- Speculation about the timing of rate cuts reach fever pitch

- Members’ decisions outlined for first time

- Vote split, could there be a swing to the doves?

- Could the BOE cut in December?

- A CPI downgrade could indicate a rate cut is close

- The market view

- Speculation about the timing of rate cuts reach fever pitch

- Members’ decisions outlined for first time

- Vote split, could there be a swing to the doves?

- Could the BOE cut in December?

- A CPI downgrade could indicate a rate cut is close

- The market view

This is a busy week for the UK. There has been a large amount of corporate news, then the Chancellor Rachel Reeves paved the way for tax rises at this month’s budget. However, the main event this week is the Bank of England meeting.

Interest rates are expected to remain on hold, and there is only a 24% chance of a rate cut, however there is a whisper, that is getting louder, that the BOE should surprise markets and cut rates today due to the deteriorating economic backdrop, and weaker than expected inflation for September that did not reach the BOE’s expected peak of 4%.

Speculation about the timing of rate cuts reach fever pitch

We expect the BOE to keep rates on hold on Thursday, since the most prudent course of action is to wait until after the Budget. This is expected to see unprecedented tax rises, which could slow growth and may boost inflation if fuel duty relief is scrapped or if VAT is increased.

The effect of any tax increases would be known by the next Monetary Policy Committee meeting in February, so that might be the most prudent time to cut rates, in our opinion. The market seems to agree; there is a 56% chance of a February rate cut priced in by the swaps market ahead of this BOE meeting.

Could the BOE cut in December?

However, the question for investors is whether anything in this Monetary Policy Report meeting will increase the odds of a December rate cut, which currently stand at 39%. If this meeting increases the chance of a cut next month, then it could have big ramifications for financial markets.

Members’ decisions outlined for first time

There are two main points to watch out for at this meeting. Firstly, this will be the first time the Monetary Policy Report will contain detailed sections outlining each member’s vote decision, which is designed to increase transparency at the MPC, and combined with the vote split today, it could help investors to determine the timing of the next rate cut.

Vote split, could there be a swing to the doves?

There could be three members who vote for a rate cut to 3.75% later on Thursday, including David Ramsden. He voted for a 50bp cut in June over fears about employment levels. If Ramsden does dissent and vote for a cut then this could be significant for future policy decisions at the BOE. In the past he has pivoted to the committee to a more dovish stance, calling for rate cuts from May 2024.

Other members have also sounded more dovish in recent weeks. MPC member Sarah Breedon has voted in favour of all 5 rate cuts since last August and she is not expected to dissent on Thursday. However, she said in a speech on Wednesday that she is confident price pressures will moderate in the coming months, saying that US tariffs have not materially impacted inflation, which is something European corporates have been repeating during their earnings reports in recent weeks.

Overall, recent rhetoric from MPC members suggests that the dovish impulse at Thursday’s meeting could be strong, even if Governor Andrew Bailey has warned about above-target inflation in recent speeches.

A CPI downgrade could indicate a rate cut is close

The BOE will also update their latest forecasts at this meeting. The September inflation report shifted the dial for the BOE’s next set of CPI forecasts after it came in weaker than expected at 3.8%, below the BOE’s expected 4% peak. This could lead to a meaningful reduction in the BOE’s CPI forecasts later today, with the potential for the CPI rate hitting the 2% target before 2027.

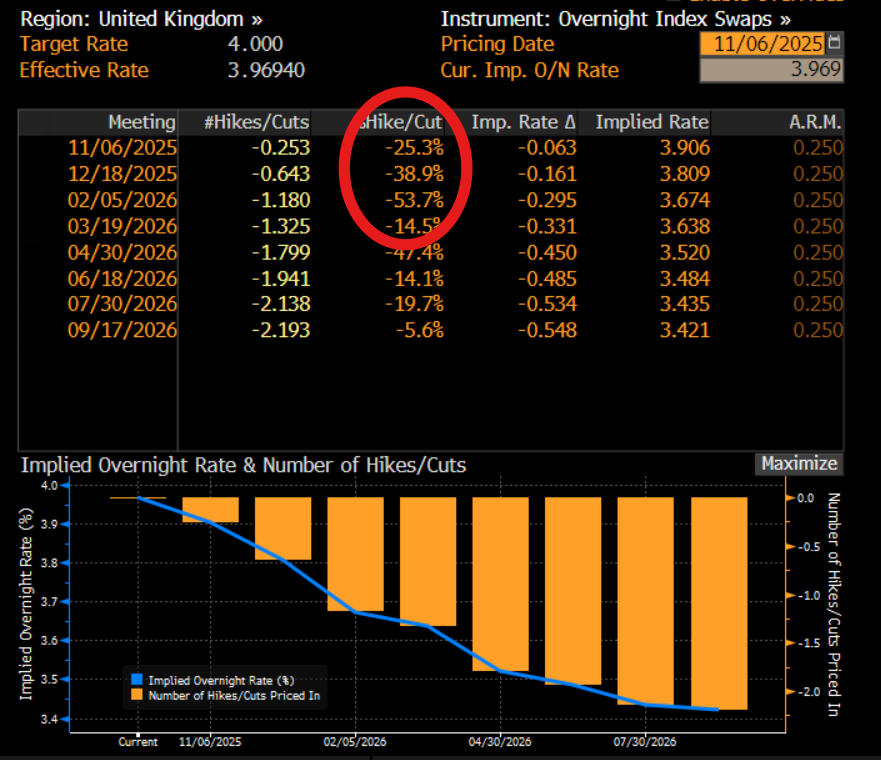

A larger number of MPC members voting for a rate cut on Thursday, combined with a reduction in the BOE’s CPI forecast could trigger a surge in expectations for a December rate cut, which currently stand at 39%, as you can see in the chart below.

Chart 1: Market-based Interest rate expectations until September 2026

Source: XTB and Bloomberg

The market view

The backdrop to this meeting is a strong rally in UK bonds and a weakening of the pound. In the past month, UK bond yields have seen a large scale move lower. The 10-year yield is lower by 27 basis points, the only other country with a larger drop in yields is Argentina.

The 2-year Gilt yield is also lower by 19bps, compared to a 2bp increase in US Treasuries and a 3.5bp decline in French yields. This has corresponded with a 10bp reduction in year-end interest rate expectations in recent weeks, and a sharp decline in sterling. The pound is the second weakest currency in the G10 FX space in the past month.

GBP/USD fell below the 200-day moving average at the end of October. Nothing good happens below the 200-day moving average, so the saying goes, which could be why the pound has been falling since then. Chancellor Rachel Reeves tried to give sterling her best left hook on Tuesday when she delivered an ill-conceived pre-budget address, which sent GBP/USD back towards $1.30. Ahead of today’s meeting, GBP/USD is stabilizing ahead of $1.3010 support, and EUR/GBP remains at its highest level since April 2023. The path of least resistance is another leg lower for sterling, however, if today’s BOE meeting is less dovish than expected, or if a December rate cut looks unlikely, the we could see a broad-based mini pound recovery.

Chart 2: GBP/USD, below the 200-day moving average

Source: XTB and Bloomberg

Qualcomm’s Fiscal Q4 2025 Results: Solid Beat Amid Tax Headwinds and Market Caution

BREAKING: Bank of England holds rates unchanged

Deutsche Boerse down 5% amid European Commission antitrust investigation🚩

💷 GBPUSD Gains Ahead of BoE Decision

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.