Risk sentiment has dipped at the start of European trading on Tuesday, and stocks are broadly lower after a strong day for risk at the start of the week. UK companies have been hit by a wave of downgrades. Haleon, EasyJet and Domino’s Pizza are all lower on Tuesday, as analyst concerns weighs on the market.

More labour market softening for UK

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe UK labour market data was broadly weaker, as the jobs market continued to look anemic. Vacancies were down 10,000 in the three months to July, unemployment was higher and jobs growth has stalled, the ONS estimated that the number of workforce jobs in the UK was 36.8 million, a decrease of 182,000 since March. This data is more evidence that the National Insurance increase for employers and the increase to the minimum wage in April are weighing on employment.

While job growth is stalling overall, there are pockets of strength, including in the public sector. The number of NHS employees surged to a record 2.07 million in the period, however, strikes in health and social work sector led to 83,000 working days lost in July.

Wage growth remains high, even though the jobs market is slowing. Wage growth excluding bonuses was 4.8%, down from 5%. However, adjusted for inflation, real pay growth was 1% between May and June this year, and real earnings continue to trend lower.

Labour market woes fail to shift the dial for UK rates

Interestingly, even though the UK’s labour market is weakening, the interest rate futures market is not rushing to price in interest rate cuts. Traders remain unconvinced that the BOE will follow the Fed and cut rates, and instead, the market sees less than 1 rate cut between now and March. There is only just over 1 cut priced between now and July, as the market bets on the BOE taking a more cautious path towards rate cuts compared to the Fed, even though both the UK and the US are seeing weakness in their labour markets.

Although wage growth remains stubbornly high in the UK, real wage growth is weak. Wednesday’s inflation data is the next focus for the UK. The risk is that high inflation and a weak labour market combined with flatlining GDP growth raises the spectre of stagflation for the UK economy, which could complicate the economic picture ahead of the Budget.

Dollar breaks down as we wait for Fed

The lack of rate cut support for the UK economy is good news for the pound. GBP/USD is higher by 0.3% this morning and remains at a 2-month high. It is a top performer vs. the USD on Tuesday. As we lead up to the Fed meeting tomorrow, the dollar is breaking down. The dollar index is trading just above 97.00 and is hovering near the lows of the year so far.

Cook could disrupt Trump’s plan for lower US interest rates

The question is, will the Fed meeting spur another leg lower for the greenback, or will 96.40, the low from July, act as strong support? There are still just under 6 rate cuts priced in by the Fed Fund Futures market between now and January 2027. The outlook for US interest rates is unlikely to change dramatically ahead of the Fed meeting. Added to this, although Trump’s pick for the Fed was confirmed, Steven Miran, his attempts to fire Fed governor Lisa Cook before this week’s meeting has failed. This means that at least one member of the Fed could disrupt Trump’s dream of rapidly lower interest rates in the coming months.

Gold strikes fresh high once again

The dollar is the weakest currency in the G10 FX space on Tuesday, as the Japanese yen, the Swiss franc and the euro are leading the way higher. As the dollar falls, the gold price is rising once again and made another record high on Tuesday. The rally in the gold price is fueling gains in FTSE 100 miners on Tuesday. Fresnillo, the index’s top performer so far this year, is also leading the index higher today. It is up more than 3% this morning, Glencore and Rio Tinto are also top performers. In contrast, UK retailers and supermarkets are struggling today, as concerns about softening labour market fuels concern about the strength of the consumer.

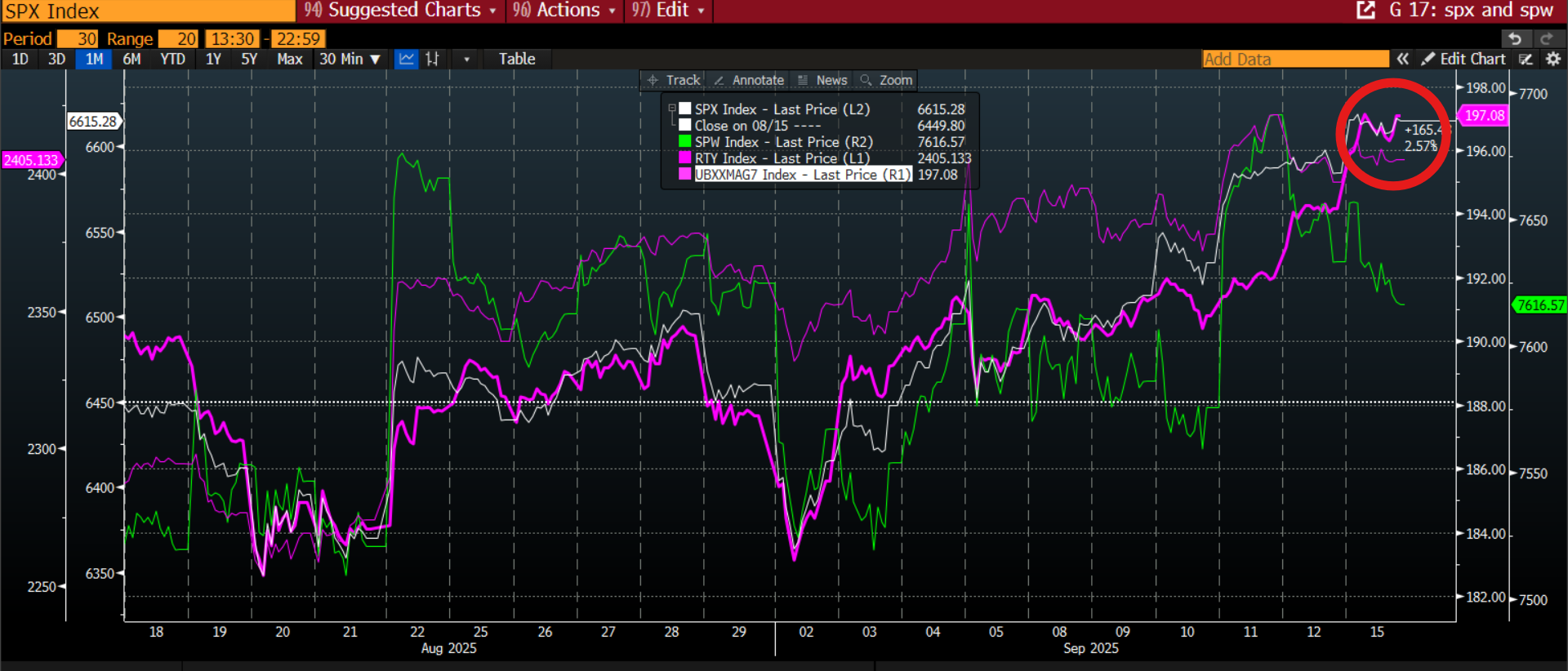

Magnificent 7 powers US stocks to fresh records

While European stocks remain under pressure, US stocks are expected to edge higher once again. US indices closed at record highs on Monday and could extend gains later today. The longer-term outlook will be dependent on the outcome of the Fed meeting, and the Dot Plot in particular. The US stock market has been powered to record highs by tech giants including Tesla, Alphabet and Oracle in recent days. The Magnificent 7 has been a beneficiary of the interest rate cut speculation in the US and has led the S&P 500 to its record highs, as you can see below. This is dashing hopes for a broad-based market rally, and it could leave tech exposed if the Fed pushes back on the dovish narrative expected by the market.

Chart 1: S&P 500, equal-weighted S&P 500, the Magnificent 7 and the Russell 2000

Source: XTB and Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.