- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

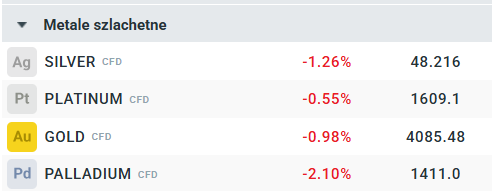

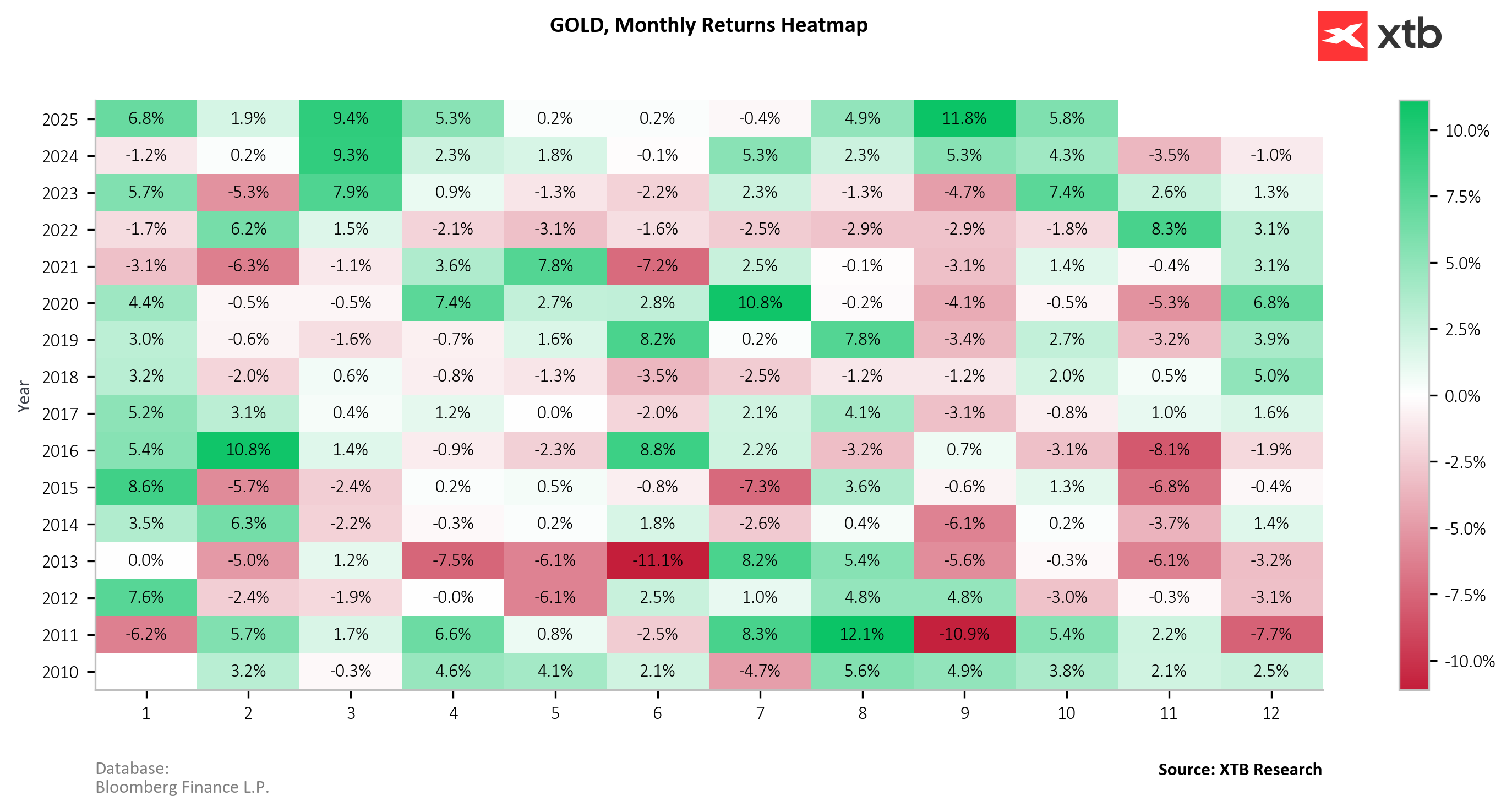

Precious metals extend their deepest correction in months. As of publication time today, gold is down another 1.00% to $4,085, silver falls 1.26% to $48.20, platinum declines 0.55% to $1,609, and palladium drops the most — 2.10% to $1,411. During the current correction, gold has lost a total of 6.50%, while silver is down 11.60%. Nevertheless, recent gains were so significant that on a monthly basis gold remains up 5.8%. Before the correction began, gold recorded two consecutive months of double-digit gains, a rare occurrence over the past 15 years of data.

The closest historical parallel to the current situation was July–August 2011, when gold rose 8.3% and then 12.1% month-over-month. In the following month — September — gold dropped 10.9%. The current setup is even more extreme, as gold has not only rallied sharply in the past two months but has also posted strong year-to-date gains. However, the macroeconomic and geopolitical environment is now substantially different.

Still, at levels above $4,300 per ounce, we observed a surge in retail buying, which may act as a contrarian signal. While long-term fundamentals remain supportive, seasonality and technical analysis point to a possible local top and a flat year-end performance. Meanwhile, ETF funds continue to accumulate, but on the Shanghai exchange, there has been a sharp reduction in long positions and a decline in silver inventories, which may suggest profit-taking.

Daily Summary: Tech sector fears send markets lower

End of Zillow? Google enters another market.

NFP preview

US OPEN: Mild optimism at the start of the week

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.