- German leader of armed industry published earnings that impressed investors and reassured market

- Massive growth in sales and income across most areas of operation

- Order backlog keeps growing

- Operating margin slightly lower due to massive investments

- Civilian market remains weak

- Optimistic outlook for the fourth quarter presented

- German leader of armed industry published earnings that impressed investors and reassured market

- Massive growth in sales and income across most areas of operation

- Order backlog keeps growing

- Operating margin slightly lower due to massive investments

- Civilian market remains weak

- Optimistic outlook for the fourth quarter presented

The German group Rheinmetall published its results today. The European arms manufacturer has seen spectacular growth in revenues and valuations in recent quarters. Riding the wave of massive increases in military spending by European countries, the company's valuations are reaching record after record. Investor expectations are growing, and valuation metrics leave little room for error or disappointment. Did the company's results meet investor expectations?

The company rose by about 3% at the opening after the results were published, indicating that the company passed another test set by the market. Rheinmetall Group is achieving consistent growth rarely seen on the European stock exchange, especially among industrial companies.

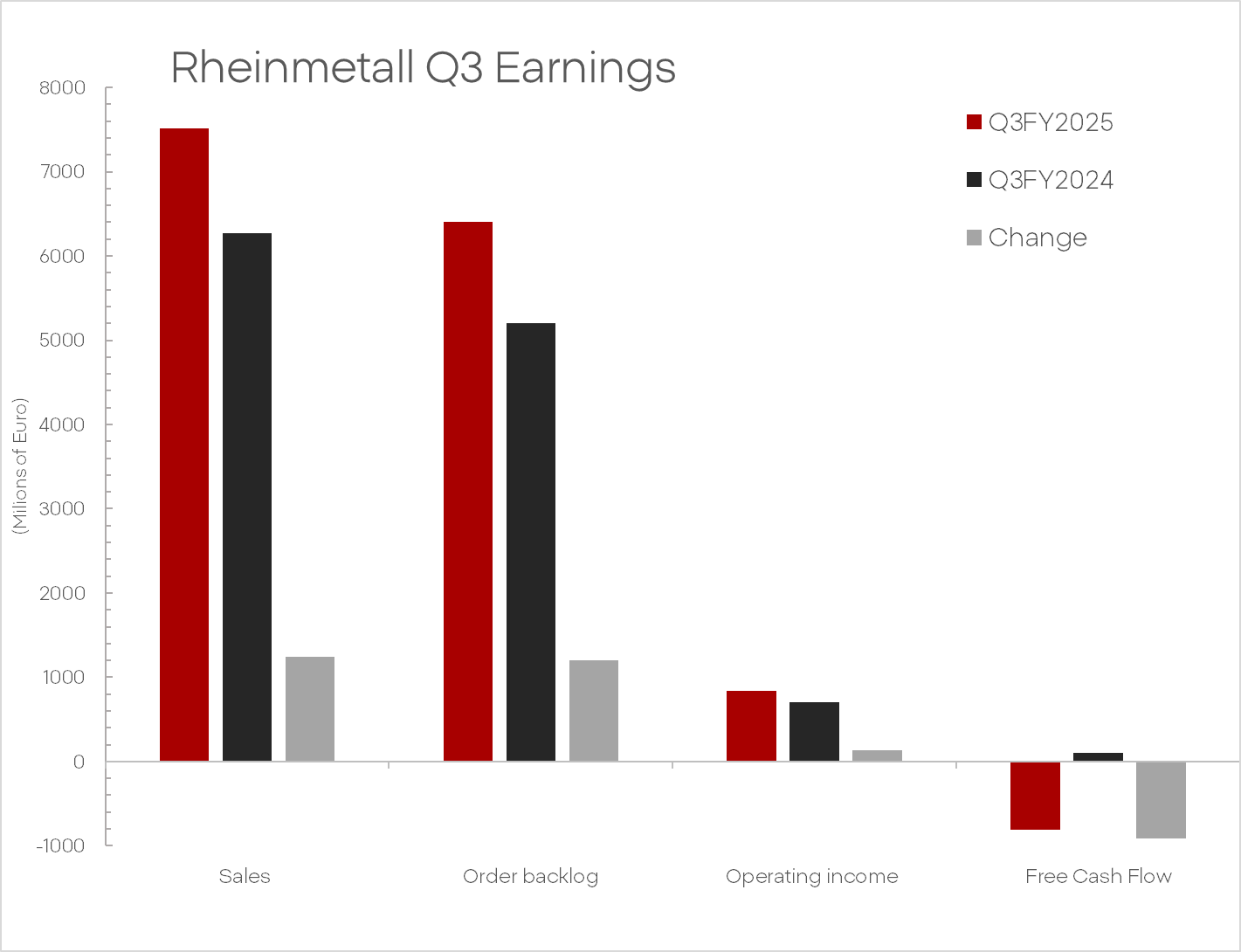

- Sales in Europe increased to 7.5 billion euros compared to 6.2 billion the previous year, growing by 20%.

- Operating profit amounted to 835 million euros compared to 705 million last year, representing an 18% increase.

- The already impressive order backlog also positively surprised. It increased to 64 billion euros, growing by another 12 billion this year.

- As important as historical data are the company's forecasts and goals. The company's management maintained its year-end goals, which include overall sales growth of 25-30% and an optimistic operating margin of 15.5%.

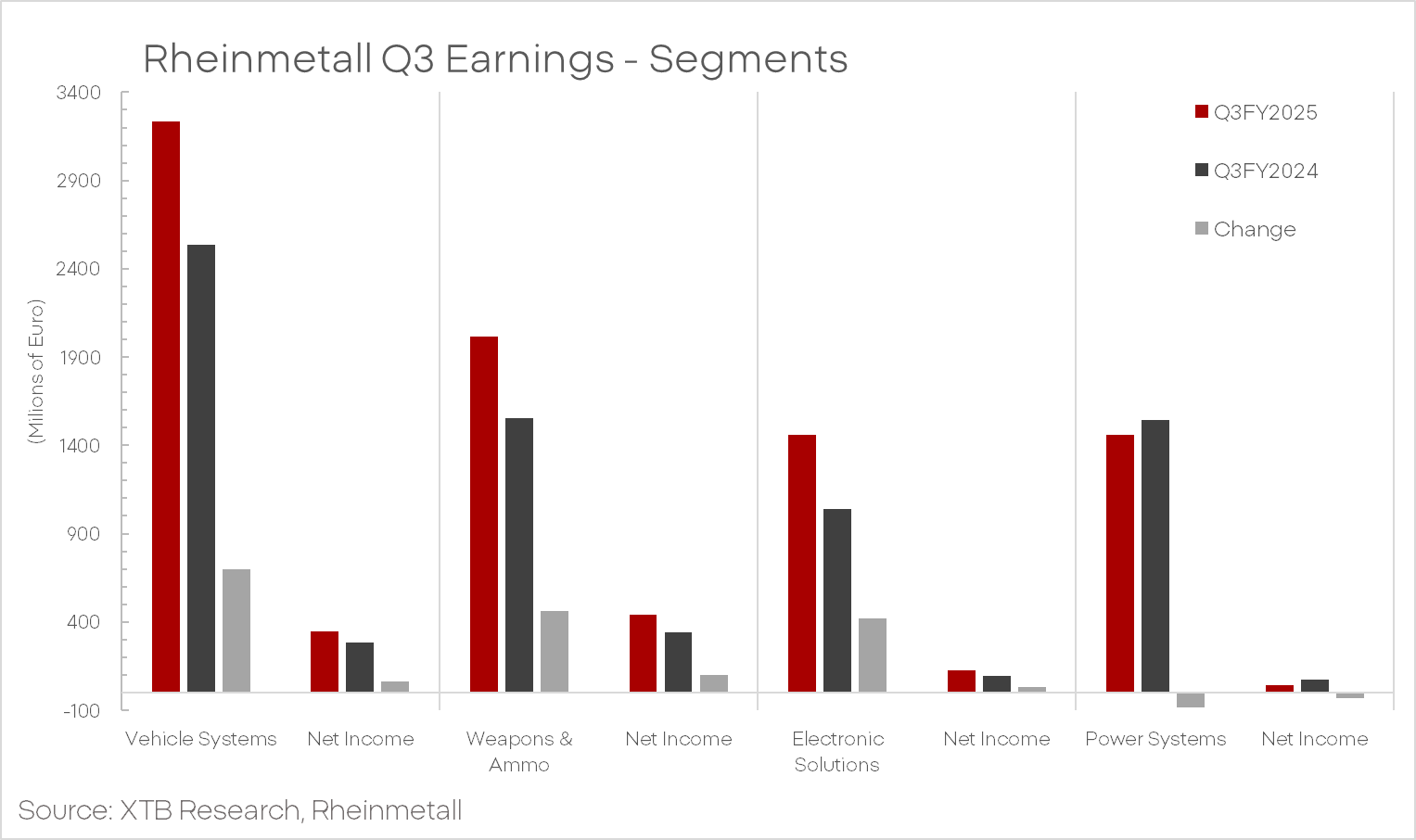

It's also worth looking at the individual segments of the company's operations. The core of the company's revenues remains the land vehicle segment. This part of the company's operations generated 3.2 billion euros in revenue, which is a 28% increase compared to the previous year, and operating profit rose to 346 million.

The ammunition and electronics segments are also performing well. In the weapons and ammunition segment, the company registered a revenue increase of 30% to over 2 billion euros. The segment also recorded an increase in operating margin to 22% despite "rising labor and material costs." The electronics systems branch recorded a record growth, with sales increasing to 1.46 billion euros, representing a 41% increase compared to the previous year.

However, not all information provided by the company is positive. The company's operations based on engines and power systems recorded a decline in sales from 1.54 billion euros to 1.45 billion. A strategic decision was made to separate "Power Systems" from the rest of the group so that revenues from the civilian market are concentrated in one subgroup. As seen from the report and management comments, this segment remains under pressure from structural weaknesses in the market and consumer. However, this is not the only challenge for the company.

Primarily, the consolidated operating margin fell from 11.3% to 11.1%, and free cash flow dropped by a staggering 912 million euros to -813 million euros.

The company clearly states that this is due to very intensive investments and expansion in all major areas of the company's operations. These investments include the production line for F-35 hulls and the "Nidersachsen" ammunition factory.

Ultimately, the earnings conference satisfied investors. The financial report reassured investors about the continued revenue growth dynamics, and management comments calmed most of the negative sentiment. Large investment expenditures are acceptable to the market, especially in the context of record orders, but failing to meet the ambitious operating margin target by the end of the fiscal year could lead to a significant price correction for the company.

RHE.DE (D1)

Source: xStation5

BREAKING: US House Speaker Johnson signals risk of longer US government shutdown

Oil continue the downfall amid rising OPEC production 📉 Saudi Arabia cuts prices

Venezuela, what would a change in power mean for oil prices?

US Open: US100 loses 1% amid semiconductors & software stocks sell-off📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.