💸 The “debasement trade” is the strategy investors use to protect their money when currencies lose value due to excessive money printing.

🏦 Since the end of the gold standard in 1971, governments have been able to issue money without backing, leading to inflation and record global debt.

🪙 In this context, gold has regained its role as the preferred safe haven, because it cannot be printed, holds its value, and is accepted worldwide.

📈 With bonds and stocks showing increasing risks, many now wonder not if gold will rise further, but when it will reach new record highs.

💸 The “debasement trade” is the strategy investors use to protect their money when currencies lose value due to excessive money printing.

🏦 Since the end of the gold standard in 1971, governments have been able to issue money without backing, leading to inflation and record global debt.

🪙 In this context, gold has regained its role as the preferred safe haven, because it cannot be printed, holds its value, and is accepted worldwide.

📈 With bonds and stocks showing increasing risks, many now wonder not if gold will rise further, but when it will reach new record highs.

In financial markets, the so-called “debasement trade” refers to an investment strategy aimed at protecting purchasing power against the ongoing devaluation of fiat money.

The idea is simple: when governments and central banks expand the money supply faster than the real economy grows, the value of the currency declines — and assets with limited supply, such as gold, silver, or bitcoin, tend to appreciate.

The History of Fiat Money

Until 1971, the international monetary system (established at Bretton Woods in 1944) operated under a gold-dollar standard. The U.S. dollar was convertible into gold at $35 per ounce, and other currencies were pegged to the dollar. This meant the amount of money in circulation was limited by the U.S. Treasury’s gold reserves — in other words, it couldn’t be printed indefinitely.

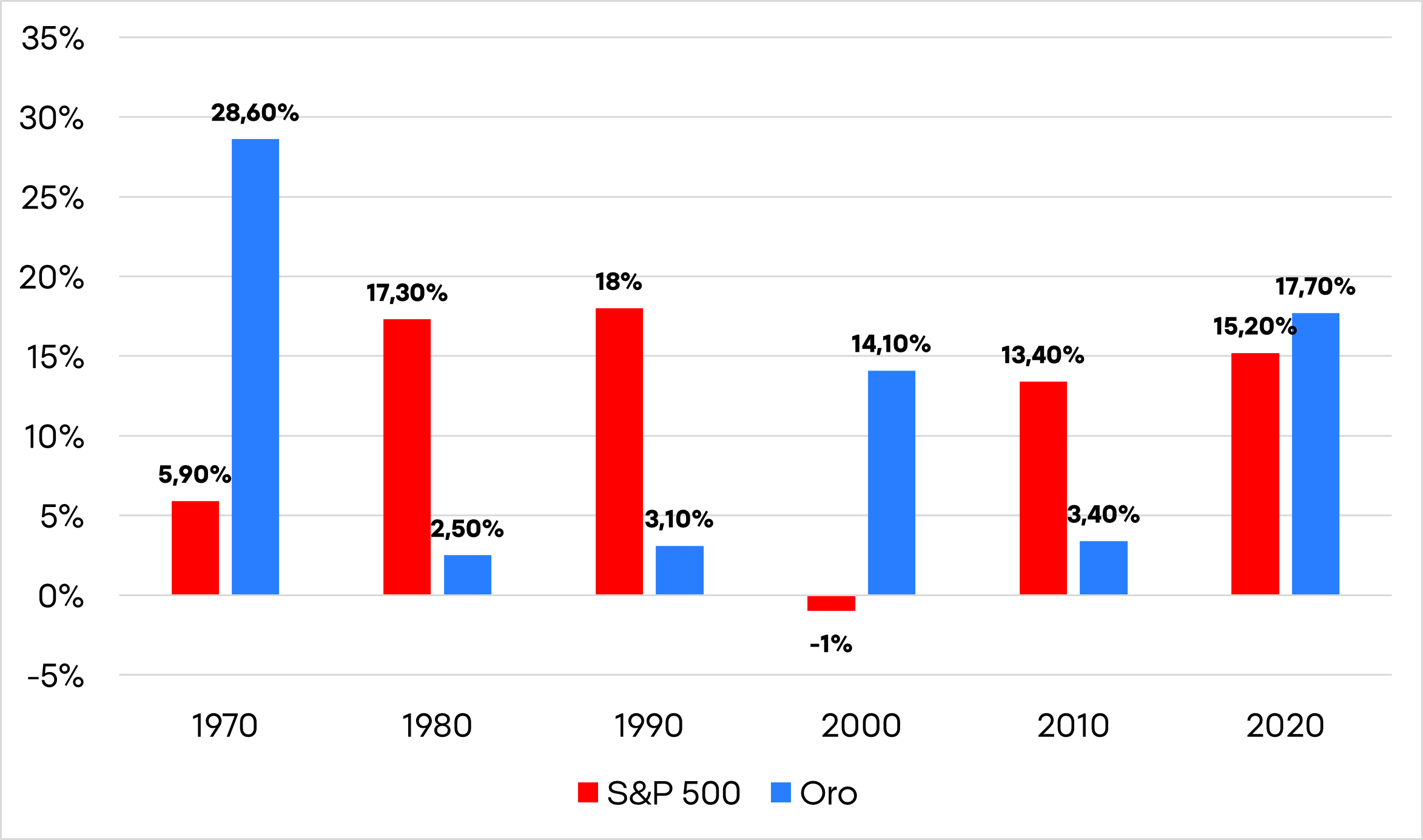

During the 1960s, however, the Vietnam War and expansive social programs created large fiscal deficits. The United States began issuing more dollars than it could back with gold, prompting several countries to demand conversion of their dollars into gold. Fearing depletion of its reserves, President Richard Nixon unilaterally suspended the dollar’s convertibility into gold on August 15, 1971 — an event known as the “Nixon Shock.” This marked the birth of pure fiat money, and during that decade gold delivered spectacular returns not seen again until recently.

Annualized performance of gold and the S&P 500 by decade. Source: XTB.

Since then, central banks have been free to expand the money supply at will. Cycles of devaluation, inflation, and asset bubbles have become recurrent. Every crisis (1987, 2000, 2008, 2020) has been met with new waves of liquidity — always producing the same pattern: accelerating money growth, rising debt, and erosion of real purchasing power.

In this context, investors have re-evaluated the role of money and sought refuge in assets that cannot be “printed” — mainly precious metals and cryptocurrencies. The debasement trade is not so much a speculative bet as a rational response to an environment where fiscal and monetary policies converge toward one outcome: the steady loss of purchasing power in fiat currencies.

Too Much Money and Too Much Debt

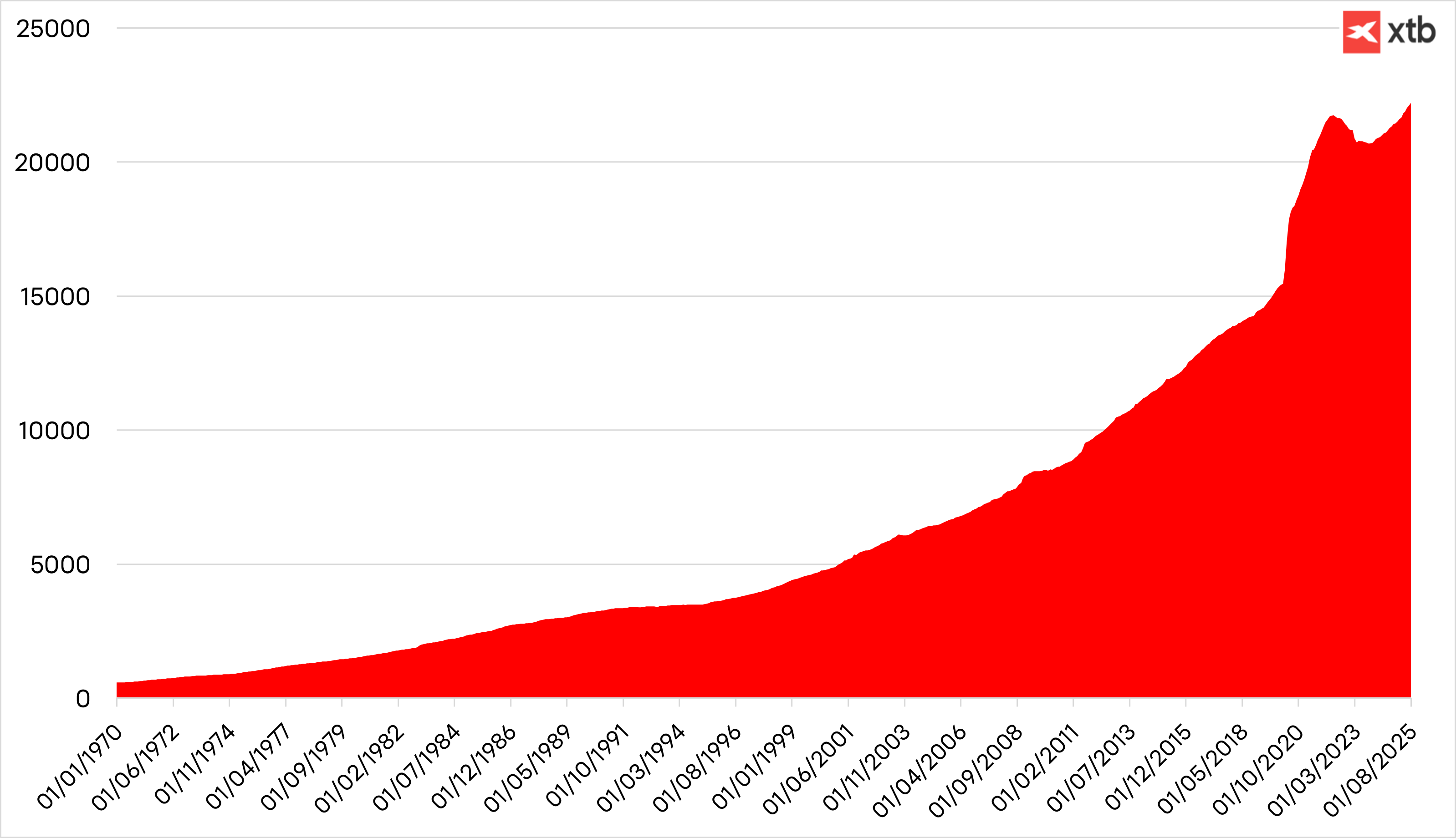

The global monetary expansion of recent years has been the largest in modern history. Following the 2020 pandemic, the U.S. M2 money supply grew by over 40% in just two years, while total global debt now exceeds $330 trillion — more than three times the world’s GDP, according to Reuters.

Money supply measured through M2. Source: XTB.

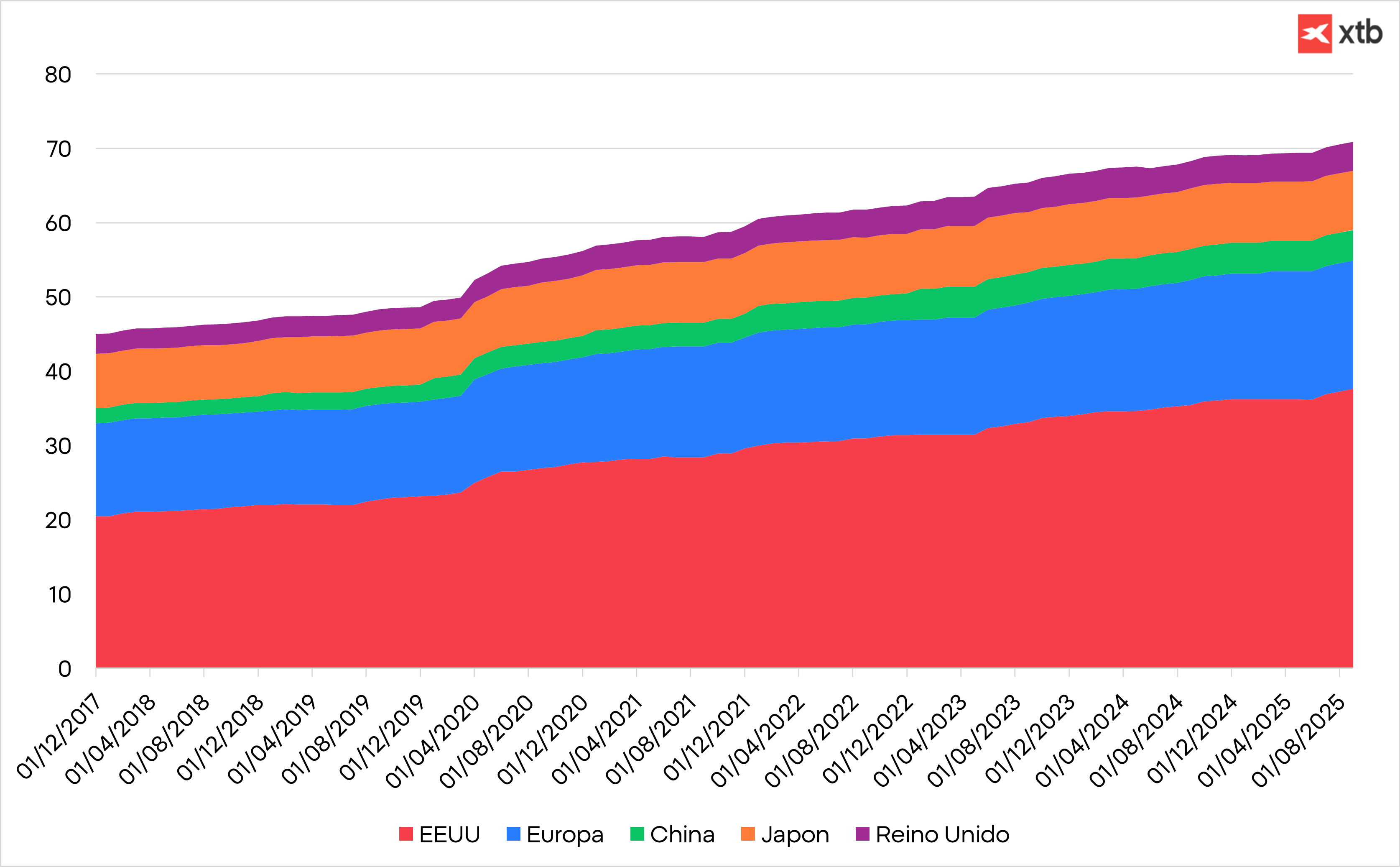

Debt growth in trillions of dollars across major economies. Source: XTB

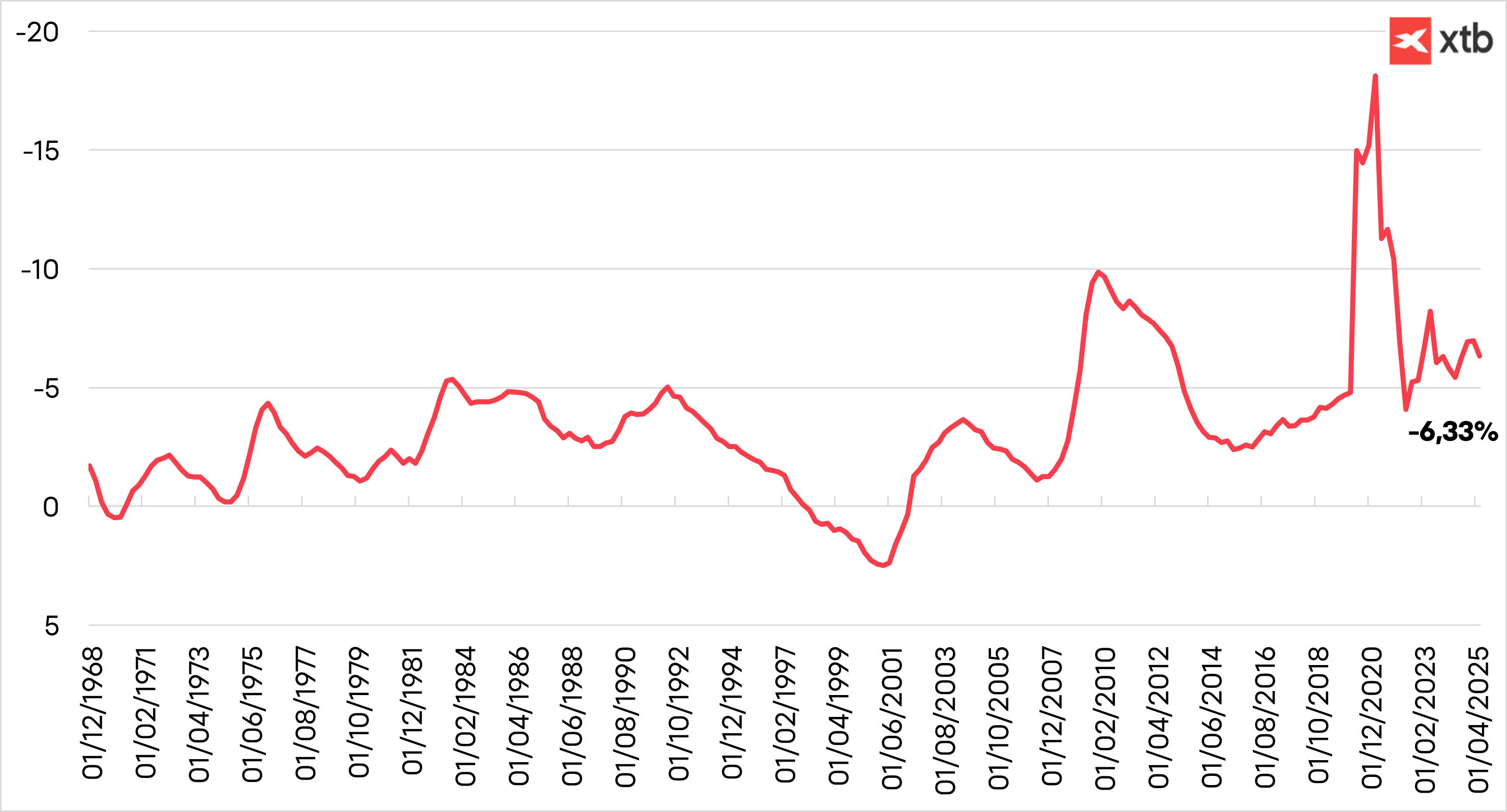

Structural fiscal deficits and debt-financed public spending have turned central banks into permanent buyers of government bonds. This vicious circle — deficit, issuance, and monetization — keeps real rates negative and makes holding cash or traditional fixed income increasingly unattractive.

U.S. fiscal deficit as a percentage of GDP. Source: XTB

The Recent Wave of Currency Devaluation

Adding political instability and fiscal irresponsibility to this backdrop creates the perfect storm for investors to turn toward alternative assets.

- Japan faces insolvency concerns, with bondholders suffering heavy losses.

- The United Kingdom is on the brink of a debt crisis.

- France is in turmoil — two governments have fallen in just four weeks.

- Germany, after years of fiscal discipline, is now expanding its debt by €500 billion — and that’s just the beginning.

- The United States is increasing its debt by 7% annually while bonds yield around 4%, ensuring a real loss each year, and the independence of public institutions like the Federal Reserve is under political pressure.

Gold as a Safe Haven

In this environment of abundant liquidity, instability, and lack of alternatives, assets with limited or decentralized supply are gaining value — and likely will continue to do so. For centuries, gold has been the preferred safe haven in times of political and economic uncertainty. Its tangible value, portability, and global liquidity offer a sense of security when everything else is in crisis.

Gold has a track record of rising during market stress. It surpassed $1,000 per ounce after the global financial crisis, $2,000 during the COVID-19 pandemic, and briefly approached $3,000 during periods of trade tension under the Trump administration. The surge even pushed gold ahead of the euro as the world’s second-most-held reserve asset earlier this year.

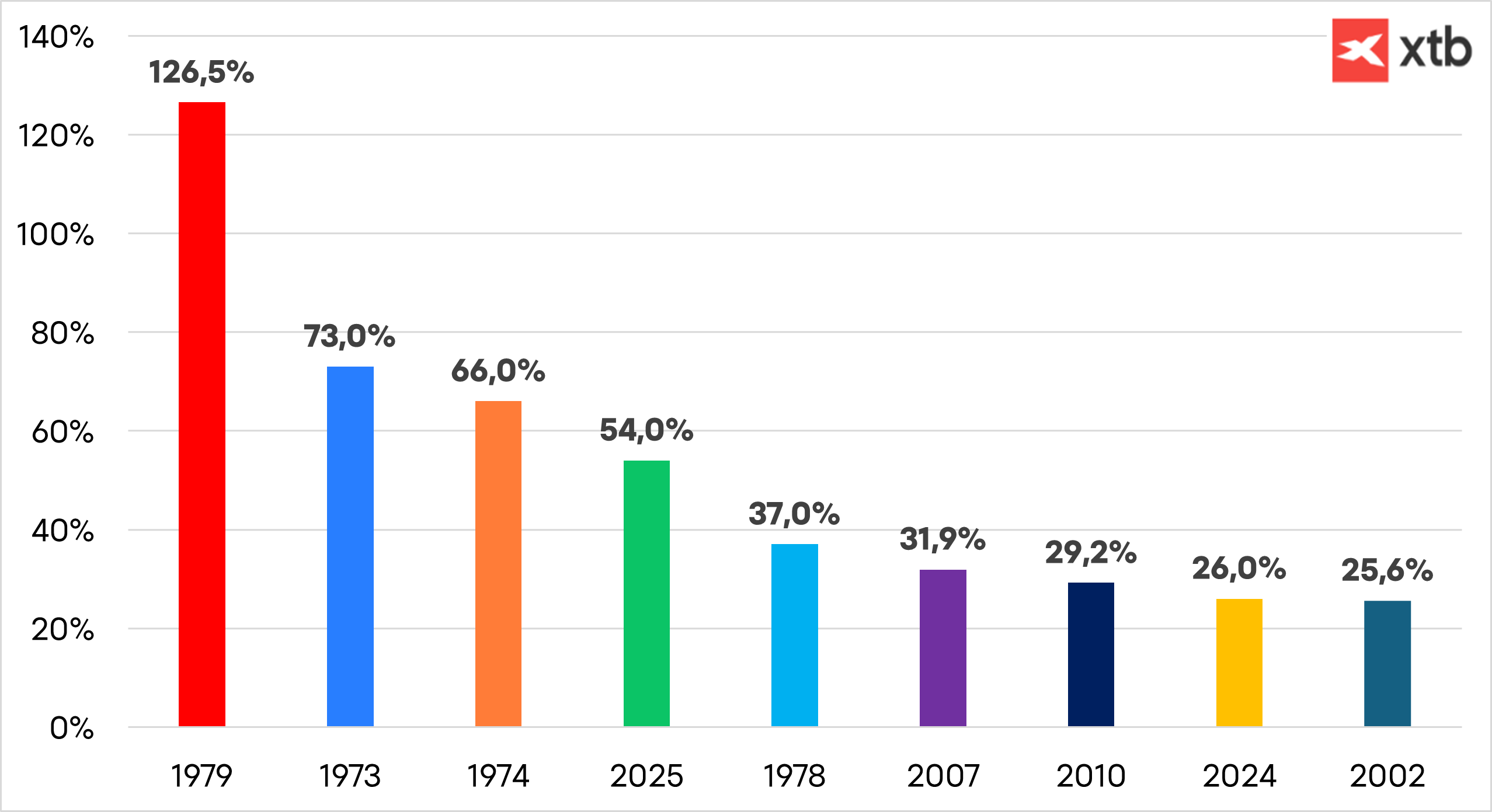

Gold performance in its best years. Source: XTB

Central banks have been net buyers of gold for the past 15 years, but their pace of accumulation doubled after Russia’s invasion of Ukraine. The freezing of Russian central bank reserves by Western nations exposed the vulnerability of foreign currency holdings to sanctions. In 2024, central banks purchased more than 1,000 tons of gold for the third consecutive year, according to the World Gold Council, and now hold about one-fifth of all the gold ever mined.

Investors, too, have flocked to gold amid renewed trade tensions, record government debt, and growing concerns over the Federal Reserve’s independence. Exchange-traded funds (ETFs) backed by gold reached their highest holdings in over three years as of September. Gold also acts as an inflation hedge, and at a time when the Fed seems likely to ease its inflation fight prematurely — pressured by immigration policies, tariffs, and a weakening dollar — it gains renewed importance. Combined with the rising risk of sovereign defaults, these forces could continue to drive gold prices higher.

Can It Keep Rising?

To answer that question, we must consider the factors supporting gold’s upward trend — and whether any viable alternatives exist. So far, few do.

Government bonds have lost appeal among investors who distrust fiscal management and prefer not to lock into assets that erode purchasing power. As money leaves bonds, some of it naturally flows into gold.

Equities continue to hit record highs, but growing fears over lofty valuations and market concentration push investors to look sideways — toward gold — as a safer store of value.

Thus, the question may not be if gold will reach $5,000 per ounce, but when. History shows that whenever money is debased, capital seeks refuge in what cannot be printed.

Fed's Williams stands for further rate cuts 🗽EURUSD drops near 1.16

Economic calendar: ECB minutes, Fed's Powell speech and US wholesale sales in focus

BREAKING: Weaker than expected import & export data from Germany

Morning wrap (09.10.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.