Ahead of Thursday’s session open, one of the giants of the U.S. defense industry released its results. Market expectations were beaten, and the company’s valuation climbed to a new all-time high, rising 4% after the publication.

An unprecedented level of geopolitical tensions and defense spending is supporting defense contractors. This also applies to Lockheed Martin, which recently found itself at the center of negative attention from the U.S. administration due to its dividend and share buyback policy.

Financial Statement Insights

The company slightly exceeded expectations both in terms of EPS and revenue in Q4 2025.

- GAAP EPS: USD 5.80 (market consensus: USD 5.75)

- Revenue: USD 20.3 billion (market consensus: USD 19.85 billion)

- Operating margin: 10.1%

On an annual basis:

- Sales increased by 5% in 2025 (to USD 75 billion), and profits rose by 11% (to USD 6.7 billion), resulting in cumulative GAAP EPS of 21.49.

- The company’s backlog grew by 17% to USD 194 billion, with a book-to-bill ratio of 1.2. The annual operating margin was exactly 9%.

- In full-year 2025, the company allocated USD 3.1 billion to dividends and USD 3.0 billion to share repurchases. Free cash flow (Non-GAAP) totalled USD 6.9 billion.

Business segments

The CEO says demand for the company’s products is unprecedented, with the strongest growth in the missiles and fire control segments. Sales in this segment rose to USD 14.4 billion (+14%), while profit surged by 382% to USD 1.9 billion. The key “workhorses” in this segment remain the Patriot and JASSM systems.

In the aeronautics segment, the company continues to benefit from sales and support of F-35 aircraft. In Q4, operating profit jumped by 80%, but year over year it fell by 17%. This is largely linked to above-plan write-downs related to one of the company’s classified projects. Given industry trends, this is most likely connected to the X-59 project and other hypersonic vehicles.

Guidance

Alongside strong results, the company also delivered optimistic guidance.

For next year, the company forecasts sales of USD 77.5–80.0 billion and full-year EPS of USD 29.35–30.25 per share.

Management states it expects continued double-digit sales growth in the missiles and fire control segment.

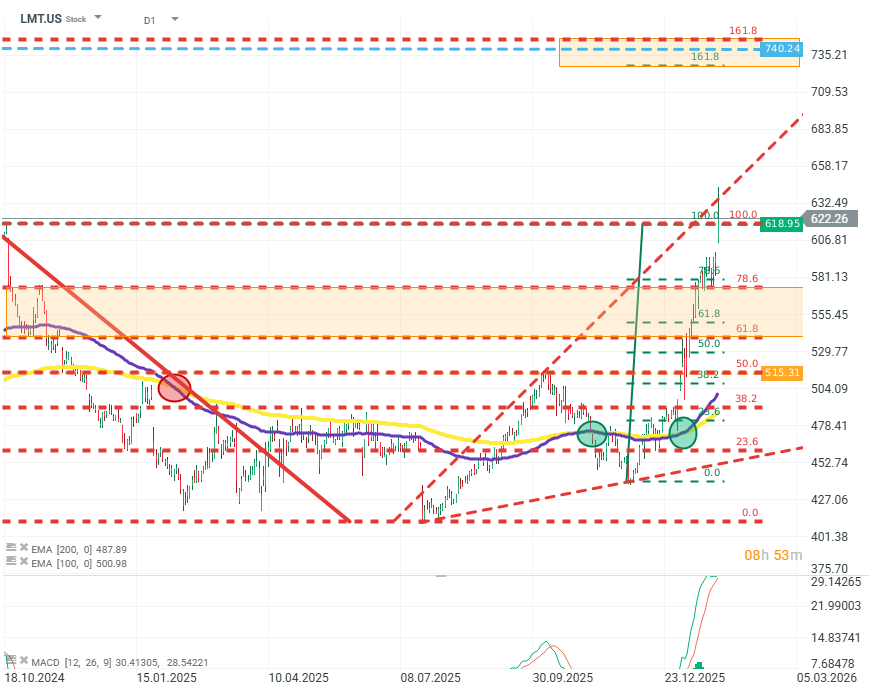

LMT.US (D1)

If the price holds above the most recent highs, then, given the current upward momentum and the structure of the EMA 100 and 200 moving averages, the stock may have a chance to continue rising even toward the USD 740 area. A pullback, potentially reinforced by a possible negative signal from the MACD indicator, could bring the price down toward support between the 78.6% Fibonacci level and the 50% retracement of the most recent upswing. Source: xStation5

Gaming companies with huge discounts 🚨 Will Project Genie end the traditional era of gaming ❓

Warsh wins Fed race

EURUSD down 0.5% amid US PPI inflation report🚨

Market wrap: European indices outperform US stocks ahead of the opening bell on Wall Street 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.