-

Strong turnaround in LVMH's earnings and a 13% jump in share prices at the opening after a quarterly surprise.

-

Sales growth in the China region and exceeding forecasts in most segments.

-

Positive outlook for 2026 thanks to improving trends in Asia and stabilizing demand in the US and Europe.

-

Strong turnaround in LVMH's earnings and a 13% jump in share prices at the opening after a quarterly surprise.

-

Sales growth in the China region and exceeding forecasts in most segments.

-

Positive outlook for 2026 thanks to improving trends in Asia and stabilizing demand in the US and Europe.

LVMH (MC.FR) latest quarterly report has delivered a surprisingly positive turnaround, suggesting luxury fashion may be winning back investor favor. After two quarters of declines, LVMH (MC.FR) halted the trend of weakening demand for high-end goods, posting 1% organic sales growth and a marked improvement in key business segments—most notably strong demand at Moët & Chandon and Dior. This surprise triggered a more than 13% spike in share price at market open, briefly leading to a trading halt due to rapid volatility.

Third-quarter results also highlighted improvement in regions that previously saw declines. In China, sales rose 2% after a prior 9% drop in the first half, seen as an early sign of recovery (also backed by today’s CPI data from China showing increased demand for luxury jewelry despite ongoing general deflation). All divisions outperformed analyst expectations, with fashion & leather goods falling less than forecast (-2% vs. -3.5%).

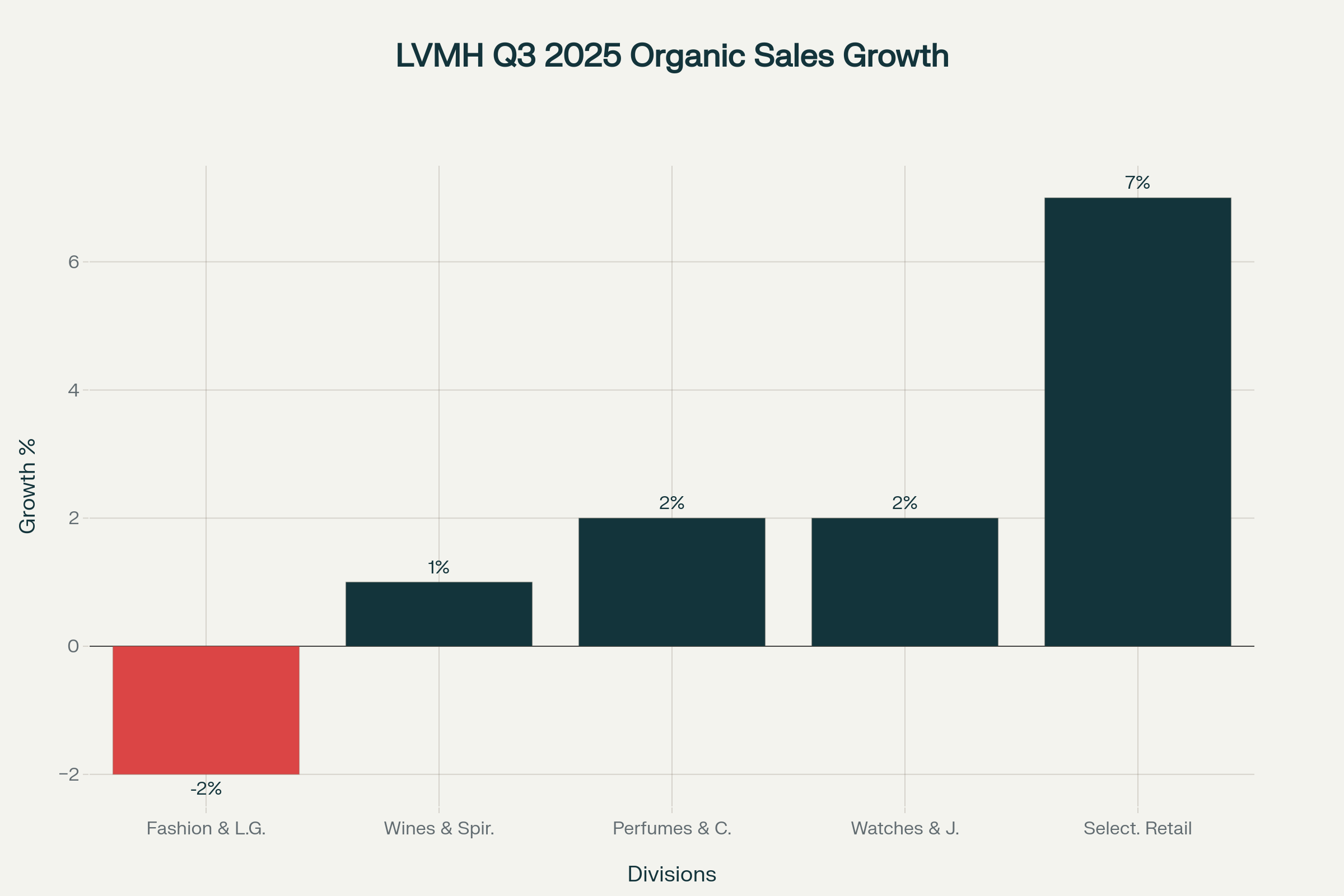

Key results and forecasts:

-

LVMH Q3 revenue: €18.28bn (+1% y/y; forecast: -0.72%)

-

Fashion & Leather Goods: -2% (forecast: -3.48%), revenue €8.50bn (-7.1% y/y)

-

Wines & Spirits: +1% (forecast: -3.18%), revenue €1.33bn (-4% y/y)

-

Perfumes & Cosmetics: +2% (forecast: +1.73%), revenue €1.96bn (-2.7% y/y)

-

Watches & Jewelry: +2% (forecast: +1.05%), revenue €2.32bn (-2.8% y/y)

-

Selective Retailing: +7% (forecast: +4.61%), revenue €3.99bn (+1.7% y/y)

-

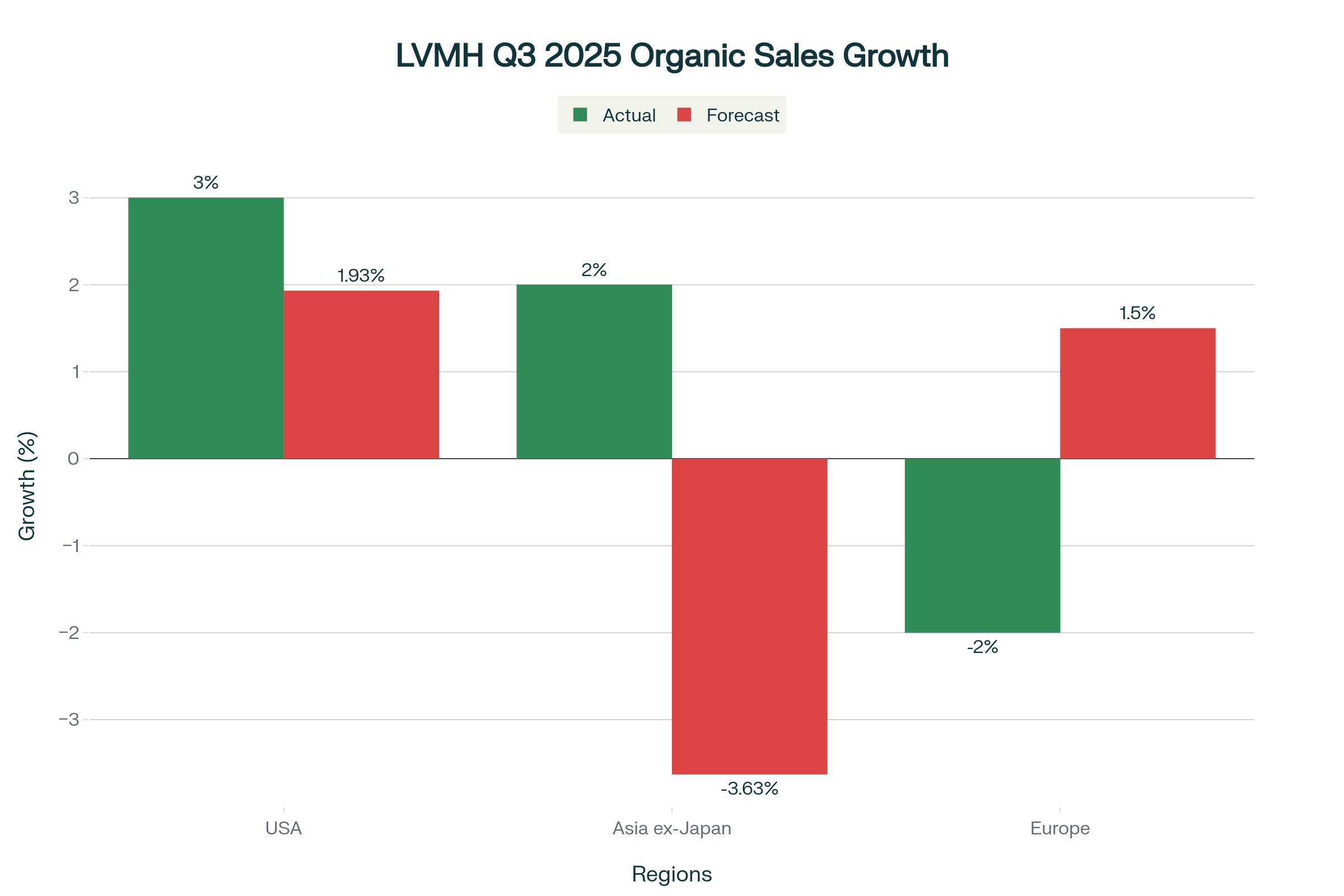

US sales: +3% (forecast: +1.93%)

-

Asia ex-Japan: +2% (forecast: -3.63%)

-

Europe: -2% (forecast: +1.5%)

-

Analysts (JP Morgan, Morgan Stanley) are forecasting continued improvement, with a possible return to sustained growth in 2026, driven especially by a rebound in Chinese demand and stabilization in the US and European markets.

LVMH organic sales growth by division, Q3 2025. Source: XTB

Outlook:

Management and leading analysts point to a gradual recovery, with the strongest rebound in Asia ex-Japan (mainly China, a key market for luxury), and continued growth potential fueled by high post-pandemic savings among Chinese consumers. Management cautions that the Q4 comparison base will be tougher, but strong brand visibility at events like those for Louis Vuitton and Dior supports a positive outlook for next year. Expectations are that 2026 will offer easier year-over-year comparisons, providing a solid foundation for the global luxury sector to rebound.

LVMH's latest quarterly results and the dynamic growth of the company's share price clearly indicate that the fashion and luxury sector may be returning to favor with investors after a period of uncertainty and decline. LVMH's reversal of the negative trend, illustrated by a 13% jump in its share price, is a strong signal, especially as the improvement in sales is also visible in key segments and demanding markets such as China.

Importantly, the rebound is not limited to the Parisian giant. In recent days, other companies in the industry, such as Kering, have also recorded solid growth. Until recently, the improvement in sentiment was mainly explained by short-term speculation on a rebound, but new data from LVMH shows that the turnaround in valuations is also driven by real, better-than-expected financial results.

LVMH Q3 2025: Organic sales growth by region (actual vs. forecast). Source: XTB

LVMH shares started trading today with a clear upward gap and broke back above their 200-day exponential moving average, which previously acted as a major resistance level in the stock’s downtrend. Source: xStation

End of Zillow? Google enters another market.

NFP preview

US OPEN: Mild optimism at the start of the week

Sanofi Under Pressure After FDA Delay and Failed Trials

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.