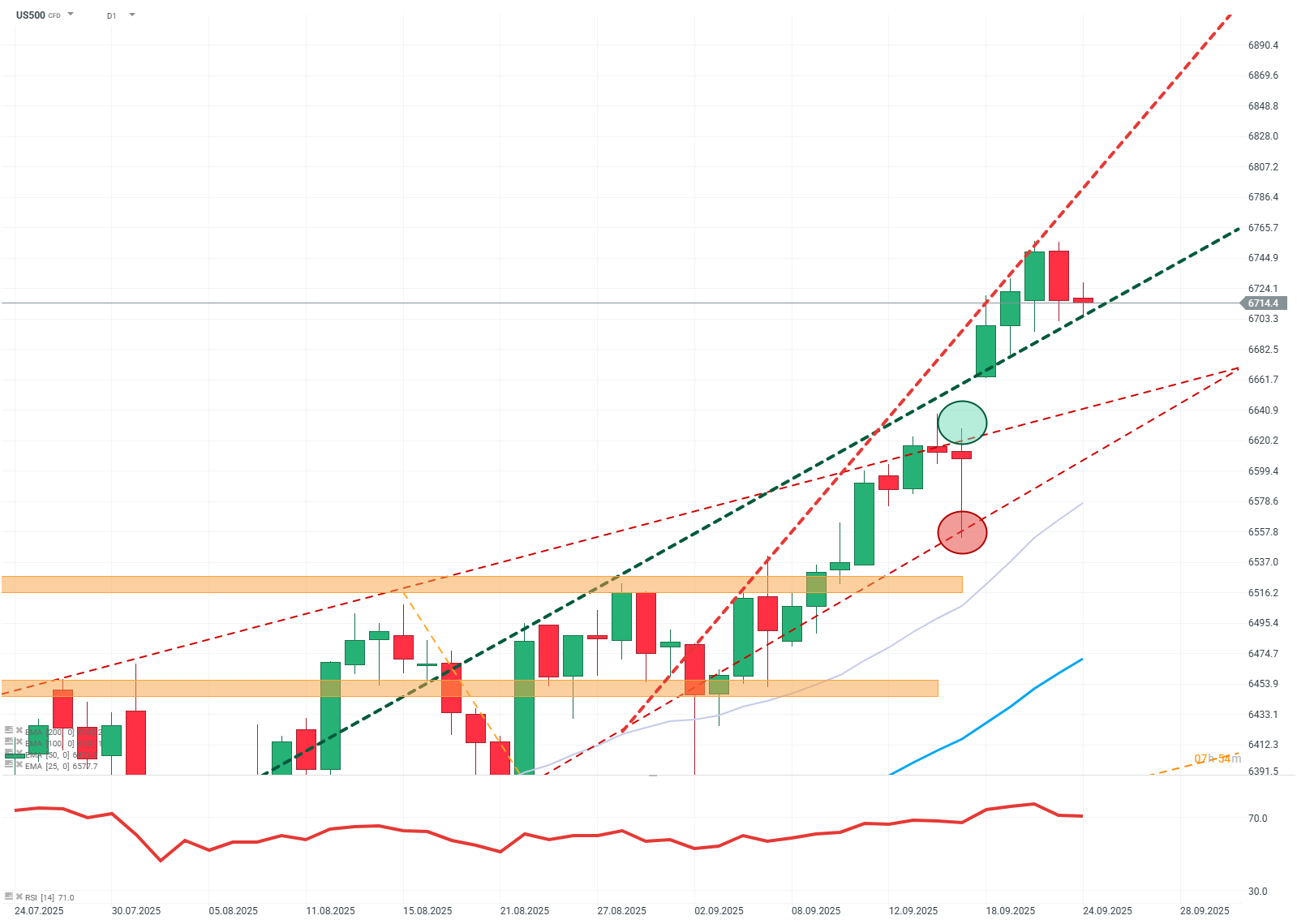

US500 (D1)

Source: xStation

The index broke out of the previous upward channel at the top and established another, steeper one. Considering the "overbought" RSI indicator, buyers may have trouble maintaining the pace. In the case of a breakout from the new channel at the bottom, a test of support around 6660 dollars is possible. If the support is breached, the most likely scenario is consolidation around 6500 dollars.

Company News:

Lithium Americas (LAC.US) - The lithium mining company soared over 50% at the opening after announcing the purchase of 10% of shares by the US government as part of strategic sector control.

Adobe (ADBE.US) - The software company is down about 1.5% after Morgan Stanley lowered its forecasts for the company.

Alibaba (BABA.US) - The Chinese e-commerce giant announced an increase in its AI development budget to 50 billion, causing the stock to rise over 8% at the opening.

Micron (MU.US) - The semiconductor manufacturer published optimistic sales forecasts on the wave of AI demand. The company is up over 2%.

Daily summary: Oracle drags indexes lower, gold tests $4,000 💰

RBNZ Rate Decision: Market Eyes Deeper Easing Amid GDP Shock

⏬US100 is down 0.5% on Oracle news

FOMC officials see structural shifts driven by AI; Kashkari and Miran back two rate cuts this year 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.