Silver continues its strong upward momentum in the final session of the week, a phenomenon that cannot be attributed to a single factor. Currently, speculative demand is rising very sharply, although it is primarily visible in the ETF options market. Bloomberg suggests that investors holding short positions in options will be forced to generate additional speculative demand for silver in order to limit their losses.

The main factors driving silver’s rally this year include another year of severe deficit caused by strong demand from the photovoltaic sector, stimulation from ETFs, and ongoing problems on the silver mining side, as it is often a byproduct of copper, gold, or zinc extraction. Additionally, monetary factors and concerns related to the appointment of a new Fed Chair are increasing demand for precious metals.

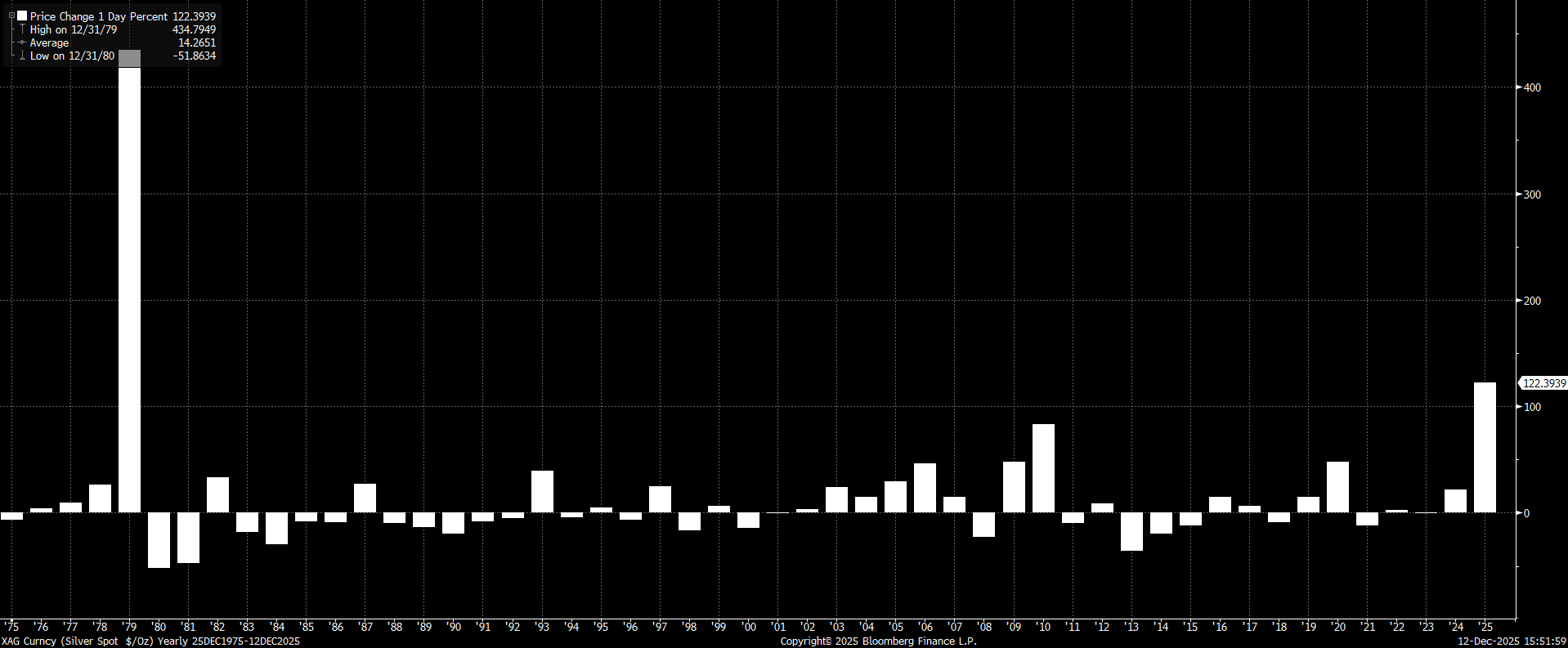

The price increase for silver this year already amounts to 120%, with this week alone contributing over 10%. There is now growing talk that the demand for silver is primarily speculative. Source: Bloomberg Finance LP, XTB

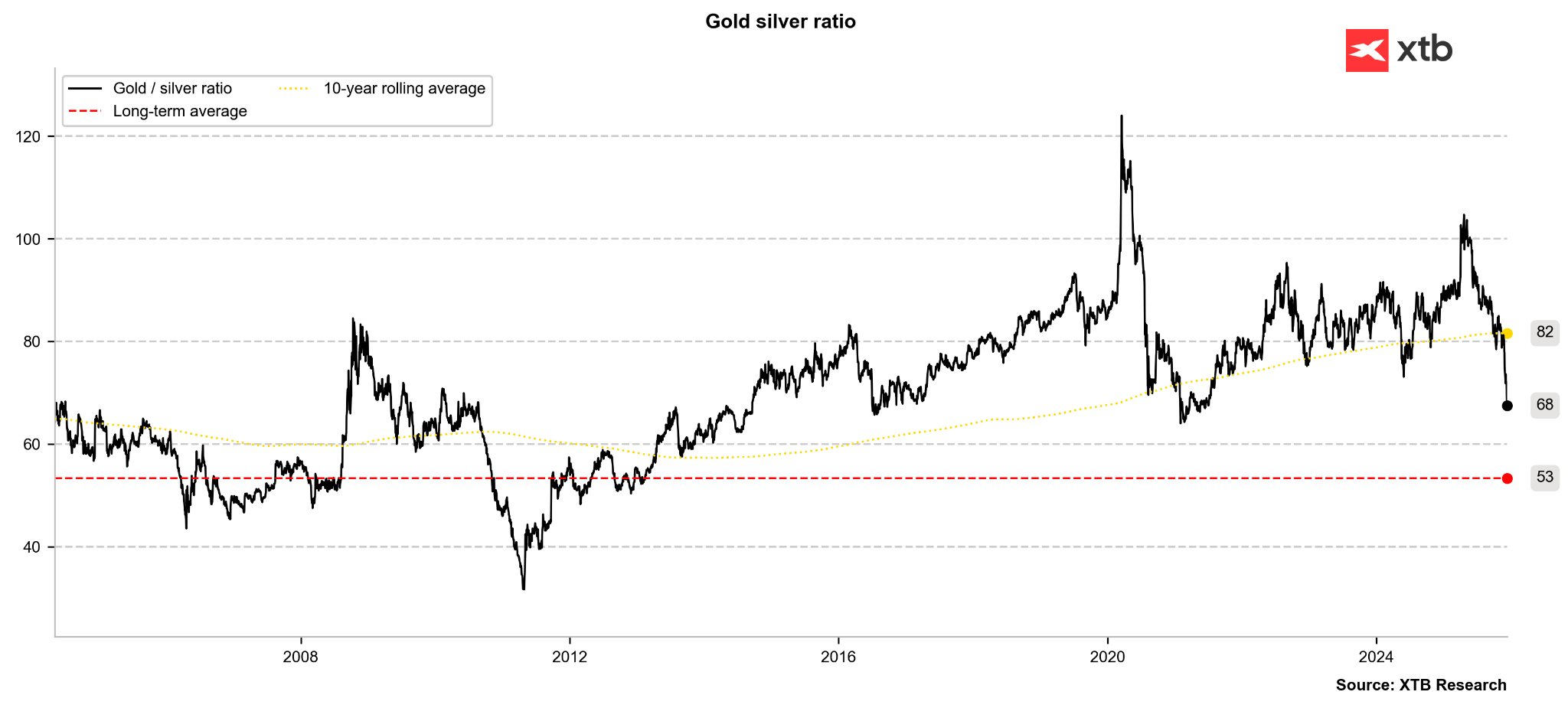

The gold-to-silver price ratio is experiencing a similar dynamic decline to that seen in 2020. The ratio itself is at its lowest level since 2021. If it were to fall to the long-term average of 53, it would imply a breakthrough above the $80 per ounce level. Source: Bloomberg Finance LP, XTB

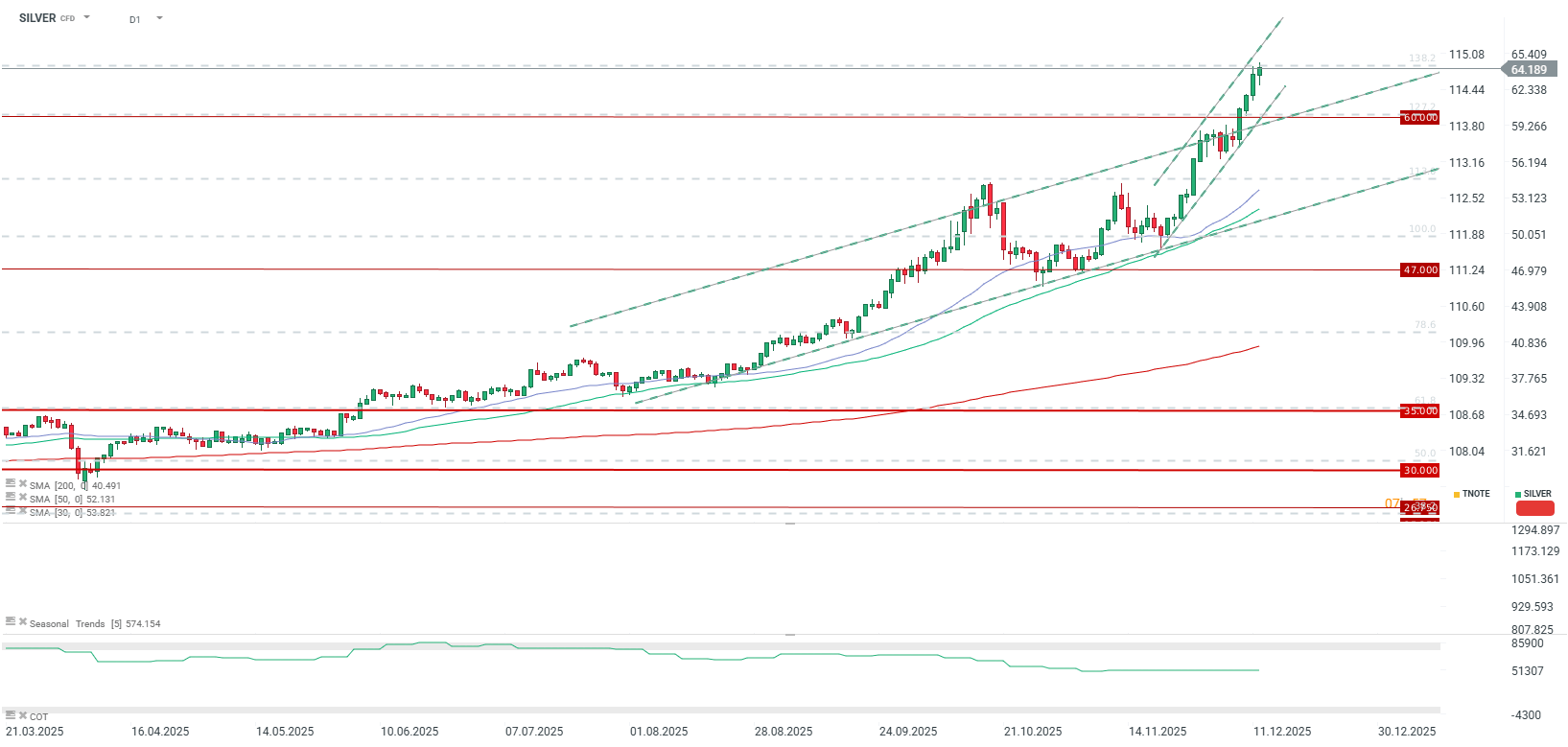

Silver marks its fourth consecutive day of gains, reaching the vicinity of potential technical resistance. Nevertheless, the $60 per ounce level could currently serve as strong support for the price. Source: xStation5

Daily Summary: End of the week in the red, tech rally waning

Three Markets to Watch Next Week (12.12.2025)

Rivian Automotive: Rising star or a meteorite?

Technology companies declines 📉🖥️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.