- Futures contracts point to a lower opening for today's cash session in Europe

- This comes after lawsuits were filed against current Fed Chairman Jerome Powell, which once again strike at the independence of the central bank

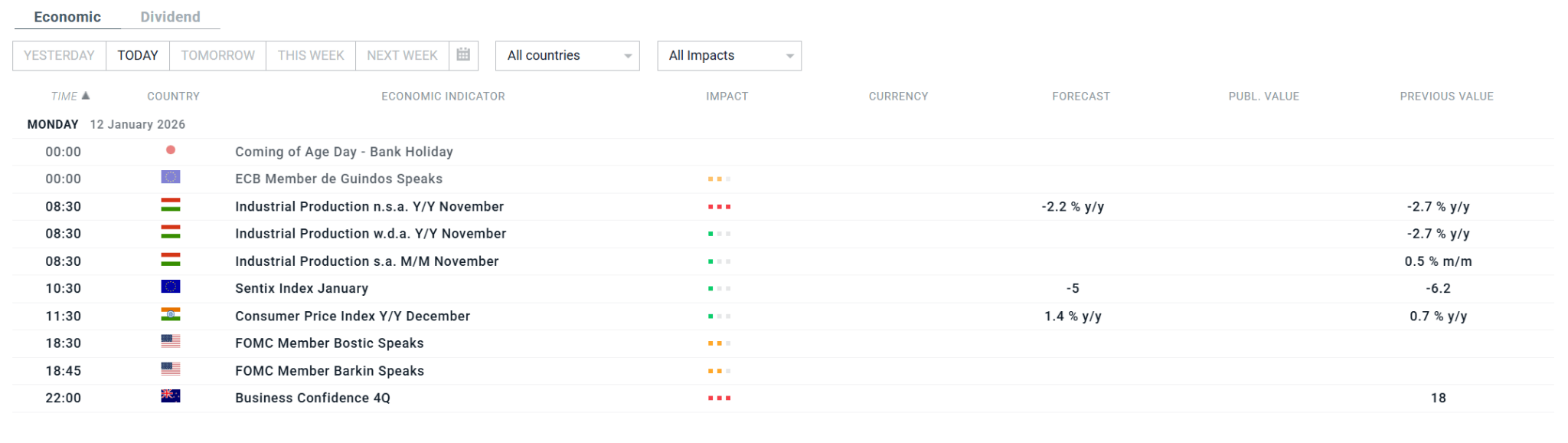

- The calendar for today's session will not include any significant macro publications

- Futures contracts point to a lower opening for today's cash session in Europe

- This comes after lawsuits were filed against current Fed Chairman Jerome Powell, which once again strike at the independence of the central bank

- The calendar for today's session will not include any significant macro publications

Monday's session on the financial markets is off to an interesting start, though not because of the macroeconomic data releases scheduled for today. After the weekend, the markets are focused on both geopolitics, centred on Greenland and Iran, and monetary issues, dictated by lawsuits filed against Jerome Powell, the chairman of the US central bank.

The turn of events means that precious metals and so-called "safe haven" currencies are performing very well today. On the other hand, futures contracts focused on American and European indices are losing value.

Investors are awaiting publications later this week (US CPI data and Wall Street banks' Q4 2025 results). Today, it seems that the markets will be driven by incoming ad hoc information.

Today's session calendar on the macro data side. Source: xStation

Chart of the day - USDIDX (12.01.2026) 🏛️

The Week Ahead

Morning Wrap (12.01.2026) – Jerome Powell under investigation; pressure in Iran/Greenland in the background 🚨

Daily summary: Markets recover optimism at the end of the week

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.