-

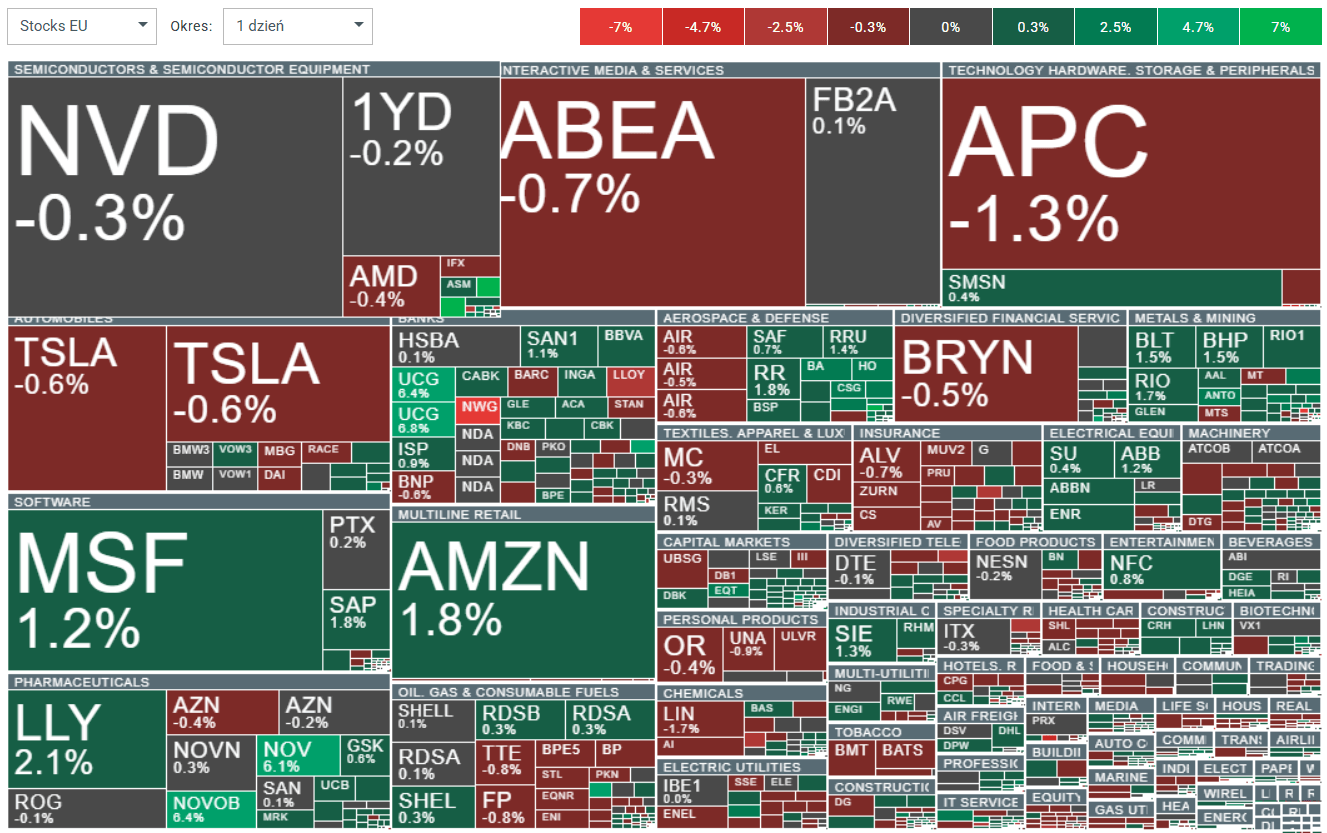

European equities held on to modest gains, but market tone remained selective and highly differentiated. Quarterly earnings are generally solid, yet investors are reacting critically even to small deviations from guidance, highlighting a still demanding market environment compared with US equities.

-

At the time of writing, the Stoxx 600 is up 0.25%, remaining near record-high levels. Germany’s DAX gains 0.23%, Italy’s ITA40 rises 0.98%, Spain’s SPA 35 adds 0.35%, while the UK’s UK100 declines 0.60%.

-

Companies in the Stoxx 600 are on track for roughly 8% EPS growth in 4Q; 61% have beaten EPS expectations and 58% have exceeded revenue forecasts. Despite this, upside potential for the index remains limited, as market reactions are often negative and 2026 guidance has failed to meet elevated expectations.

-

Tariff-sensitive companies delivered the strongest earnings beats in a year, while China-exposed names and purely EU-focused companies underperformed. Value, growth, and quality stocks beat expectations more consistently than momentum and small caps.

-

AI-risk niches under pressure: software, data services, publishers, financial information providers, alternative asset managers, and gaming stocks declined as markets priced in medium-term margin risks from AI-related disruption.

Key single-stock moves (Europe)

-

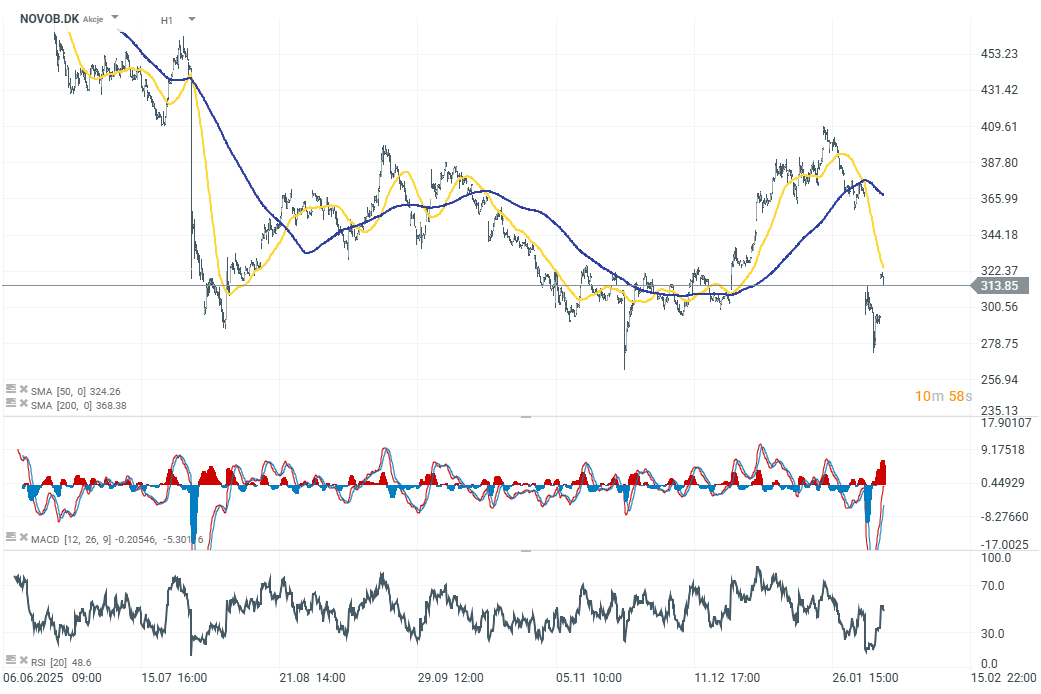

Novo Nordisk rebounds +7% after last week’s nearly 25% correction, following Hims & Hers’ announcement that it will stop selling Wegovy copies after the FDA tightened enforcement.

-

UniCredit rises +4% after presenting strong outlooks through 2030 and plans to return around €50bn to shareholders by 2030.

-

InPost surges +13% on takeover interest valuing the company at €7.8bn.

Global macro

-

Japan’s ruling LDP secured a supermajority, keeping the Takaichi trade in focus and reinforcing expectations of fiscal expansion.

-

The proposed two-year suspension of the food sales tax is seen as highly likely and is estimated to create a ~¥5trn annual fiscal gap, with key implications for bonds and FX.

-

The yen strengthened following verbal intervention by Japanese authorities. USDJPY is down 0.50%, and the yen is among the stronger G10 currencies despite Takaichi’s decisive victory.

-

Precious metals remain strong: gold is testing the $5,000 level, up 1.0% on the day, while silver gains 2.40% to $97.

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Jane Street: Legendary market maker in the court

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.