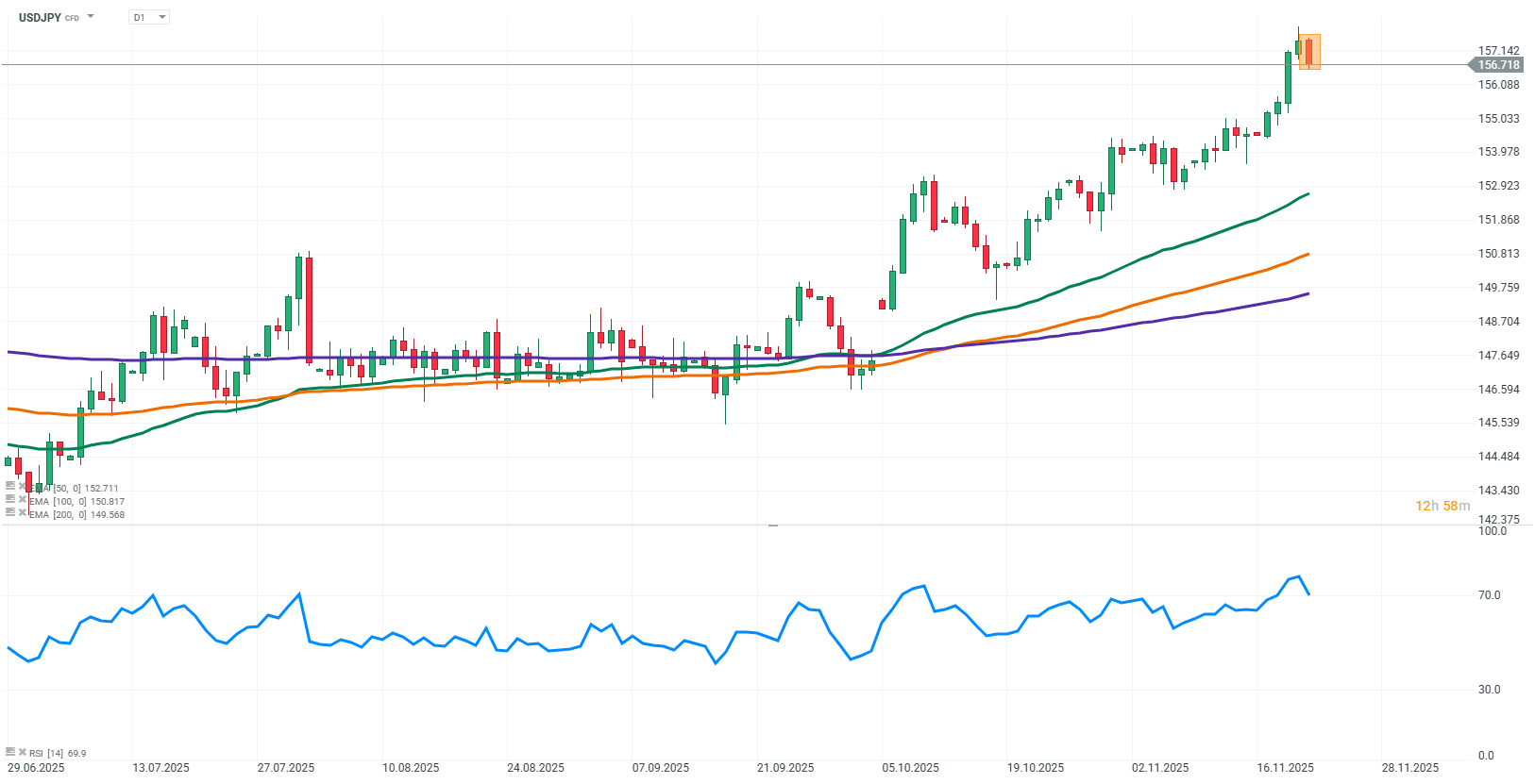

The USD/JPY exchange rate is currently around 156.7. Today's trading is influenced by a complex mix of fundamental factors, where a strong dollar competes with potential interventions from Japan. The difference in monetary policy between the US and Japan still favors the dollar, but the risk of actions by the BOJ and the Japanese government limits the pair's upside. The focus remains on US data, FOMC minutes, and Japan's recently approved fiscal package worth JPY 21.3 trillion, which could determine the next moves of the pair.

Source: xStation5

What’s driving USD/JPY today?

Monetary policy of the Fed and BOJ

The Fed maintains a hawkish stance, and the market interprets the FOMC minutes as a signal that US interest rates will remain relatively high. The Bank of Japan continues its ultra-loose policy, refraining from rapid normalization, which limits potential yen strength. These differences in monetary approaches create a structural advantage for the dollar.

Summary:

The Fed remains hawkish, BOJ keeps a loose policy. The interest rate advantage favors the dollar.

Risk of intervention and Japanese government policy

The Japanese government has repeatedly highlighted the need to stabilize the yen, but so far has limited itself to statements. A government representative emphasized that sudden moves in the FX market require attention and possible stabilization. The lack of concrete actions combined with the BOJ's ultra-loose stance creates tensions and keeps investors cautious about the yen.

Summary:

The government monitors the yen, BOJ remains passive. Markets interpret this as a sign of currency weakness.

Japan’s fiscal package

The recently approved fiscal package worth JPY 21.3 trillion has triggered mixed reactions in the market. Some of the funds are aimed at easing inflationary pressures, but the new bond issuance could increase the burden on the debt market, which, together with rising yields, supports the yen in the short term.

Summary:

The fiscal package raises debt market risk and temporarily supports the yen.

US macroeconomic data

Strong US labor market data, including NFP, wages, and the unemployment rate, strengthens the dollar. The market interprets these figures as confirmation that the Fed will maintain high rates. Japanese macro data currently have limited impact because the BOJ reacts slowly and does not change policy in the short term.

Summary:

US data drive USD/JPY, while Japanese data have little influence.

Interest rate differential

The wide gap between high US rates and low Japanese rates continues to work against the yen. Markets benefit from the dollar's advantage and still use the yen in funding strategies, maintaining the structure of the dollar's superiority.

Summary:

The large interest rate differential favors the dollar. The yen remains weak in funding.

BREAKING: UoM report suggests a decline in inflation expectations 📌

BREAKING: US PMI beats expectations slightly; EURUSD with no reaction 📌

UK Budget preview

BREAKING: Mixed results for the UK PMI index. GBPUSD muted

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.