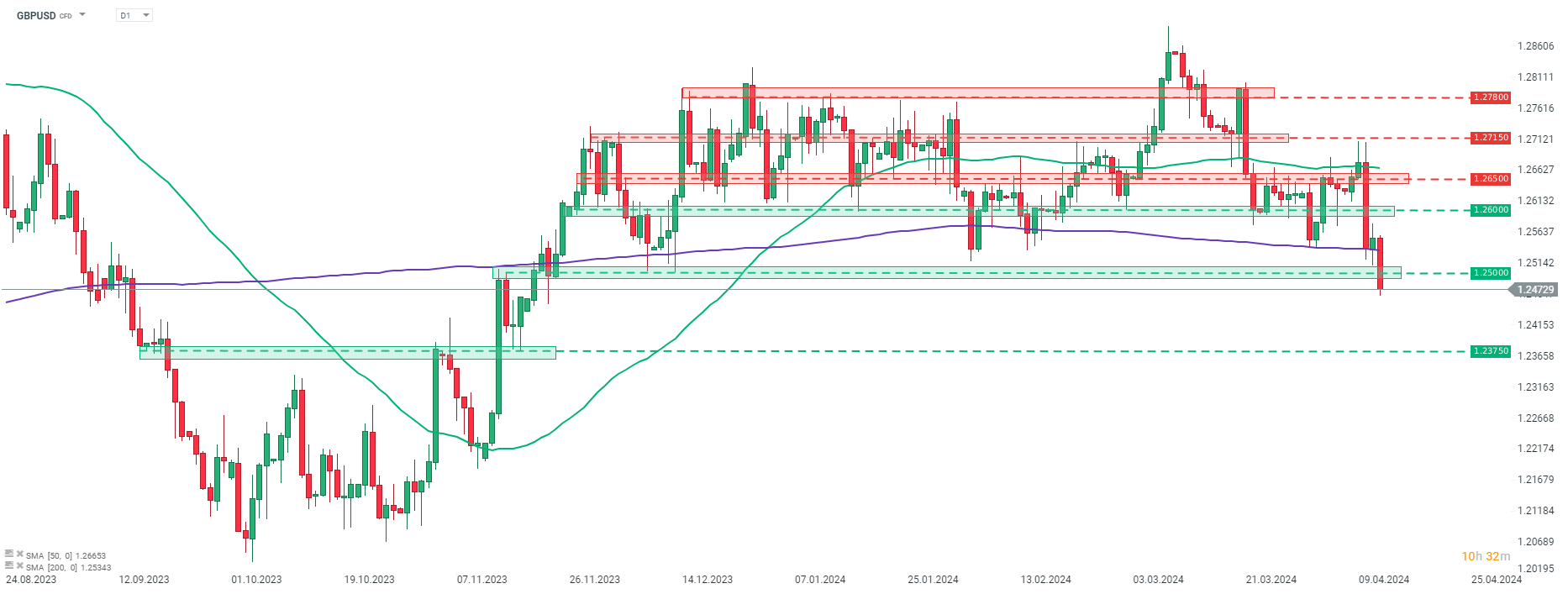

GBPUSD is taking a hit today, dropping to the lowest level in almost 5 months! The move is driven by continued strength in the USD, which is benefitting from falling market expectations regarding Fed rate cuts. Right now, markets are no longer expecting Fed to deliver the first-rate cut in the first half of 2024, but rather in July or September. Today's drop in GBPUSD comes even in spite of a better-than-expected UK data for February released this morning. UK report showed GDP growth in February at -0.2% YoY (exp. -0.4% YoY), as well as a 1.4% YoY jump in February's industrial production (exp. 0.6% YoY).

Taking a look at GBPUSD chart at D1 interval, we can see that the pair slumped below the 200-sesion moving average today (purple line), that acted as a support during the 4-month long sideways move. Declines accelerated later on and the pair slumped below the 1.25 support zone as well, reaching the lowest level since November 22, 2023. The next major support zone to watch can be found ranging around 1.2375 level, and is marked with previous price reactions.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.