- The American defense industry enters another earnings season with record order portfolios but constrained production capacity.

- Global demand remains at a very high level, yet supply chain issues and raw material costs are undermining margins.

- Europe and the Middle East are slowly diversifying their sources of armaments

- Results significantly above or below expectations may signal geopolitical shifts and changes in the fiscal and foreign priorities of the USA.

- The American defense industry enters another earnings season with record order portfolios but constrained production capacity.

- Global demand remains at a very high level, yet supply chain issues and raw material costs are undermining margins.

- Europe and the Middle East are slowly diversifying their sources of armaments

- Results significantly above or below expectations may signal geopolitical shifts and changes in the fiscal and foreign priorities of the USA.

Demand is strong, but not without limitations

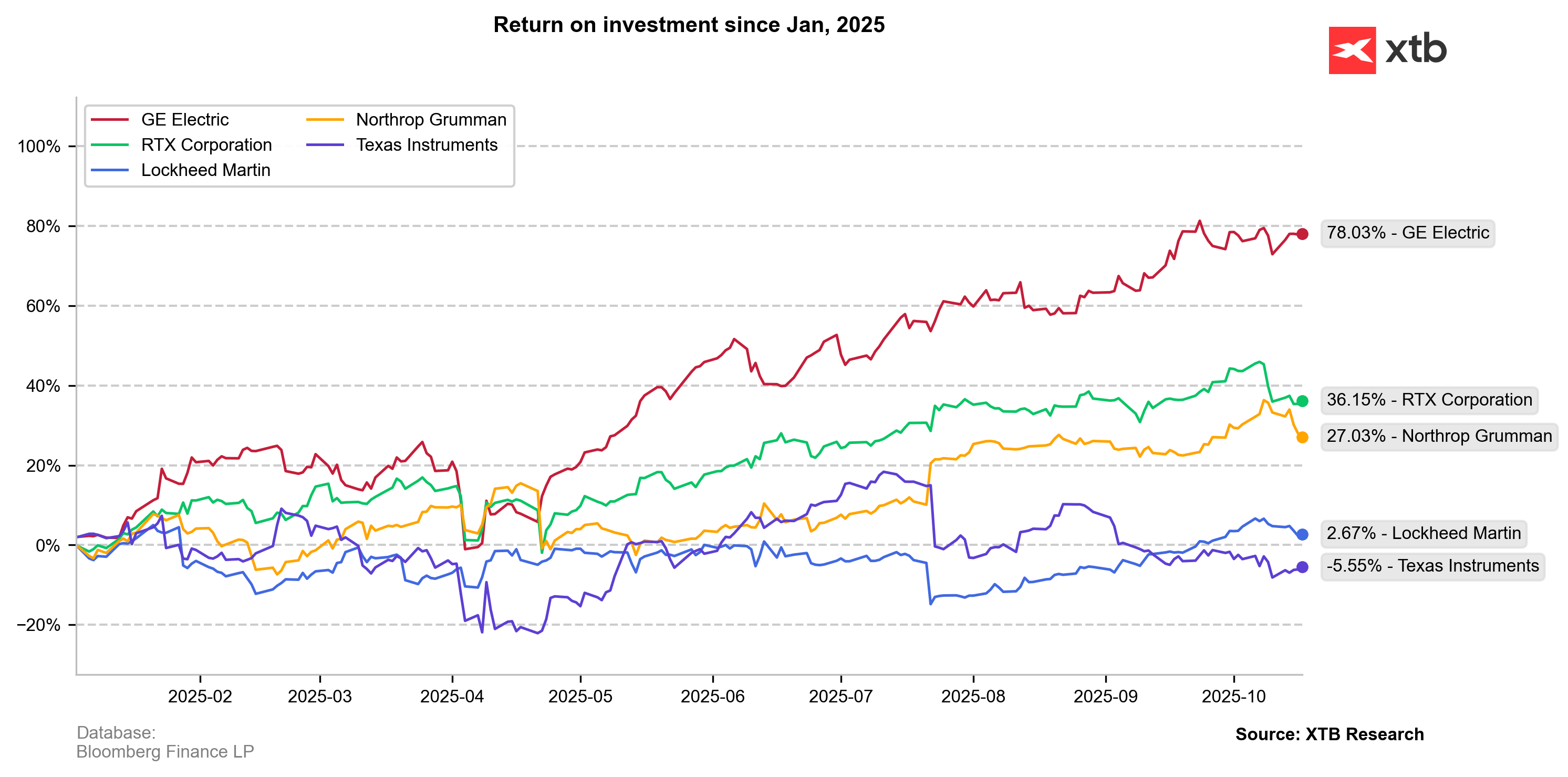

The American defense industry sector is still experiencing an exceptional boom, driven by geopolitical events of recent years. Since the outbreak of the war in Ukraine in 2022, the stock prices of companies like Lockheed Martin, Northrop Grumman, RTX, GE Aerospace, and partially Texas Instruments have clearly risen, reflecting a sharp increase in global demand for military equipment. American corporations have not experienced as rapid a rise as their European competitors, but they have maintained very strong financial foundations and record order portfolios.

The operational situation of the companies is good, but not as good as it could be. The market remains in structural imbalance. Demand exceeds supply because the production capacities of many companies are still constrained by supply chain shortages, component shortages, and staffing difficulties. An example is RTX, which has been struggling for months with issues related to the GTF engine installed in Airbus passenger planes. Similar constraints affect GE Aerospace, which, although benefiting from a record number of LEAP engine inspections and services, is still unable to fully meet the demand of airlines and manufacturers.

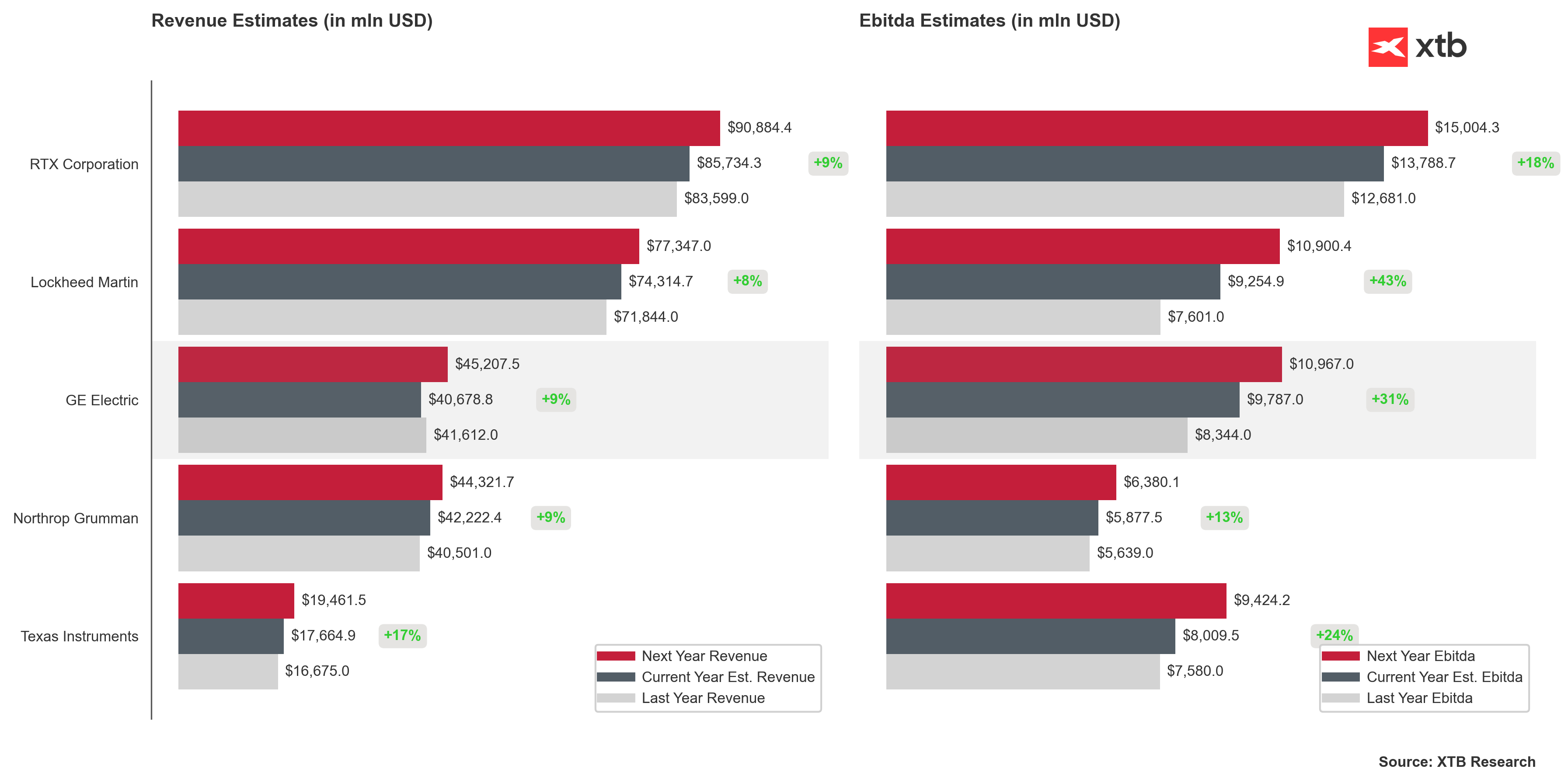

At the same time, military modernization programs are consuming increasingly larger resources. Lockheed Martin reports a record order portfolio of around $170 billion, RTX over $230 billion, and Northrop Grumman is increasing investments in the development of the B-21 Raider strategic bomber. Demand from NATO countries, the Middle East, and the Indo-Pacific region remains at historically high levels.

GE Aerospace and RTX have a significant share in civilian segments related to commercial aviation, while Texas Instruments is primarily a manufacturer of analog and semiconductor components used in industrial electronics, automotive, and defense systems, but not dependent on military orders. This means that their results do not always directly reflect the condition of the entire defense sector, but rather the overall state of the advanced technology industry in the USA.

Erosion of credibility

Additionally, the political factor cannot be overlooked. The inept and unreliable foreign policy of the United States in recent years, especially during Donald Trump's presidency, has weakened the trust of some allies. Europe is openly discussing the need to become independent of American equipment and build its own defense industry. The European Union has adopted a plan according to which at least half of arms purchases should be made within the Community by the end of the decade.

However, this does not mean a sudden reversal of the trend. In export data, the United States' share in global arms deliveries has increased to over forty percent in recent years. European arms imports have increased by more than half, and most of them still come from the USA. This shows that we are talking about a process of slow but determined diversification, not a sudden and total retreat. It is very likely that this is the last year in which the USA can boast such a large dominance in the sector.

Growing inventories, higher capital, and resource constraints

In the upcoming quarterly reports, it is worth paying attention to changes in balance sheet structures. Companies may show higher inventory levels and growing investment expenditures. This is a consequence of problems with the availability of rare earth metals, which are crucial in the production of engines, radars, and fire control systems. The United States still largely relies on raw materials and components processed in China. The Pentagon is trying to change this state by financing the development of domestic sources and processing plants, but this process requires time and money.

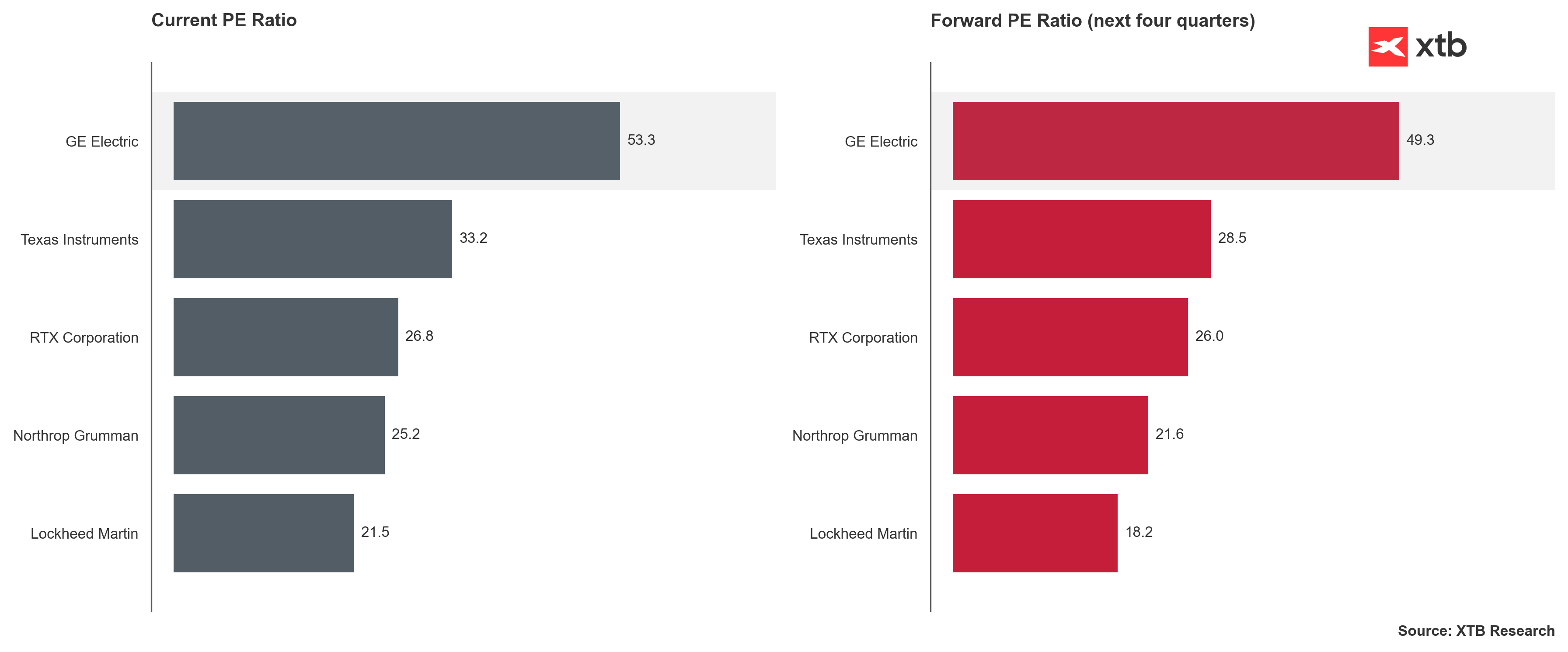

Higher expenditures on inventories and working capital investments may lower current margins and cash flows. In particular, programs implemented at fixed prices, such as the B-21 at Northrop Grumman or some missile contracts, are sensitive to rising material and labor costs.

During earnings conferences, investors will closely monitor not only the numbers but also the language used by CEOs and CFOs. Warning signals may include terms like "capacity issues," "bottlenecks," or "extended delivery cycles." On the other hand, mentions of improved efficiency, increased production capacity, and accelerated order fulfillment will be received positively. It is also worth paying attention to backlog indicators, the ratio of new orders to deliveries, and cash flow conversion.

Will the budget's sacred cow slim down?

In recent months, the topic of rising debt and the tense fiscal situation of the United States has been increasingly returning. Although the defense sector is traditionally considered the "sacred cow" of the American budget, in the long term, even it may feel financial constraints. For now, however, Congress maintains a record level of funding, and the total defense budget for 2026 is expected to exceed $900 billion. If the entire sector's results fall significantly below expectations, it may suggest the first symptoms of fiscal fatigue and the progressing isolation of the United States on the international stage. If this scenario is to unfold, forecasts for sales in the coming quarters will be as important, if not more so, than the results.

The opposite scenario, i.e., results significantly above forecasts, could mean more than just a long-awaited improvement in efficiency. If American defense companies start reporting a sharp increase in sales and investments, shortened delivery cycles, expansion of ammunition production capacity, and aviation, it may be a signal that the country is preparing for increased military activity. Such a picture could indicate preparations for potential intervention or kinetic confrontation.

The American defense industry remains in excellent condition despite the increasingly concerning state of American finances and the economy. However, it operates at the edge of its maximum capabilities. Record order portfolios, resource shortages, and strained supply chains create a mix where revenues grow on paper, but margins remain under pressure.

The market still trusts the determination of the USA to pour endless streams of money into its military, but it increasingly sees the inefficiency of the American industry and political system. The upcoming results will show whether American corporations can turn demand into sustainable profit and growth or whether they will get stuck in the trap of inefficient supply chains, unstable budgets, and management without prospects.

US OPEN: Investors exercise caution in the face of uncertainty.

⏫Silver and gold rally ahead of FOMC minutes

Daily Summary: Declines on indices and a precious metals crash

US OPEN: Start of the week with mild discounts, amid geopolitical tensions

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.