- Rate cut expectations turn lower, globally

- NFP report more important for dollar than FOMC

- Division at the Fed

- A resumption of QE is expected

- The market outlook

- Rate cut expectations turn lower, globally

- NFP report more important for dollar than FOMC

- Division at the Fed

- A resumption of QE is expected

- The market outlook

The Federal Reserve is scheduled to announce a 25bp rate cut this evening at 1900 GMT, thirty minutes later, Jerome Powell will deliver his press conference. While there is a 90% chance of a rate cut at this meeting, the outlook is less clear. In the lead up to this meeting, bond traders are scaling back their expectations for future rate cuts, with only two further reductions expected throughout 2026.

Rate cut expectations turn lower, globally

This is an abrupt shift from a week ago when three rate cuts were expected, and it follows a hawkish shift in other regions, with rate cut expectations getting rapidly scaled back in Australia, New Zealand and Canada. The ECB is also expected to have finished their rate cutting cycle. This leaves the Fed and the BOE as outliers, and could impact the performance of the dollar and the pound in the coming months.

NFP report more important for dollar than FOMC

The market has preempted the FOMC meeting, and the November payrolls report, which will be released on 16th December. This data could be more important than the Fed meeting, and options traders are pricing in a bigger move for the dollar on the back of the NFP report compared to this evening’s FOMC meeting.

While there have been signs that the US market is softening, the signals more recently have been mixed. The Fed is likely to cut rates today due to the softening in private sector payrolls, which continued to get released over the government shutdown. However, more recent data, including the latest JOLTS job openings data, was better than expected, showing fewer openings, which helped to push up Treasury yields.

Ahead of this meeting, the 10-year Treasury yield has broken above 4%. This reflects the Fed Fund Futures market, which is pricing in for future Fed rate cuts to come in the first half of 2026, with a pause after that. There is also a small, but growing, chance of a rate hike next year, although that is not our base case.

Chart 1: US 10-Year Treasury yield break out

Source: XTB and Bloomberg

Division at the Fed

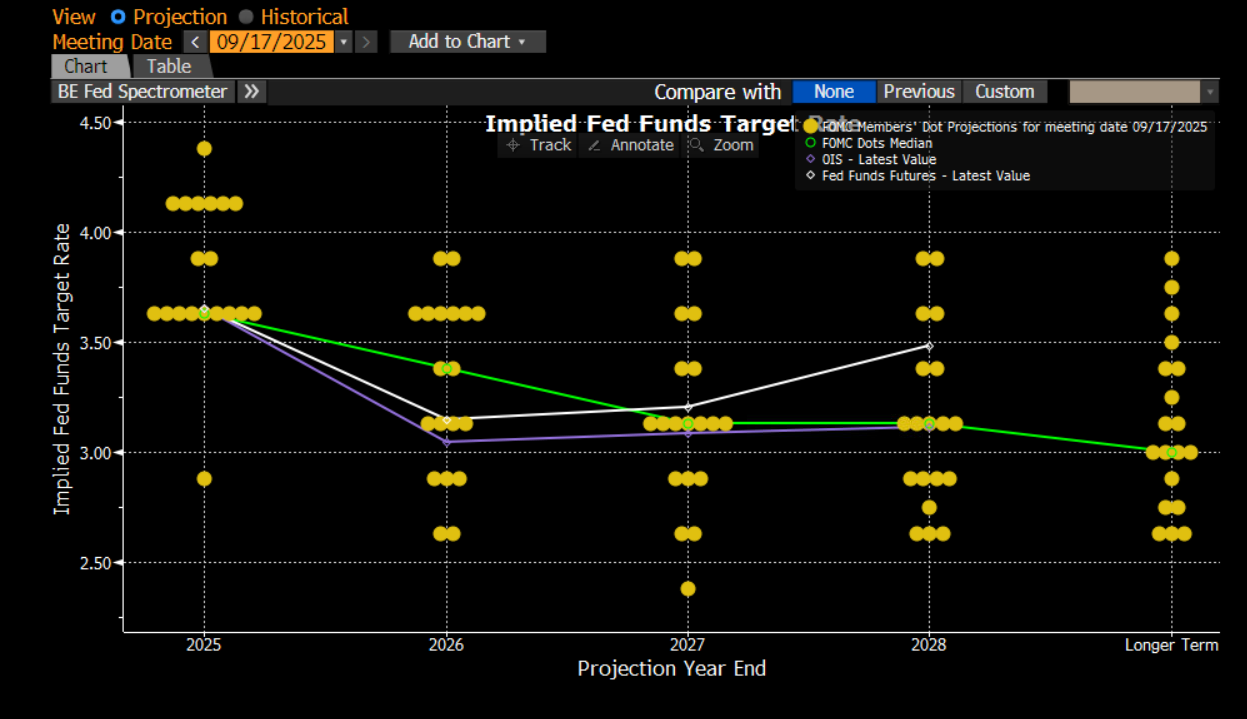

All of this is why markets expect a ‘hawkish cut’ from the Fed later today. However, the rate cut will not be the main event, in our view. The press conference could be spicy, with Fed chair Jerome Powell verbally pushing back against the prospect of multiple or sequential rate cuts in 2026. The Dot Plot is also likely to highlight the wide range of views held by the Federal Reserve. FOMC members that were picked by President Trump are likely to call for more rate cuts, while some members are expected to take a cautious stance. We even expect there to be dissenters who vote against today’s decision to cut, citing concerns over inflation. Overall, we expect the December Dot Plot to look like September’s, and for the median long-range interest rate outlook to remain around 3-3.25%.

Chart 2: The September Dot Plot

Source: XTB and Bloomberg

A resumption of QE is expected

There have been concerns relating to dollar liquidity in recent months, so we also expect some changes to the Fed’s QE programme at this meeting, which will be important for stock markets. The Fed may announce some organic balance sheet expansion for 2026, or QE-lite, after it formally ended its QT programme at the start of this month. QE-lite, could include purchasing short-term Treasury bills to manage bank reserves in an effort to smooth the financial system’s plumbing, which has tightened in recent months. This could come into force at some point in Q1 and would stabilize the size of the Fed’s balance sheet.

A boost to QE in the traditional, post 2009 sense is very unlikely, however, a slight increase in the size of its balance sheet is necessary to ensure healthy bank reserves. There are a small minority of analysts who think that the Fed could announce a bill-buying binge, with an initial $45bn of purchases to maintain ample reserves in the banking system. If this happened, then it could cause stocks to spike higher, as liquidity is their lifeblood. It could also weigh on the dollar, and boost gold, since QE is usually associated with a deflationary environment, yet inflation in the US is currently well above the 2% target.

The market outlook

Stock index futures are mixed as we lead up to this meeting. The options market is pricing in a 1% +/- move for equities on the back of this meeting, which is significantly larger than moves in recent days, so it could be volatile later in the US session. In the longer term, the question for investors is whether a ‘hawkish cut’ can be balanced out by the promise of more QE?

The FX market will also react to this meeting. The dollar is weaker across the G10 FX space today, but it remains range bound, Dollar index upside is limited by resistance at 99.38, the 200-day sma. A hawkish cut could propel the dollar above this level.

Chart of the day: EURUSD (10.12.2025)

Amazon increases its investments in India. Could this be a growth catalyst?

BREAKING: Inflation in Norway in line with expectations!

Morning Wrap (10.12.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.