While a market consensus had coalesced around the possibility of an RBA hike, several major investment banks remained outliers, betting on a hold. Consequently, the Reserve Bank of Australia has delivered a modest surprise to the upside—not merely through the move itself, but via its forward-looking stance. The RBA distinguishes itself as the first major central bank to pivot toward tightening in 2026, defying a global monetary landscape where many peers are still unwinding the post-2022 inflationary spike.

The RBA’s Gambit

The Reserve Bank of Australia raised its cash rate by 25 basis points, lifting the benchmark to 3.85% from 3.6%. This marks the first hike since February 2024. Only months ago, the prevailing narrative suggested further easing; however, a sharp hawkish pivot in late 2025, coupled with persistent price pressures, saw the probability of today’s move surge to 80%. The Board cited three primary catalysts:

-

Stubborn Inflation: Price growth accelerated faster than anticipated in H2 2025. Core inflation (trimmed mean) currently sits at 3.4%, remaining uncomfortably above the 2-3% target band.

-

Resilient Consumption: Household spending has gained momentum, a trend mirrored by robust business activity. Economic growth remains solid with signs of further acceleration.

-

Tight Labour Market: The unemployment rate has hit a seven-month low of 4.1%, while labour supply remains constrained.

While the RBA noted that some inflationary components may be transitory, it warned that the primary risk stems from supply-side pressures and a rapid recovery in private demand.

Macro Forecasts: A Significant Inflation Revision

The central bank’s updated economic projections reveal a more aggressive outlook:

-

GDP Growth: Forecast to remain near-trend this year before dipping more than a percentage point below trend in H2 2026.

-

Inflation (Trimmed Mean): Expected to hover around 0.9% q/q for the next two quarters (up from the typical 0.7%), ending 2026 at 3.2% y/y—still above the upper limit of the target range.

-

Unemployment: Projected to rise gradually as the tightening cycle takes hold.

Governor Michele Bullock noted that inflation is likely to remain above target for a "protracted period." While she remained non-committal on whether this marks the start of a sustained cycle or a one-off adjustment, institutional analysts are more hawkish. CBA anticipates another hike as early as May, while Westpac suggests the "bar for further tightening remains very low."

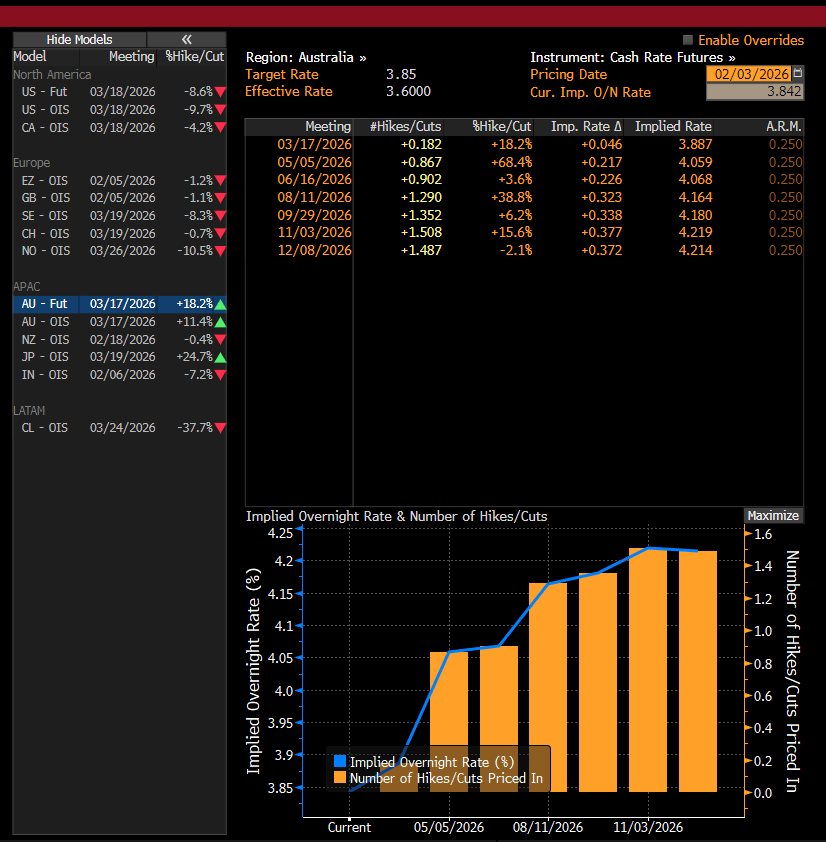

Market pricing currently implies a full hike may not arrive until August, though the probability for a May move has already climbed to 87%. Source: Bloomberg Finance LP

Technical Analysis

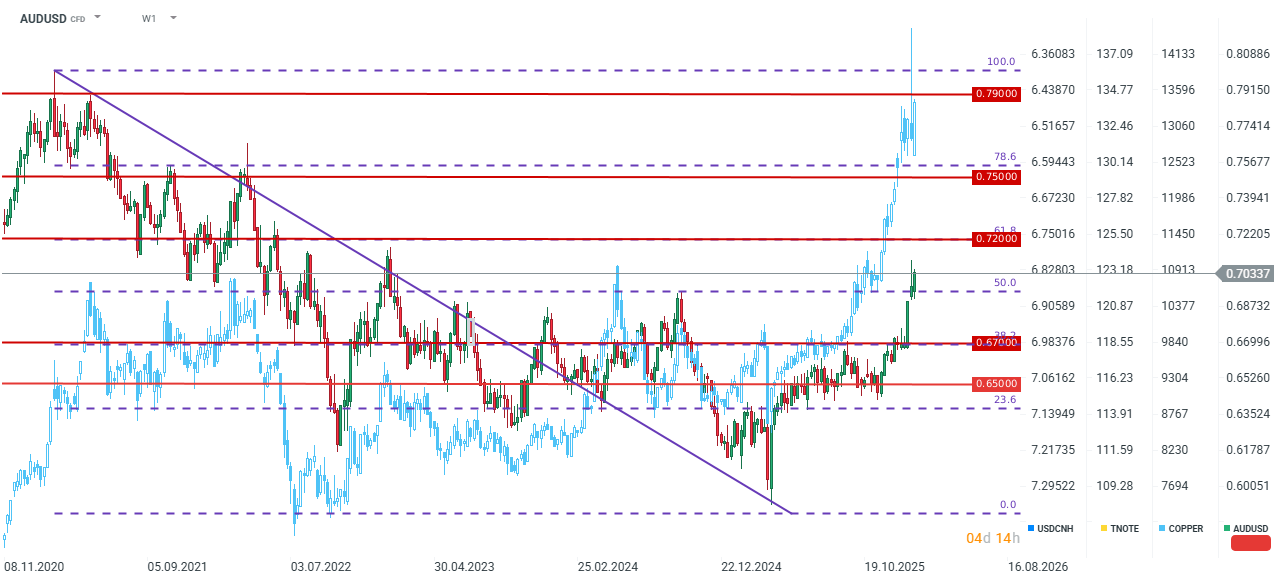

The AUD/USD pair has enjoyed a strong multi-week rally, currently testing the 0.70 handle. While the recent sell-off in commodities threatened a deeper correction, metals are rebounding: Copper is back near $13,000, Silver is approaching $90, and Gold has reclaimed $4,900. A daily close above this level for Gold could signal a "bullish engulfing" pattern, suggesting the end of the recent correction.

Trading at its highest level since February 2023, the "Aussie" appears well-positioned. A widening yield spread between Australia and the US, combined with the commodity super-cycle, could propel the pair toward the 61.8% Fibonacci retracement at 0.7200, with a medium-term target in the 0.74–0.75 range.

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Jane Street: Legendary market maker in the court

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.