-

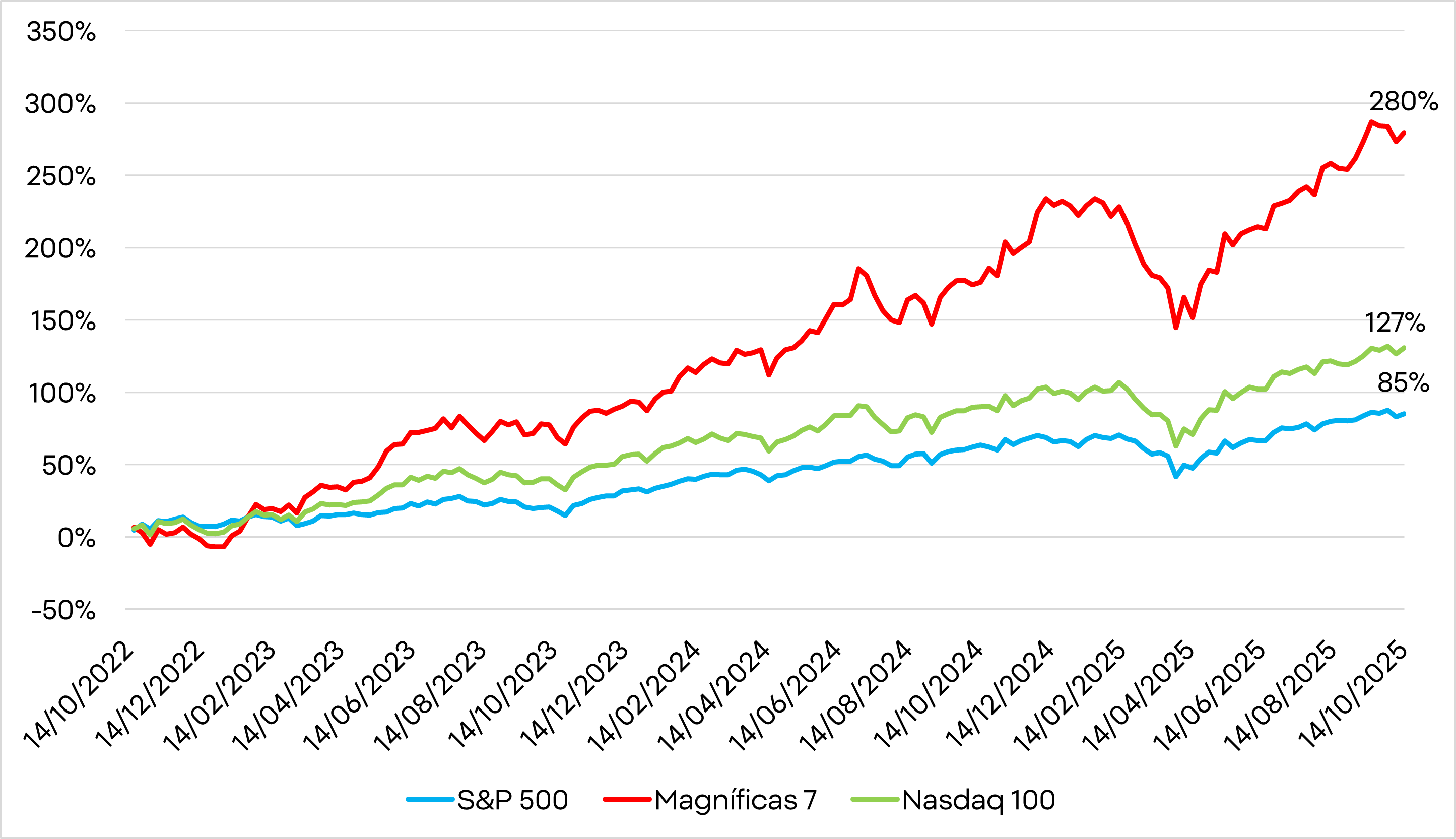

Artificial intelligence is powering the strongest bull run since 2022, with the S&P 500 up 85% and the “Magnificent 7” soaring 280%.

-

Unlike the dot-com bubble, today’s tech giants are delivering real profits and trade at far lower valuations.

-

Returns on invested capital still exceed funding costs, suggesting the expansion may continue.

-

Rather than a bubble, AI appears to be the driving force of a new global economic transformation.

-

Artificial intelligence is powering the strongest bull run since 2022, with the S&P 500 up 85% and the “Magnificent 7” soaring 280%.

-

Unlike the dot-com bubble, today’s tech giants are delivering real profits and trade at far lower valuations.

-

Returns on invested capital still exceed funding costs, suggesting the expansion may continue.

-

Rather than a bubble, AI appears to be the driving force of a new global economic transformation.

Artificial intelligence has gone from being a promise to becoming the driving force behind a new stock market era. The S&P 500 began its current bullish streak on October 12, 2022, shortly before the launch of ChatGPT. Since then, it has gained 85%. Over the past twelve months, the index has risen 15%—double the average increase seen in the third year of a bull market. Investors, fascinated yet uneasy, are asking whether we’re witnessing a genuine technological revolution or the prelude to another financial bubble.

The numbers speak for themselves. Nvidia has surged 1,500% in just three years; Meta Platforms, more than 450%. The ten largest companies on Wall Street now account for 40% of the S&P 500 and 22% of global market capitalization. At the peak of the dot-com bubble, that figure barely reached 14%. Current levels are historic, but unlike back then, today’s tech giants are generating real profits—not empty promises.

Across the ten biggest market bubbles of the past century, average gains from trough to peak were around 244%. That suggests that the “Magnificent Seven” may still have some room left—but not much. And the timing also aligns with the historical average of roughly two and a half years. Are we in a bubble?

High Valuations—but With Real Support

Valuations are high, yes—but not the highest in history. And more importantly, today’s leading tech companies are delivering strong, sustained profits.

While current valuations are elevated compared to the broader market and historical averages, they remain far below those of Internet stocks before the dot-com crash.

In late 1999, Cisco traded at 96.7 times future earnings, Oracle at 92.1, and eBay at an incredible 351.7. Today’s AI leaders are much more restrained: Microsoft (32.2), Apple (31.9), Meta (24.1), and Alphabet (23.4). Even Amazon (30) and Nvidia (31.8) sit below their five-year averages. Only Tesla stands out with a multiple of 186.

In other words, prices are demanding, but they’re backed by tangible earnings—not by speculative dreams.

Stock prices have risen sharply, but so far this has been accompanied by solid and sustained earnings growth, rather than wild speculation about the future. This is unusual compared to past bubbles, where favored companies were often driven by lofty expectations of dominance, not by proven performance.

Previous bubbles also tended to coincide with periods of intense competition, as investors and newcomers flooded the market. This time, enthusiasm for AI is concentrated in just a handful of companies.

A key metric to watch is the gap between return on invested capital (ROIC) and the weighted average cost of capital (WACC). Today, that spread remains positive—meaning firms are still generating returns well above their financing costs. As long as it stays that way, the expansion cycle can continue. True bubbles burst when capital costs rise or returns fall enough to close that gap.

On a macro level, the context is also different. During the dot-com era, the Federal Reserve began raising interest rates, triggering a wave of defaults. Today, the opposite is happening: rates are being cut, and the Fed’s balance-sheet reduction program has been paused.

A Revaluation, Not a Fad

The rise of artificial intelligence is concentrated in a few hands, but it’s not built on pure speculation.

The profits of leading companies are growing in step with their stock prices. Taiwan Semiconductor, the world’s largest chipmaker, recently raised its already-lofty revenue forecasts—clear evidence that demand remains red-hot.

One of the companies most exposed to the AI boom is OpenAI. Its latest deal with Broadcom—adding to agreements with Nvidia and AMD—pushes its estimated spending above one trillion dollars. Despite skepticism around that number, the company reportedly has $100 billion available from Nvidia investments, hasn’t yet tapped debt markets, and enjoys support from the Trump administration.

That last point may prove crucial. The race for AI dominance is also a geopolitical battle. Whoever leads—whether the U.S. or China—will control the global economy of the future. Economic efforts and government spending to secure that lead will likely intensify in the coming months, benefiting the industry’s key players.

Lessons from the Past

The comparison to the 1990s is inevitable, but the differences are profound. Then, soaring stocks often belonged to young, unprofitable startups.

Today, the leaders of the AI rally are mature, profitable giants.

Take OpenAI: it now has about 700 million users—roughly 9% of the world’s population—up from 500 million in March. Its revenues are on track to triple from 2024 levels.

There are also at least three additional reasons why AI doesn’t resemble a classic bubble:

- Cross-industry integration: AI is embedded across nearly every sector, not isolated in one niche.

- Immediate productivity gains: measurable efficiency and cost savings are already visible.

- Strategic backing: governments and economic blocs are funding AI as a geopolitical priority, justifying unprecedented levels of investment and debt.

Risks on the Horizon

Of course, risks remain. The gap between investment and returns could widen if spending accelerates too fast.

Rising leverage, China’s capital race, and the possible use of opaque financial vehicles could inflate systemic risks.

There’s also a chance that AI might fall short of its revolutionary promises—or that today’s data-center chips could become obsolete before delivering their expected returns.

And mounting energy costs, driven by the electricity demands of massive data centers, add another layer of pressure.

Conclusion: The Road Ahead

History shows that bubbles burst when profits no longer justify valuations or when credit dries up. So far, there’s no sign of either.

Artificial intelligence is creating real value, boosting productivity, and opening new economic opportunities.

Far from being a bubble, this could well be the beginning of the greatest economic transformation in modern history. The challenge is no longer to fear AI’s rise, but to learn how to harness it. Those who understand it first will lead the next decad

With earnings season underway and results so far looking strong, the Nasdaq 100 could be the best-performing U.S. index for the rest of the year, at a time when some doubts are beginning to emerge about regional banks. Source: Xstation

BREAKING: Final inflation reading matches expectations. Core HICP inflation marginally higher

Economic calendar: Eurozone inflation at the week’s close

BREAKING: Sweden's Unemployment Rate Slightly Decreases

Daily summary: indexes edge lower into the close, gold tests $4,300 💰

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.