Yesterday's FED decision brought optimism to today's trading session in Europe. Major indices, including DAX and Euro Stoxx 50, are up by slightly over 1%. Technology and clothing companies are driving the market upwards, benefiting from improved forecasts, solid results from previous days, and expectations of improved consumer sentiment due to lower interest rates in the USA. Contracts DE40, FRA40, and AUT20 are up by over 1%.

An additional stabilizing factor is the agreement between the Italian banking lobby and the government to freeze deferred tax assets until 2026, which was positively received as a signal of regulatory predictability. At the same time, some investors remain cautious, as defensive positions are forming in the banking sector on the options market, suggesting that distrust of future fiscal burdens still persists. Contracts on Italian indices are up by over 0.4%.

Macroeconomic Data.

The Fed meeting concluded with a 25 basis point rate cut, which was in line with market expectations. The decision signals that the FED values the strength of the labor market and market stability, but also indicated that the U.S. economy is still strong and does not yet require further cuts to maintain growth.

In Europe, the Central Bank of Norway also decided on a 25 basis point cut, which was positively received by the market. The Norwegian krone is strengthening in light of the "hawkish cut."

Today, the Bank of England also made a decision to maintain the current level of interest rates. The market seems to suggest that the Bank of England overestimates the strength of the British economy or does not believe in the declared path of the bank's interest rates. The pound, despite maintaining rates, is losing against most major currencies.

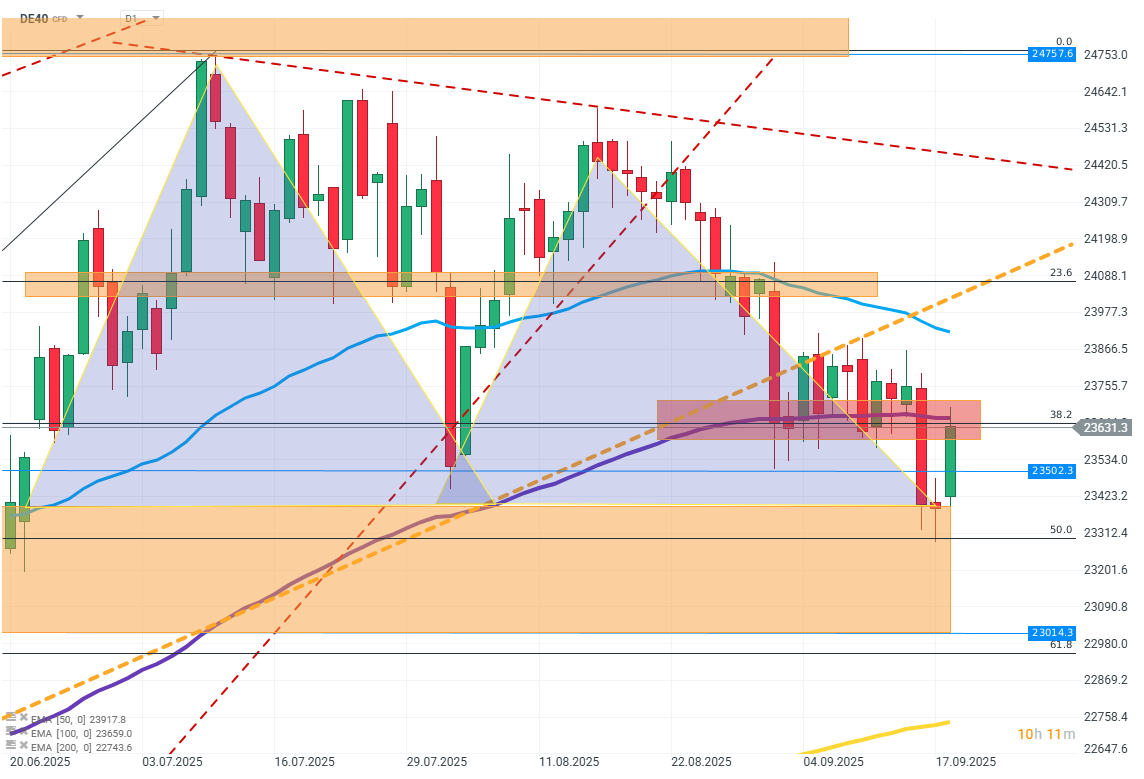

DE40 (D1)

Source: xStation

The chart shows an attempt to negate the head and shoulders pattern, where the market tried to rebound after breaking the neckline, but the current increases look like a classic retest from below. The FIBO setup and previous support levels, which have turned into resistance, strengthen the scenario of continued declines. A successful breakout and maintaining above the neckline could mean negating the pattern.

Company News:

Pets at Home Group (PETS.UK) - The valuation collapsed by several percent after the company's CEO left. The company also warned of risks to its revenues in light of deteriorating consumer sentiment.

The agreement between the Italian banking lobby and the government to freeze deferred tax assets until 2026. Unicredit (UCG.IT) is down about 1%.

Continental (CON.DE) - The tire manufacturer is losing over 20% of its valuation. This is due to the spin-off of "Aumovio," which will focus on the production of braking systems and automotive software.

Zalando (ZAL.DE) - The clothing company is up by almost 5% following the revelation of a large share purchase by one of the investors.

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.