MicroStrategy’s preferred shares have lost nearly 7.0% and 13.5% this month as sentiment in the cryptocurrency market deteriorated. As a result, the decline in preferred shares raises questions about the company’s ability to continue financing Bitcoin purchases and covering cash-paid dividend obligations.

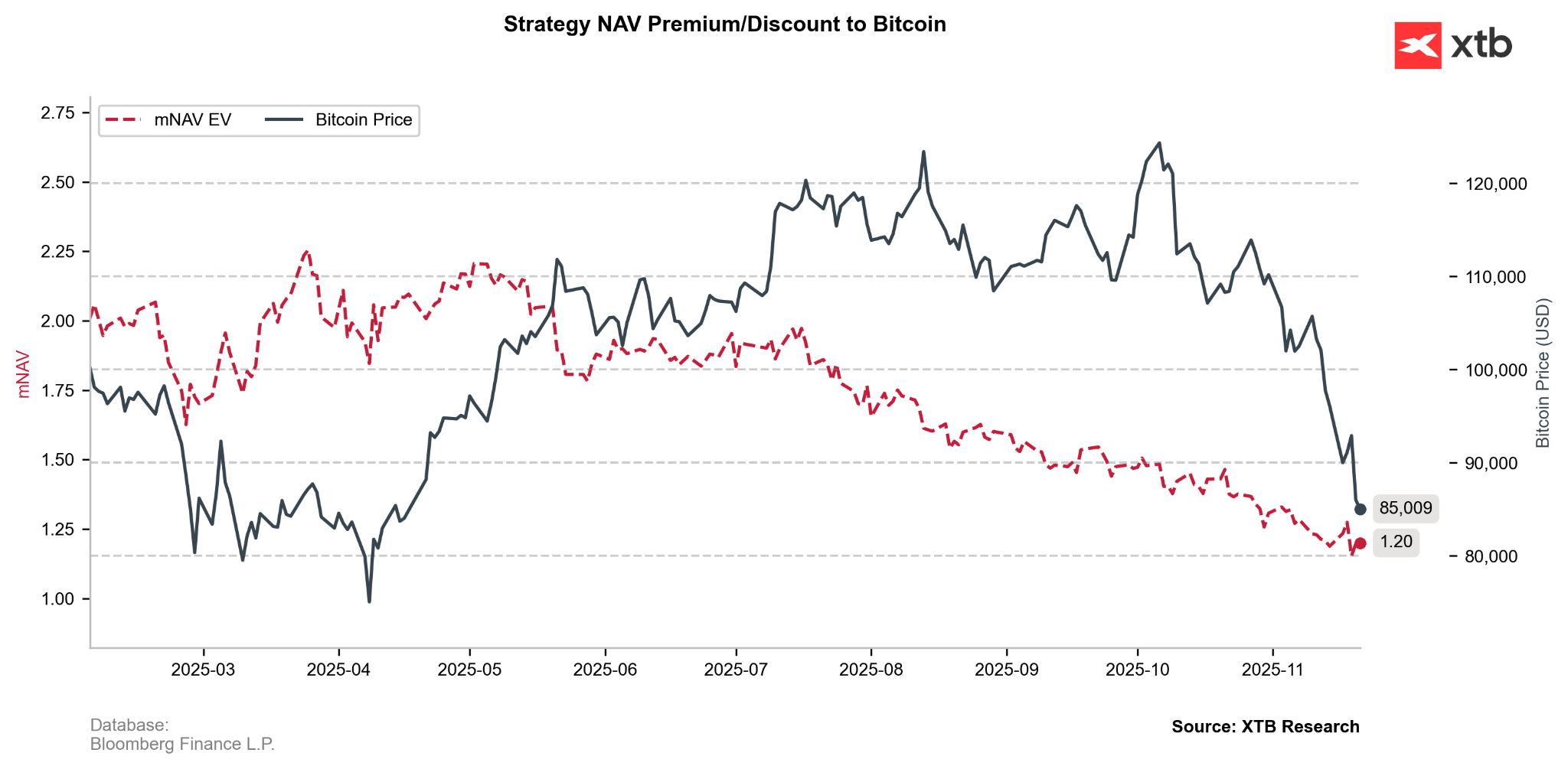

The company’s premium, which historically allowed Strategy (MSTR.US) to raise capital more cheaply than buying Bitcoin directly, has been declining steadily since mid-2025 (mNAV = EV/BTC holding).

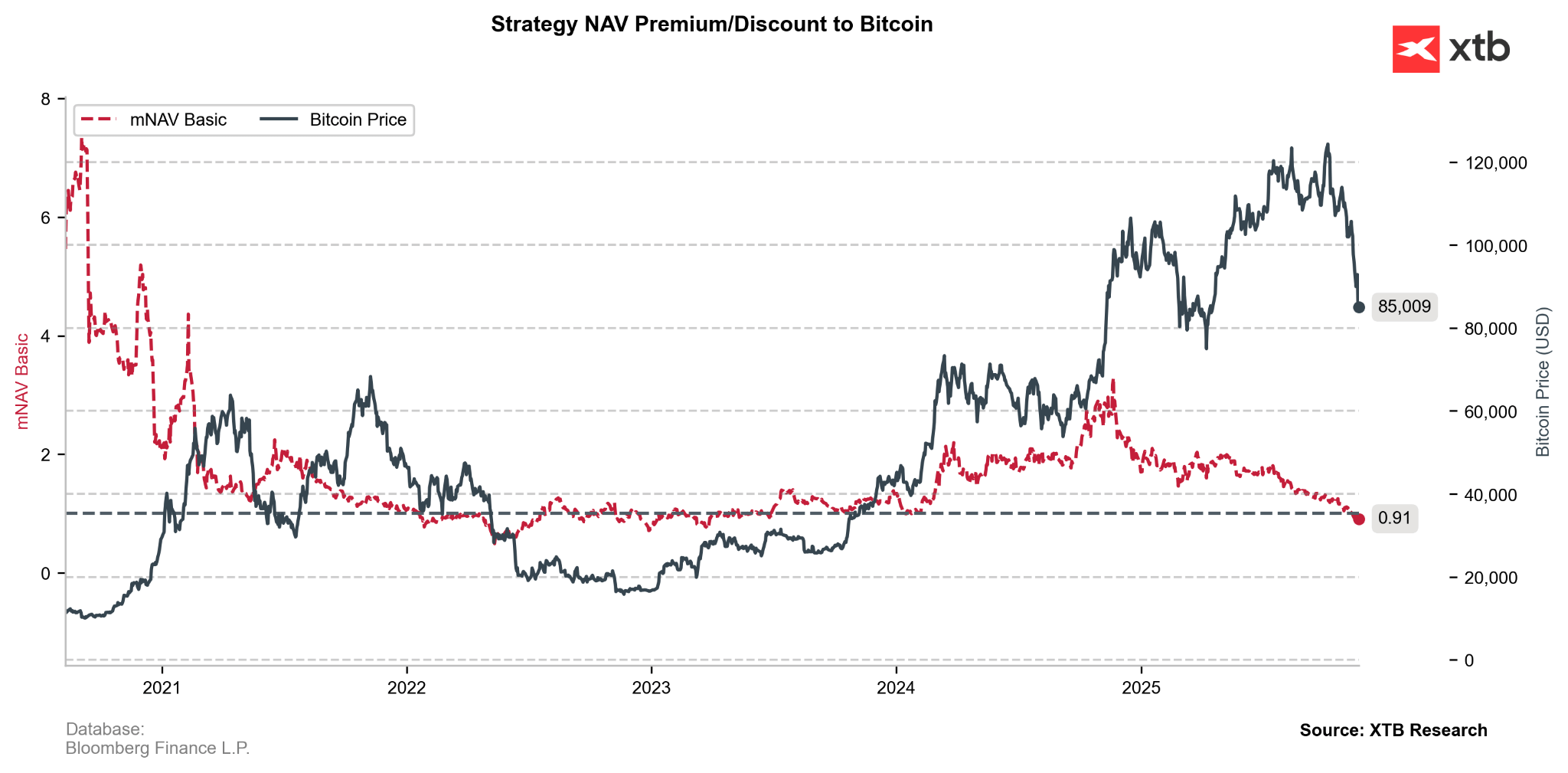

The mNAV Basic ratio (mcap / BTC holding) has fallen below 1, meaning the company’s total market capitalization is now lower than the value of the Bitcoin it holds at current prices. JPMorgan also warned that MicroStrategy could be removed from major MSCI indices, which could trigger outflows of 2.8–8.8 billion USD.

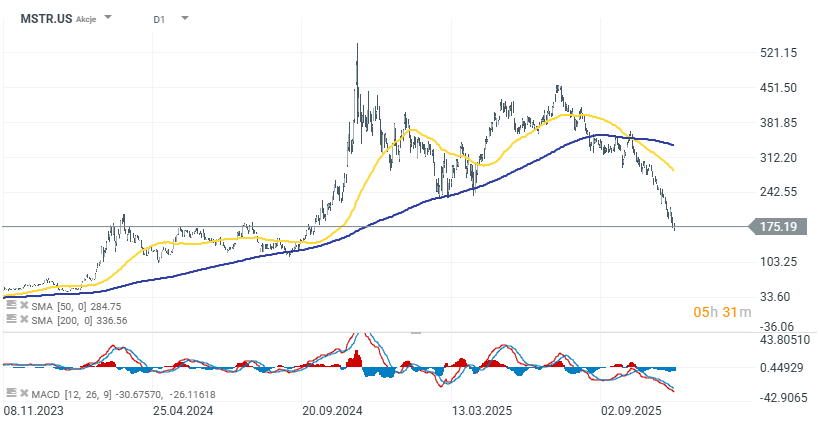

MSTR shares have fallen 10% this week, 55% over the past six months, and 60% year-over-year — much more sharply than Bitcoin itself, which is down 32% from the peak. The stock is trading near 52-week lows amid very high volatility. The company continues to raise capital through new preferred-share issuances, but rising funding costs and the risk of index removal remain key risk factors for investors. In the short term, the most important element appears to be stopping the decline in Bitcoin. Strategy is not facing a liquidity threat, as the nearest debt obligations mature only in 2027 (a small portion) and in the years that follow.

Daily summary: Markets recover optimism at the end of the week

US OPEN: Investors exercise caution in the face of uncertainty.

What we can learn from Warner Bros as Rio makes swop for Glencore

Oklo shares surged in a true “atomic open” on today’s session

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.