- Signs of stabilization in risky assets, as Bitcoin sell off pauses

- BOE confirms that capital requirements for banks will be lowered

- Dollar gives back gains as risk stabilizes

- UK pension funds turn away from the US

- Why the US’s stock market advantage may not persist in 2026

- Why Japan’s monetary policy matters for global finance

- UK data deluge to set the tone for markets

- Rocky start to December trading, but foundations for a rally remain

- Signs of stabilization in risky assets, as Bitcoin sell off pauses

- BOE confirms that capital requirements for banks will be lowered

- Dollar gives back gains as risk stabilizes

- UK pension funds turn away from the US

- Why the US’s stock market advantage may not persist in 2026

- Why Japan’s monetary policy matters for global finance

- UK data deluge to set the tone for markets

- Rocky start to December trading, but foundations for a rally remain

The focus this morning is likely to be on the stabilization for risk assets after Monday’s sell off. The start of December did not offer too much hope for the bulls, and if the first day of December trading is anything to go by, we could be following in November’s footsteps and sentiment may remain shaky. So far, stock market futures suggest that stock indices are stabilizing on Tuesday.

The Bank of England is also in focus on Tuesday, after it confirmed that it would lower banks capital requirements for the first time since the financial crisis from 14% to 13%. It also said that UK capital requirements were high compared to the US and the EU and that it will launch a review of the leverage ratio that applies to how much capital banks need to hold compared to their total assets. Sterling is extending gains above $1.32 on this news; however, gains may be limited as reviews can take time.

The UK’s banking sector is worth watching today, as this is good news for UK lenders. The fact that all 7 lenders passed the BOE’s latest stress tests and the BOE’s assessment that the UK’s financial sector is in good health and could withstand an economic shock, is positive for UK assets overall. A healthy financial sector is a cornerstone for the economy, and this could be reflected in stronger stock prices and a pickup in the pound, after it was the weakest currency in the G10 FX space on Monday. The pound has picked up slightly on Tuesday as the dollar gives back gains and as the yen weakens.

Bitcoin has been a reliable lead indicator for overall risk sentiment, and yesterday, its 5% demise was cited as one of the reasons why stocks and bonds fell, and bond yields soared across the world. There were no obvious drivers for Monday’s broad risk sell off apart from the decline in bitcoin and rising bets that the Bank of Japan will raise interest rates later this month.

There was a relatively mild sell-off in stocks at the start of the new month, and futures suggest that things could be calmer today. The Vix index rose yesterday, but it still remains below the average of the last 12 months. Bond yields could stabilize as Japanese yields have fallen slightly on Tuesday morning, and Bitcoin is higher by $600 at the time of writing. However, it may be hard for markets to sustain an upward trend in the current environment and US and European futures are pointing to a mixed start to trading later today.

There are residual concerns about an AI bubble, the FT is reporting that British pension funds have been reducing their equity allocations to the US and moving into other regions as fears grow about an AI bubble and concentration risk. The trend is to increase allocations to UK and Asian markets, and this could be a big theme in 2026.

When the institutional money makes a move, it is worth noting, since they tend to be juggernauts that take a while to change direction. If UK pension funds are turning away from the US and looking globally for returns, this could signal that the valuation gap between the US and elsewhere might start to narrow. This is a theme that has been around for a while, but it might start bearing fruit.

The Bank of England is also getting in on the act, and in its latest Financial Stability Report, released this morning, it once again flagged the risks from high valuations, specifically from AI stocks and it said that ‘global risks remain elevated.’ However, trading financial markets are all about managing risk, and we do not think that these comments will dramatically alter the outlook for stocks in the near term.

Understanding the impact that Japan’s monetary policy can have on markets is worthwhile in the current environment. While there is a near 80% chance of a 17bp rate hike from the BOJ later this month, and only 2 rate hikes priced in over the next year, global markets reacted because of the potential threat this could cause to liquidity. Japanese investors have long held capital abroad in a search for yield. However, an unwind of this carry trade threatens to remove some of this liquidity if it causes Japanese investors to repatriate their funds back home. However, this knee jerk reaction may have gone too far and Japanese investors are likely to continue to be a major source of liquidity and funds around the world. Even if they do repatriate funds, it is likely to be small as an interest rate of 0.67% is unlikely to be too much of a draw.

Ahead today, we get durable goods orders from the US and a drip feed of other delayed economic data including PPI. This could help determine US economic strength, however, the main event is the delayed PCE that will be released at the end of this week. It is worth watching out for any more fallout from the UK Budget, after the OBR chief resigned on Monday. This has still not silenced calls for the Chancellor to go, after the PM’s botched attempt to shore up her Budget on Monday.

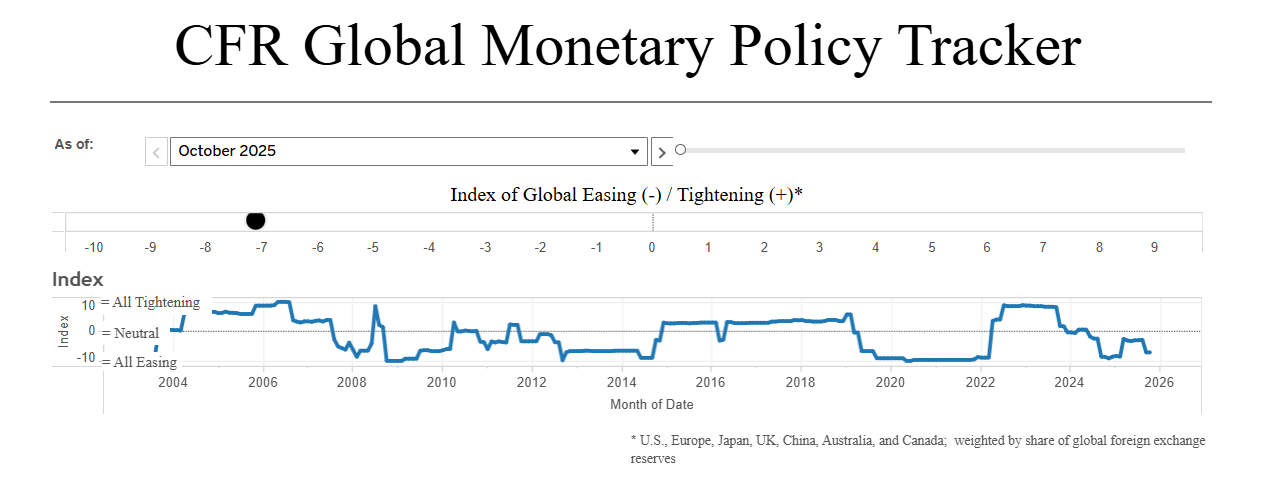

It's been a rocky start to December trading, but we do not think that hopes for an end of year rally are over yet. The biggest fear would be a ‘hawkish cut’ from the Fed, at the same time as the BOJ is raising interest rates. This week’s economic data dump from the US is crucial for market sentiment, as it will give us an idea of whether the world’s largest economy remains solid enough to sustain a stock market rally. However, unless the Fed takes a massive hawkish pivot, the latest CFR global Monetary Policy Tracker is still in easing territory, which is positive for risky assets like stocks as we move into year end.

Chart 1: CFR Monetary Policy Tracker

Source: CFR

DE40: DAX gains on Tuesday 📈 Bayer surges 10% on unexpected US administration support

BREAKING: EURUSD with limited reaction to near-consensus CPI data from the eurozone 🔎

Chart of the day - Bitcoin (02.12.2025)

Morning wrap (02.12.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.