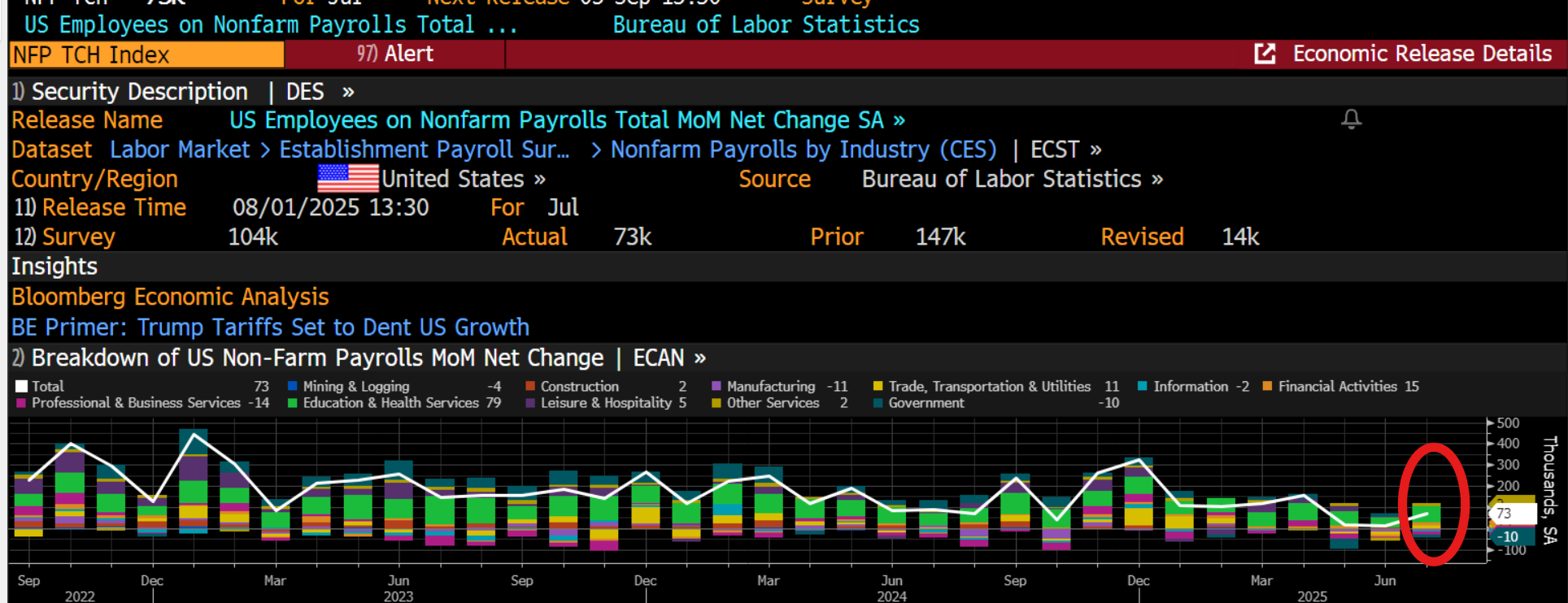

The July payrolls report was weaker than expected at 73k last month, and June’s payrolls were revised down from 147k to 14k, the two lowest monthly readings for payrolls of 2025 so far. The last two months have seen a sharp weakening of the US labour market, and this suggests that the US economy could be in the early stages of a jobs shortage.

Dollar falls as payrolls disappoint

The immediate market move has been a broad weakening in the US dollar, which has gone from hero to zero, and is now the weakest currency in the G10 FX space on Friday. USD/JPY is back below 150.00, and USD/CHF is extending lows of the day even though Switzerland has been slapped with the highest US tariff rate on any country so far. The yen and the euro are strongest performers in the G10 FX space post the NFP report, while the pound is only able to eke out a small 0.1% gain. 10-year US Treasury yields are extending losses and are down 13bps in the aftermath of the labour market report, and 2-year yields are lower by 17 bps.

European stocks still set to under perform the US

US stock futures were sharply lower, S&P 500 futures are pointing to a 1% drop at the open, although Dow Jones futures have bounced off their lows. European stocks, which had already sold off on the back of the overnight tariff news, are extending their losses as we move into the afternoon, and if US futures markets are correct, European stock indices are expected to continue to underperform US markets today, after a bruising week for European stocks.

The US payrolls data has eclipsed news about the latest tariff rates applied to the world’s economies by Donald Trump, and is now dominating markets. Bond yields had been rising across Europe, but they have also turned lower. UK 2-year yields are down by 4 bps. The old adage, ‘if the US sneezes, the rest of the world catches a cold’, could be on investors’ minds as we end the week.

Fed expected to do as Trump says and cut, cut, cut later this year

Overall, this data has led to a rapid recalibration of US interest rate expectations. Earlier on Friday there was a 40% chance of a rate cut by the Federal Reserve at their September meeting, now it is 81%. There are just about 2 rate cuts expected by the Fed on Friday, after Wednesday’s FOMC meeting that had been reduced to 1.3 cuts expected. The market now seems to think that two months’ worth of weak labour market data is enough for some rapid rate cuts from the Fed, with two cuts expected at the September and December meetings, and a 50/50 chance of a cut in October as well.

Ahead of the payrolls report, President Trump posted another contentious comment on his Truth Social platform, saying that the Fed board should assume control if interest rates are not cut. Presumably, Trump knew that the labour market data was weak, but it certainly adds pressure to Jerome Powell, now that the economic data is not going his way.

A weak report, however you look at the data

Digging a bit deeper into the data, this was an unexpectedly weak report. Private sector employment was weaker than expected, and manufacturing payrolls contracted. Education and health services provided the largest number of jobs last month, however, there were declines in professional and business services, government, information and mining. The leisure and hospitality sector, which has been a big driver of jobs growth in recent years, only managed to create 5k jobs last month. This could be a sign of a slowing consumer, which is a big worry for equity investors.

A new narrative for the US economy emerges

Tariffs have yet to meaningfully kick in, so the fact that jobs growth has been anemic at this early stage is worrying. As we start a new month and end the week, a new narrative about the US economy is emerging. It is one where the labour market is rapidly softening, where wage growth remains strong, which could pressurize corporate margins down the line, and where the US economy needs interest rate cuts.

For now, that narrative is bad news for global stocks, and US stocks also look like they will take a tumble later today. It is also bad news for the dollar, which has been knocked off its perch as the best performing currency in the G10 FX space.

Chart 1: US NFP monthly breakdown

Source: XTB and Bloomberg

Daily summary: Dollar loses ground after NFP; OIL.WTI at its lowest since 2021 💡

OIL.WTI loses 2.5% 📉

From Euphoria to Correction: CoreWeave and the Future of AI Infrastructure

Market focus shifts to CPI, while Brent crude slips below $60

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.