Oracle’s ambitious $10 billion AI data-center project in Michigan has been thrown into doubt after financing talks with key partner Blue Owl Capital collapsed. This marks a serious setback for a company already under heightened scrutiny due to rapidly escalating capital needs. Blue Owl — which financed Oracle’s largest U.S. data-center projects — walked away after lenders demanded stricter lease and debt terms amid growing concerns about project delays, Oracle’s fast-rising leverage, and cooling sentiment toward hyperscale AI investments. Oracle maintains that the developer partner has already selected a new equity investor and that talks are progressing as expected, but the failed negotiations highlight rising doubts about the pace and profitability of AI-infrastructure expansion.

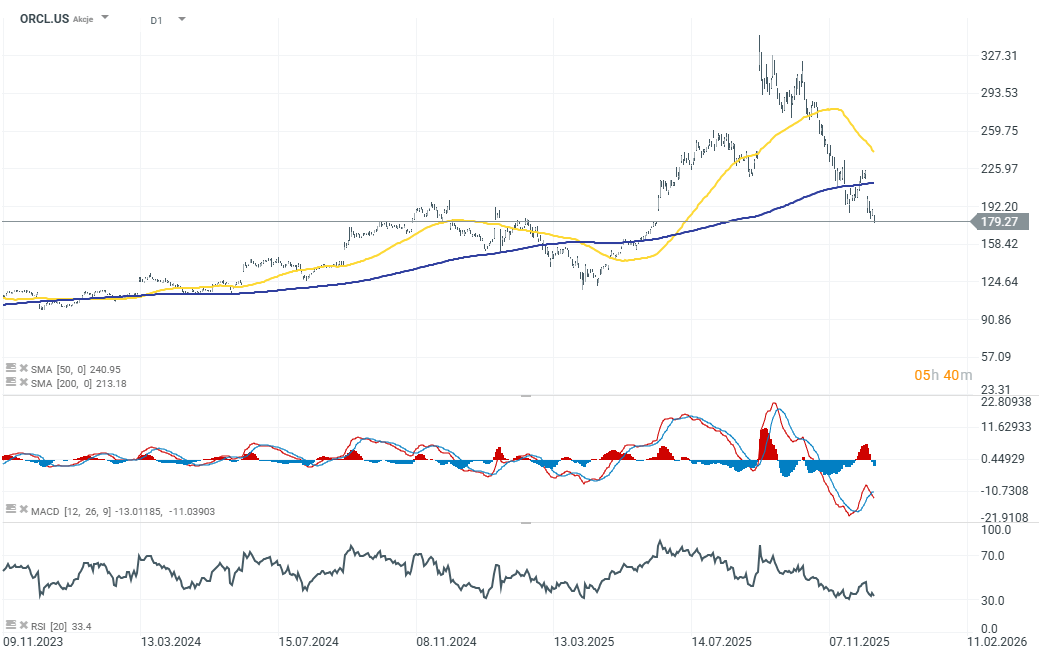

Market reaction was swift and painful. Oracle shares have been under selling pressure since mid-September. The latest earnings also disappointed. From the highs, the stock is now nearly 50% lower. To fully erase the AI-driven rally, Oracle would need to fall another ~35%.

A look at Oracle’s financial situation

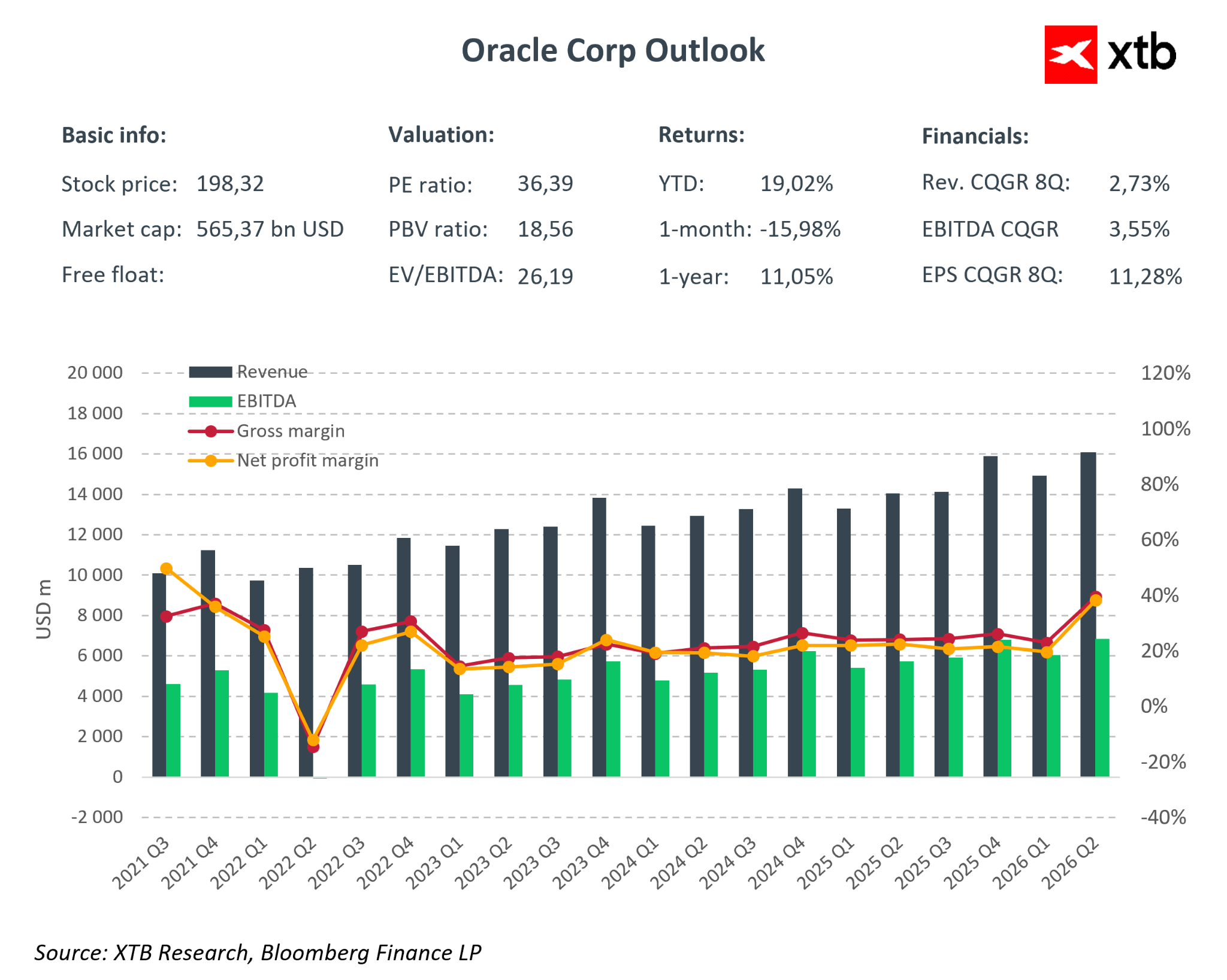

Earnings have disappointed the market. In Q2 FY2026, Oracle reported revenue of $16.06 bn (+14% y/y), below expectations of $16.2 bn. Adjusted EPS came in at $2.26 — far above the 1.64 forecast — thanks to one-off gains, including the sale of Ampere shares.

Record RPO backlog — potential, but long-dated. The $528 bn backlog (+438% y/y) includes contracts with OpenAI, Nvidia, and Meta, which could generate additional revenue in the coming years. While the number shows enormous growth potential, the market fears much of this pipeline is long-term, and meaningful realization of these orders remains distant.

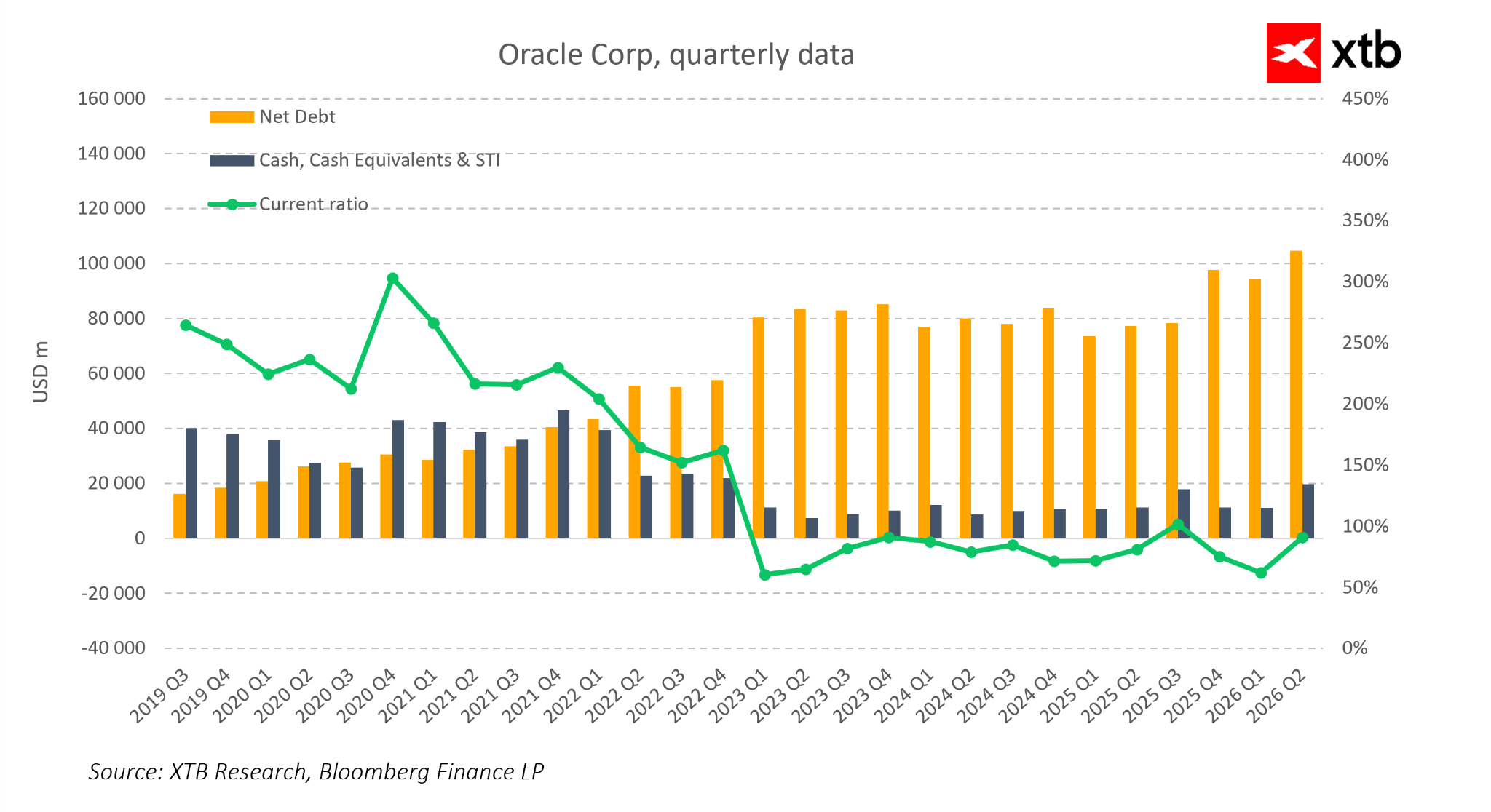

Exploding CAPEX and debt — a growing market risk. Oracle increased capital expenditures in Q2 FY2026 to ~35 bn USD for data centers and GPU clusters for AI, while total debt has climbed to an estimated ~115–120 bn USD. The market is growing increasingly concerned about the scale of spending and its impact on the balance sheet. Future performance will depend heavily on how quickly these investments convert into revenue and cash flow.

Debt has reached record levels while cash reserves continue to shrink. The widening gap between rising debt and declining cash indicates rapid capital burn and increasing liquidity-risk pressures amid heavy AI capex. Increasing leverage is also making Oracle more sensitive to fluctuations in financing costs.

ROIC is approaching WACC, signaling declining ability to create value through new AI investments. EBITDA growth is not keeping pace with the rising cost of capital, increasing pressure on earnings and the balance sheet. The shrinking ROIC–WACC spread signals erosion of capital efficiency and rising risk that infrastructure expansion becomes a burden rather than a profit engine.

Oracle (D1 timeframe)

Today’s sell-off continues the sharp sentiment shift around AI — from euphoria, which briefly pushed the stock to $348 and elevated Larry Ellison to the top of global wealth rankings, to growing investor anxiety about delays, financial leverage, and whether the multibillion-dollar data-center expansion can generate returns quickly enough. The turmoil surrounding the Michigan project’s financing has crystallized these concerns, accelerating the market’s transition from “AI hype” to a more disciplined and skeptical stance.

Lennar dips 4.6% after publishing quarterly earnings💡

Oil price spike boosts FTSE 100, as CPI cements rate cut expectations for BOE

DE40: Many informations, few movements

From Euphoria to Correction: CoreWeave and the Future of AI Infrastructure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.