-

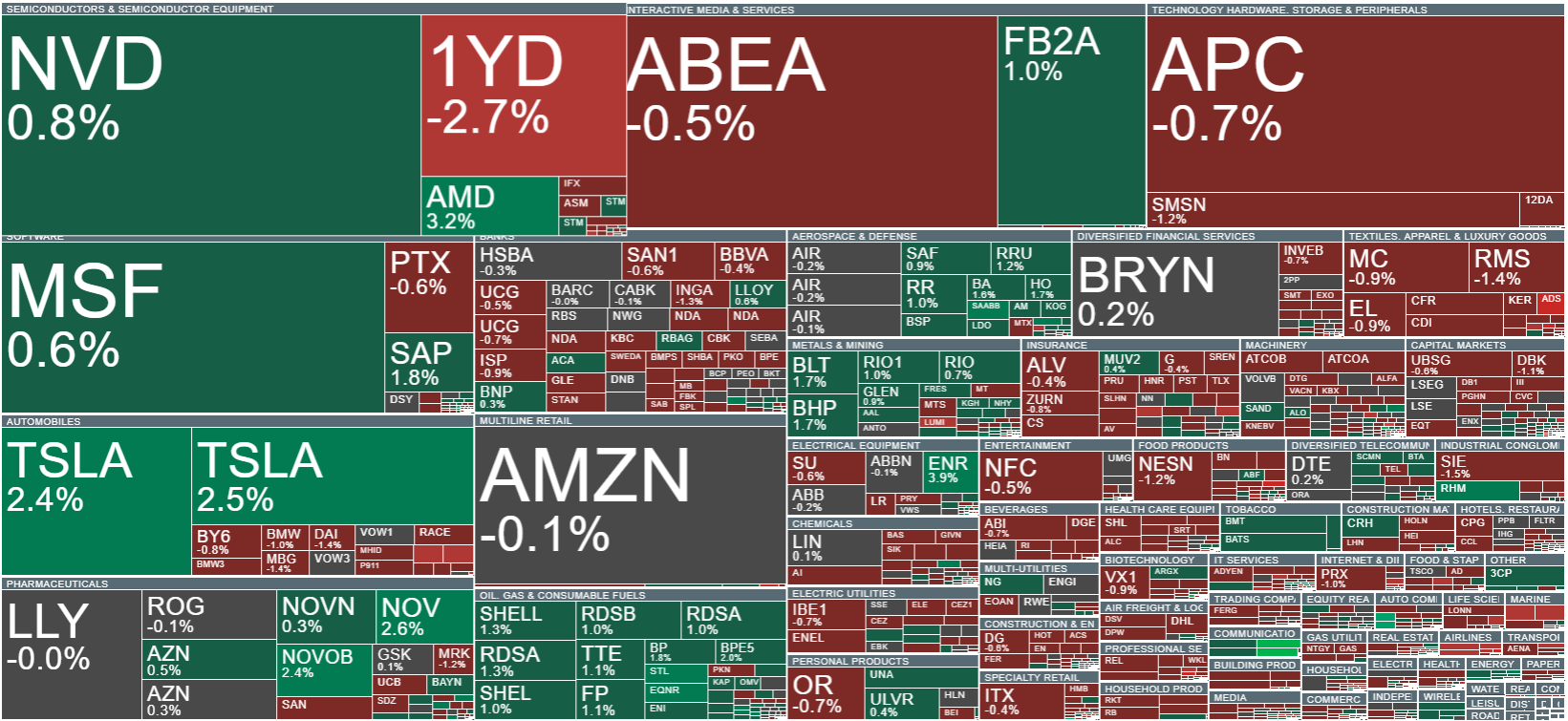

The week is ending mostly in the red on European markets. Futures for most indices are showing slight declines: the French FRA40 is down 0.1%, the Spanish SPA35 has fallen 0.2%, and the Italian ITA40 is similarly lower. On the other hand, futures for the German DE40 are up 0.2%, while the UK100 is showing a modest gain.

-

Today, Europe saw a series of important economic data releases, with the continent’s major economies and the eurozone presenting preliminary PMI readings.

-

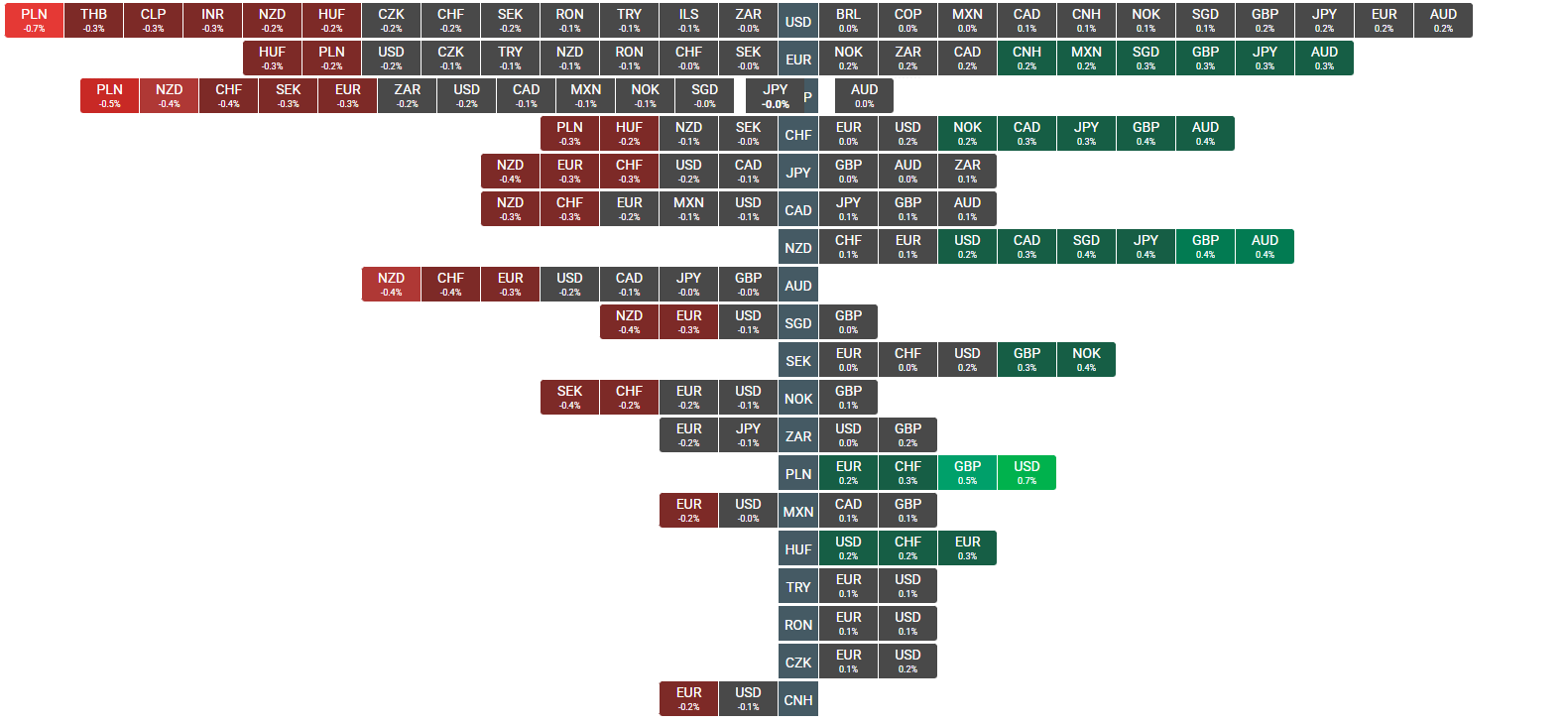

France: Private sector activity fell in January, with the Composite PMI dropping to 48.6, mainly due to weak services (47.9), although industrial production rose to 51, and business confidence reached its highest level in 16 months.

-

Germany: Business activity increased in January, with the Composite PMI at 52.5, driven by services (53.3) and a rebound in industry (48.7), alongside rising new orders, though employment declined and costs and production prices increased.

-

Eurozone: Private sector activity continued to expand in January, with the Composite PMI above 50, supported by services (51.9) and industrial production (49.4), while business confidence rose despite falling employment and rising cost pressures.

-

United Kingdom: Private sector activity accelerated in January, with the Composite PMI reaching 53.9, driven mainly by services (54.3) and industry (51.6), amid rising new orders, although firms continued to limit hiring and faced cost pressures. Retail sales in December rose 0.4% month-on-month, exceeding expectations, mainly due to strong online sales, signaling improving consumer sentiment. Year-on-year sales were up 2.5%—the strongest increase since April—though Q4 remains weak and sales levels are still below pre-pandemic levels.

-

France political update: The French government survived a no-confidence vote over the 2026 budget, with the Prime Minister planning to push through the spending side using Article 49.3 of the constitution.

-

Precious metals: Mixed trends continue, with gold down around 0.2% at $4,920 per ounce, while silver rises about 3%, testing $99 per ounce.

-

Cryptocurrencies: Mixed sentiment persists. Bitcoin is down slightly by 0.1% and Ethereum by 0.2%.

-

Intel: Intel reported solid Q4 2025 results, with revenue of $13.7 billion and EPS of $0.15, beating analyst expectations and seeing a 9% year-on-year increase in its Data Center and AI segment. However, investors reacted cautiously, focusing on a weak Q1 2026 outlook, cost pressures, and execution risks, leading to a sell-off and softer market sentiment.

Source: xStation5

Source: xStation5

Cocoa crashes 7% 📉

Silver surged 40% in January moving toward $100 per ounce📈

Gold: correction risk rising? 🚨 Goldman lifts 2026 target

Chart of the day: EURUSD under pressure after PMI data! 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.