-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

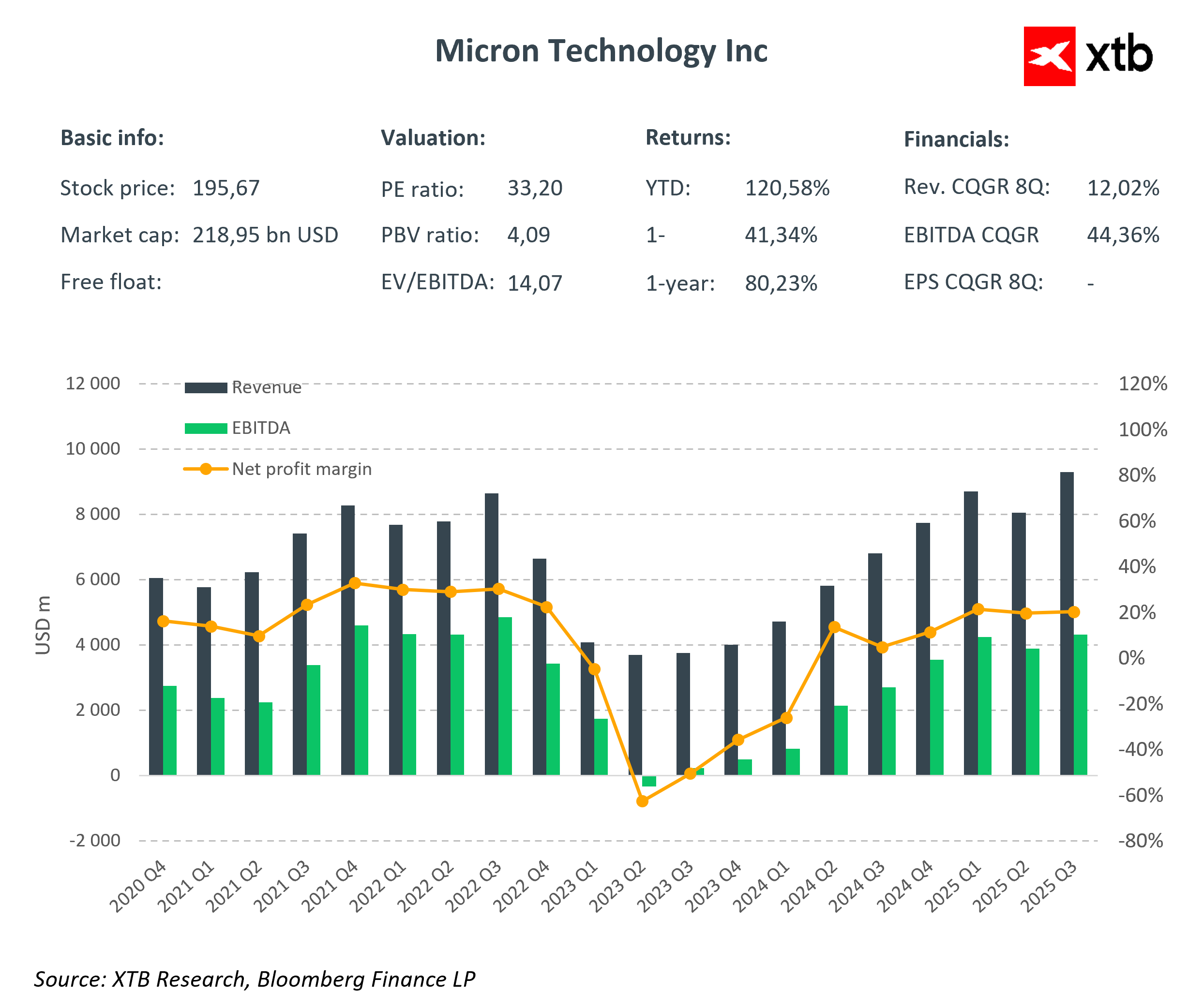

Positive news for Micron seems to be coming nonstop. UBS has just raised the stock price target from $195 to $225, maintaining its “Buy” recommendation. This is another sign of growing optimism around the memory chip manufacturer, mainly driven by the dynamic increase in demand for HBM (High Bandwidth Memory), a key component in the development of artificial intelligence and advanced computing systems.

UBS has revised its forecasts, expecting global demand for HBM to reach 17.1 billion GB in 2025 and rise to 27.2 billion GB in 2026, which is higher than previous estimates. One of the key customers is expected to be NVIDIA, further strengthening Micron’s revenue growth prospects. On the other hand, UBS points out production capacity constraints. The full capacity of the new factory in Idaho will only be reached in the second half of 2027, which may limit the pace of expansion. Despite this, the market remains positive.

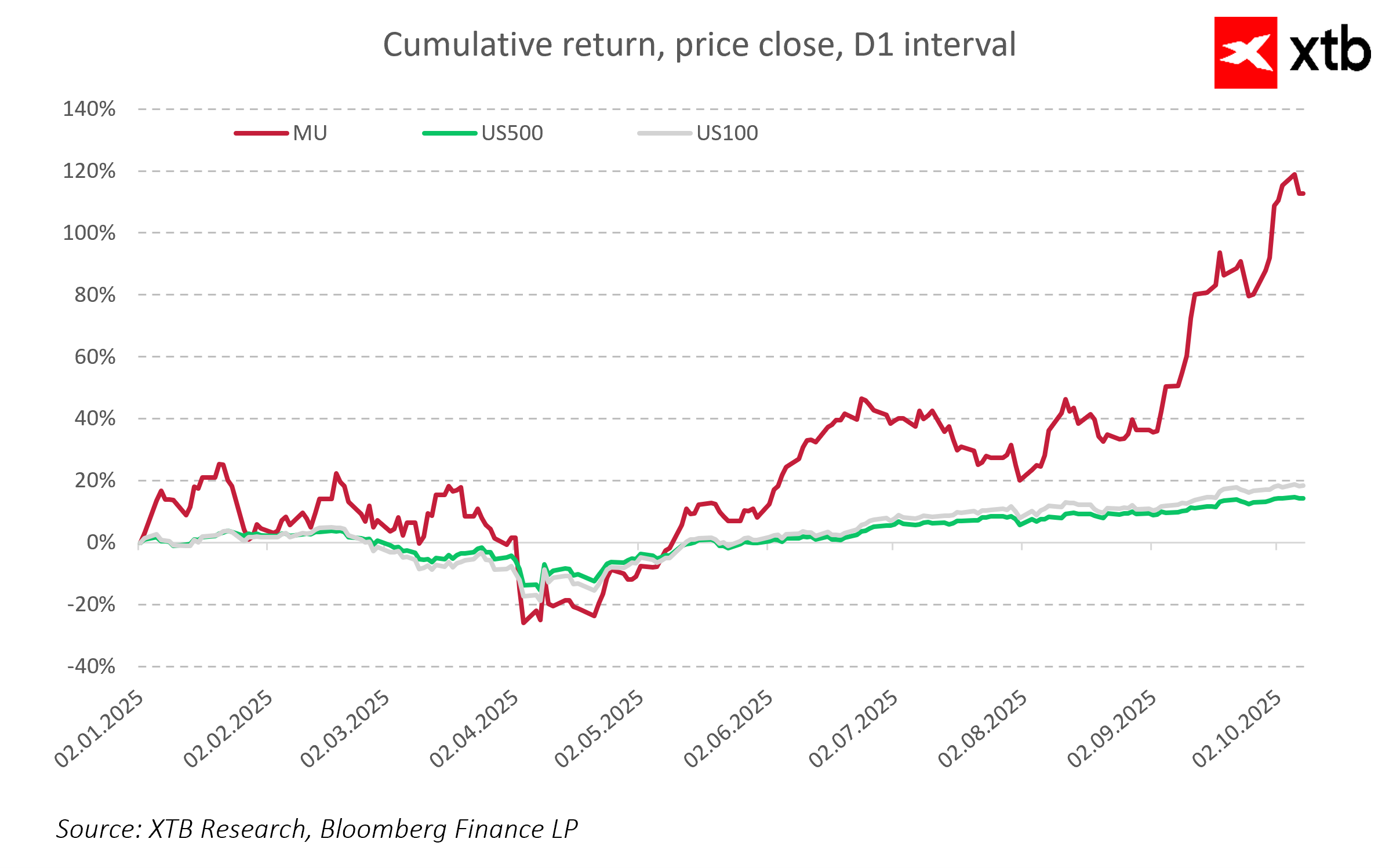

Micron’s shares are up 5 percent in today’s session and have already gained over 120 percent since january. The new valuation from UBS may act as an additional catalyst, but with such dynamic growth, it is wise to remain cautious and closely monitor whether the company can maintain its current growth pace.

Daily Summary: Growth on most markets, Precious metals at ATH again

BREAKING: EURUSD Slightly lower on FOMC minutes! 🚨

Palladium gains over 6%!📈🚨

BREAKING: Oil stocks grow more than expected!🔥

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.