The market has largely cooled down after the recent surge in precious metals. The latest increase in precious metal valuations had a pace and scale that is difficult to fully justify with hard fundamental data. Part of the movement was an emotional reaction driven by geopolitical uncertainty and the entrenched belief that metals always gain in times of unrest. However, the market once again demonstrated its ability to anticipate facts and only later seek justification for them. This is particularly true for retail investors, whose participation was very noticeable in the recent rise.

This does not mean, however, that precious metals lack reasons to grow. Institutional purchases remain a strong pillar, especially from central banks of developing countries, which have been systematically diversifying reserves for several years. The second element of this structure is monetary policy, whose direction still favors cutting interest rates and maintaining them at a low level. This creates a kind of price floor, not so much guaranteeing increases as limiting the scale of potential declines.

Gold, however, is not an untouchable asset. The status of a safe asset does not mean immunity to corrections or declines, as has been observed on the charts recently. For example, a clear signal of lasting improvement in relations between the United States and China could lead to part of the risk premium being withdrawn from quotations. A similar effect could be brought about by unexpected tightening of monetary policy in major economies.

GOLD (D1)

Source: xStation5

Fluctuations in rates in the short and medium term have negligible significance for central banks, which look at the market over many years. For retail investors, however, they are a source of real profits or losses, and for investment firms, they constitute a significant element of financial results and balance sheets. This difference in perspectives means that the same price movement can be simultaneously insignificant and very painful for different market participants.

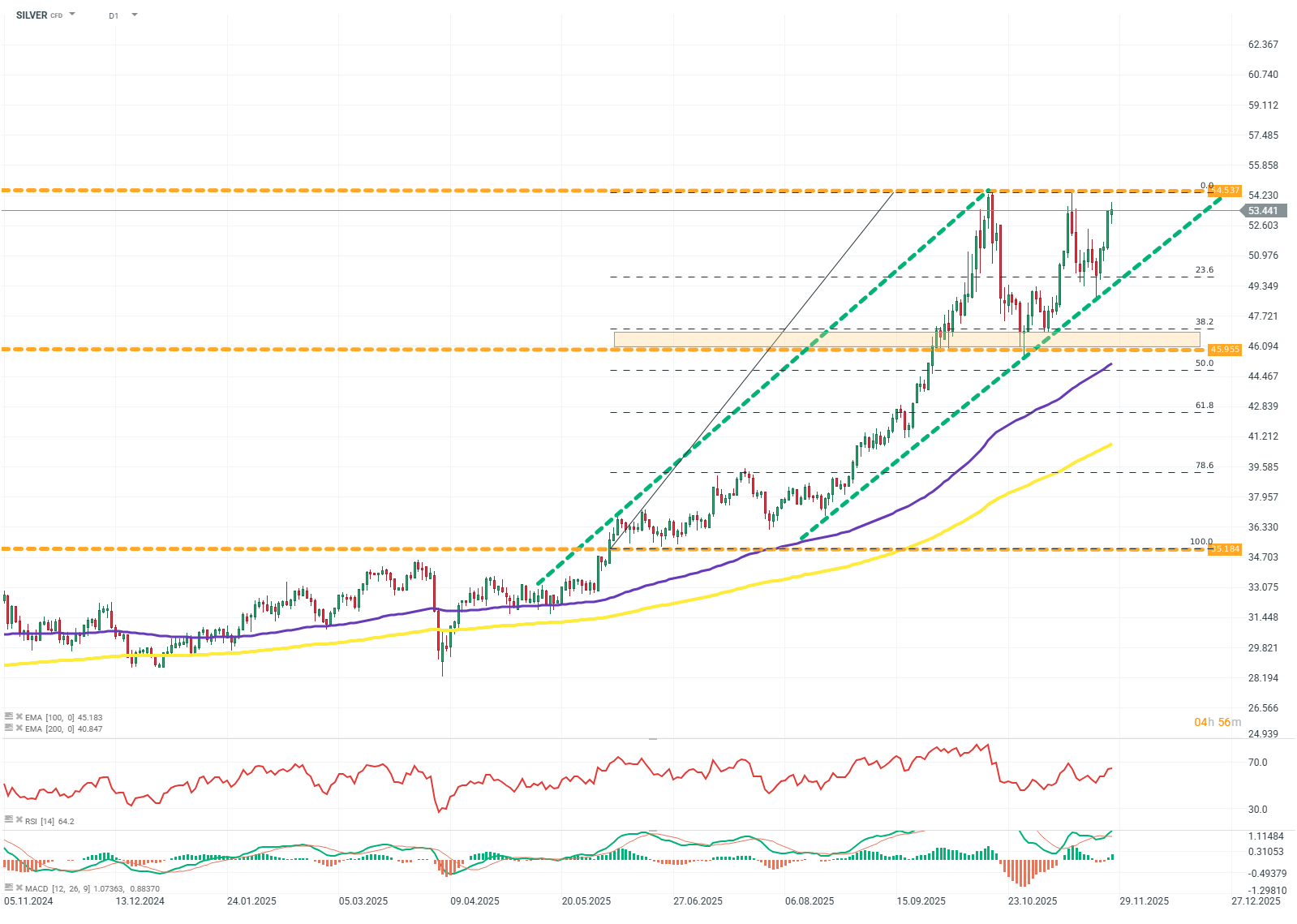

A careful investor should also pay attention to price relations between individual metals. Currently, silver shows better price dynamics than gold. Its growing importance in renewable energy and the electronics industry is changing the demand structure. If this trend continues, silver may gradually catch up with its "bigger brother," although this path will most likely be neither quick nor easy.

SILVER (D1)

Source: xStation5

Daily Summary: Wall Street absence limits market's activity

Toyota - After Earnings

Stock of the Week – Adobe Inc (27.11.2025)

European Central Banks publishes minutes📋EURUSD gains slightly

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.