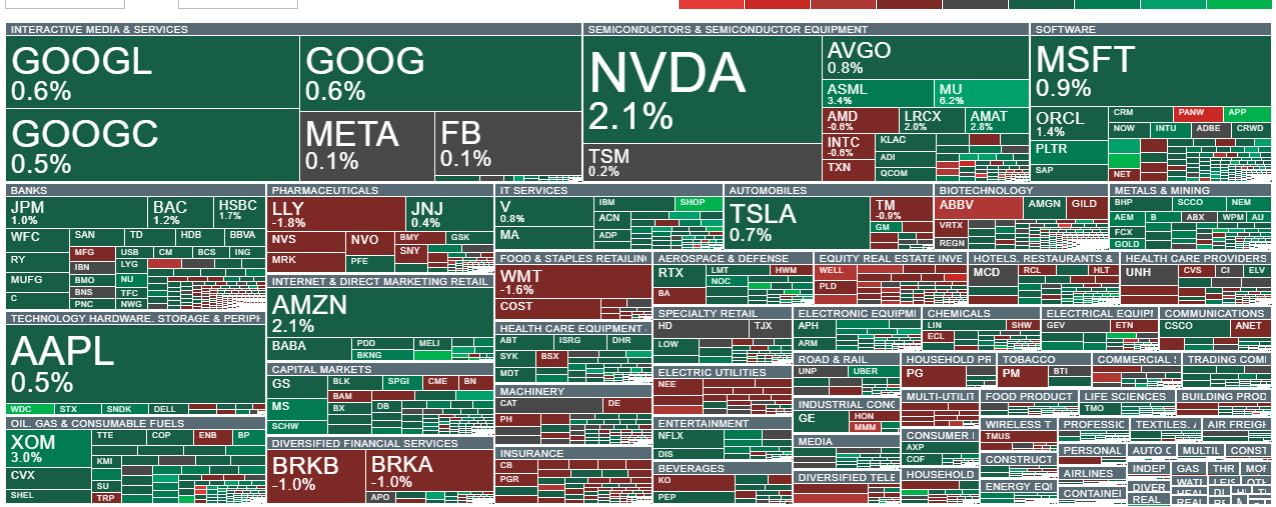

US100 is up more than 1%, with US indices regaining ground after Wednesday’s sell-off. US data — from building permits to industrial production and durable goods orders — beat expectations, supporting the US dollar.

According to Citadel Securities, retail investors have been buying software stocks at a record pace on Citadel’s platform (data tracked since 2017). As the firm put it: “Net notional on our platform has reached levels we have never observed before.”

Citadel added that the scale, persistence and breadth of the buying have materially exceeded prior peaks, highlighting retail as a key source of incremental demand in early 2026. Average daily dollar demand for US equities on the platform (Jan 2–Feb 13) was roughly 25% above the previous record set in 2021 and about twice the 2020–2025 average.

The momentum has also spilled into options. Retail participation in 2026 is already running at historically high levels. Average daily options volume year-to-date is nearly 50% above the 2020–2025 average and more than 15% above last year’s pace. Retail options investors have been net buyers in 41 of the past 42 weeks, pointing to sustained risk appetite rather than sporadic positioning.

Interestingly, despite a stronger USD index (USDIDX) today and EURUSD down nearly 0.5%, precious metals are rising. Gold is up almost 2.5%, attempting to break decisively above the psychological $5,000/oz level, while silver is jumping as much as 5%. This move may also have a meaningful retail-flow component.

US data

-

Industrial production (m/m): 0.7% (Exp: 0.4%; Prev: 0.4%; Rev: 0.2%)

-

Industrial production (y/y): 2.3% (Prev: 1.99%)

-

Manufacturing output (m/m): 0.6% (Exp: 0.4%; Prev: 0.2%)

-

Capacity utilization: 76.2% (Exp: 76.6%; Prev: 77.3%; Rev: 75.7%)

-

Durable goods orders (m/m): -1.4% (Exp: -1.8%; Prev: 5.4%)

-

Core durable goods (m/m): 0.9% (Exp: 0.3%; Prev: 0.4%)

-

Durable goods ex-defense (m/m): -2.5% (Prev: 6.6%)

-

Durable goods ex-transportation (m/m): 0.9% (Exp: 0.3%; Prev: 0.4%)

-

Building permits: 1.448m (Exp: 1.400m; Prev: 1.411m)

-

Housing starts: 1.404m (Exp: 1.310m; Prev: 1.272m)

Cocoa is sharply lower, down more than 6%. Year-to-date, prices are down over 45%. Ghana (the second-largest producer) cut its farmgate prices by nearly 30% last week. Ivory Coast (the largest producer) says it will keep farmgate prices unchanged through the end of the current main season (March 31), though reports suggest it is considering a cut.

Markets are also pricing a higher risk of military escalation in the Middle East after the US moved additional military equipment into the region. Oil is gaining more than 3.5% on these concerns.

(summary in progress)

Source: xStation5

Fed minutes released 🗽Key takeaways

Western Digital shares gains 8% reaching new all-time high 📈

Gold surges 2.5% nearing $5000 per ounce 📈

Strong Quarter for Analog Devices and Record Outlook

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.