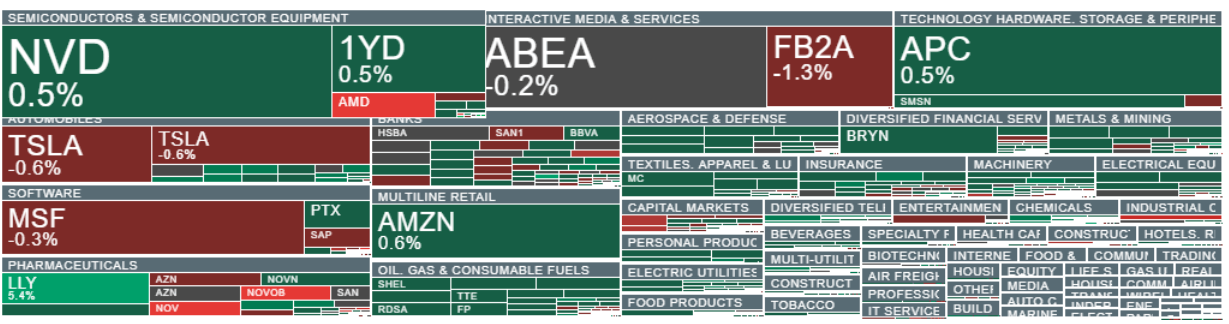

- Equity markets are attempting to rebound after the earlier selloff in software names, while gold has moved back above $5,000 per ounce, confirming persistent underlying nervousness and strong demand for precious metals. Ahead of the U.S. open, AMD and Novo Nordisk are among the biggest laggards. The market is also bracing for Alphabet’s earnings release later today, after the U.S. close.

- Shares of semiconductor heavyweight Advanced Micro Devices are down nearly 10% in premarket trading after issuing a weaker-than-expected sales outlook. Investors interpreted the guidance as a sign that AI monetization momentum may be less impressive than previously assumed, particularly after the strong rally in AMD and other names across the sector.

- Another clear negative in today’s session is the selloff in Novo Nordisk, which dropped 17% following a disappointing sales outlook. The move reinforces the narrative of intensifying price pressure in obesity drugs and growing political pressure on pharmaceutical pricing. The decline, however, was partially offset by Eli Lilly’s strong report, with sales up 43% year-on-year. AbbVie also delivered solid results.

- In Europe, gains are moderate: the UK’s FTSE 100 is up more than 1.2%, supported by commodity and mining stocks, while France’s CAC 40 is higher by 0.9%. Germany’s DAX is down over 0.3%. The chemical and automotive sectors are among the strongest performers, consistent with an ongoing rotation away from “growth/AI” and toward more traditional cyclical exposure.

In London, Trustpilot is down nearly 10% amid concerns over AI-driven “competition.” Declines are also accelerating in other stocks perceived as vulnerable to AI disruption — LSEG and Relx are both down more than 2%, while Wolters Kluwer is also trading lower.

Swiss bank UBS beat expectations and announced a share buyback program ($3 billion for 2026), but the stock is down nearly 5% on profit-taking. Credit Agricole, meanwhile, disappointed due to higher costs and increased provisioning for credit risk, with shares down more than 3%.

Beazley is up more than 8% after reports of a potential takeover offer from Zurich Insurance. The offer implies a roughly 63% premium to Beazley’s market capitalization before the process began in January. Beazley’s board has indicated it would be willing to accept if the offer becomes firm.

DCC PLC is up nearly 9% after maintaining a constructive outlook for 2026. The company expects “strong operating profit growth,” citing a solid quarter through December as well as continued strategic progress and development activity.

GlaxoSmithKline is gaining more than 5% after reporting Q4 results and reaffirming guidance:

-

Pretax profit: GBP 1.48bn (+15% y/y), above the GBP 1.37bn consensus

-

Operating profit: GBP 1.63bn (+14% y/y), above the GBP 1.53bn consensus

-

EPS: +9.9% y/y, nearly 10% above consensus

-

Management highlighted continued momentum into 2026 (Specialty Medicines and Vaccines)

In the U.S., cyclical and economically sensitive stocks are outperforming; Russell 2000 futures are up 0.2% and S&P 500 futures are up 0.2% ahead of Alphabet’s earnings. Nasdaq 100 futures are down 0.1%, but pared losses slightly after weaker-than-expected ADP data (~20k vs ~40k expected).

- Markets remain in the process of “digesting” a new risk factor: fears of accelerating automation and potential AI-driven disruption across software business models are again weighing on stocks viewed as most exposed to this trend, including companies tied to information and content-processing technologies.

- A key challenge is still the market’s ability to consistently price AI winners versus losers. With valuations stretched and earnings season underway, investors are punishing companies that fail to meet elevated expectations more aggressively.

- Market commentary suggests a broader “confidence break” across the AI/tech category, resulting in more systemic selling until investors rebuild conviction around specific companies and their fundamental competitive advantages.

- Ahead of the Wall Street open, declines are also extending to firms with significant exposure to lending to the software sector, including Blue Owl Capital, Ares Management, and Apollo Global.

Barclays argues that high valuations and optimistic expectations leave little margin for error, but sees the latest pullback as a healthy correction without classic signs of panic. Support for equities, in their view, should come from a re-acceleration in global growth and improving corporate earnings.

FX and rates: the dollar is modestly higher (+0.2%), yields are broadly stable with a slight upward bias, and the yen continues to weaken as traders anticipate a favorable election outcome for Japan’s ruling camp.

Crypto is stabilizing after heavy declines: Bitcoin is holding around $76,000, while Ethereum remains under moderate pressure near $2,100.

Commodities: gold rose roughly 2% to around $5,046, confirming defensive demand despite the equity rebound; WTI crude is slightly higher (~$63.4), without a clear directional catalyst.

Source: xStation5

Daily summary: The beginning of the end of disinflation?

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.