- Markets begin the new trading week with significant sell-offs.

- Precious metals are once again attracting the most attention from investors. At present, SILVER and GOLD are down 11.3% and 7.5%, respectively.

- Poor sentiment is also evident in NATGAS and OIL.WTI, which are down 17.1% and 6.37% respectively.

- OPEC+ kept March production unchanged and did not provide any guidance for the period after the first quarter.

- The situation on all of the above instruments was also not helped by the lack of major military intervention in Iran, which part of the market had expected over the weekend.

- Listed companies and cryptocurrencies are following the sharp declines in raw materials.

- The drop in Bitcoin to around $75,200 has pushed Strategy's average purchase cost of cryptocurrencies above the current price. For this reason, it is possible that we will see significant price declines for companies in the crypto sector and Strategy itself at the start of the session. At the moment, before the market opens, the company's shares are down 9%.

- Stock exchanges in the Asia-Pacific region started the session in the red. Japan's Nikkei 225 is down 0.48%. The Hang Seng in Hong Kong lost as much as 2.4%. The Shanghai Composite fell by 1.3%. The S&P/ASX 200 in Australia fell by 1%. Investors are selling off shares, and the market's attention is focused on the Reserve Bank of Australia's upcoming decision on interest rates, which is expected on Tuesday morning (an increase in rates is expected).

- In India, the tax increase on derivative transactions announced in the budget caused a sharp decline in share prices.

- South Korea saw sharp fluctuations, and authorities suspended trading on the KOSPI stock exchange for five minutes after futures fell 5%.

- Stock markets in Asia and the Pacific experienced a general decline due to negative events such as the partial shutdown of the US federal government, an unexpected drop in Chinese PMI indices, and the aftermath of a sharp crash in precious metal prices. An additional blow was dealt by the weakness of the technology sector following reports that Nvidia had put its plans for a £100 billion investment in OpenAI on hold.

- In Australia, January's manufacturing PMI rose to a five-month high, and the Melbourne Institute's inflation index increased by 0.2% m/m (previously 1.0%), with an annual rate of 3.6% y/y, which supports inflation concerns and market speculation about a possible rate hike by the RBA on 3 February.

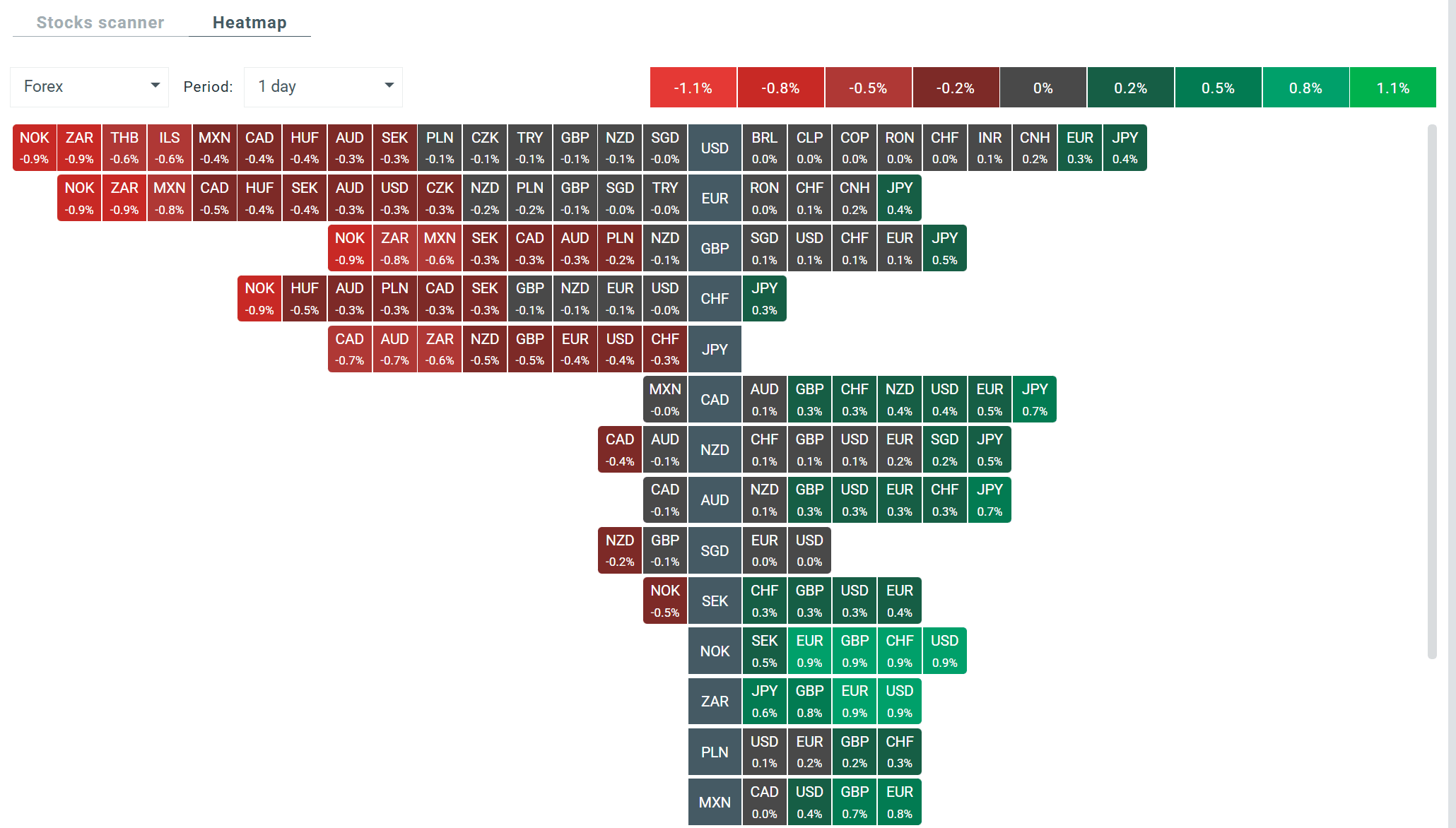

- On the broad FX market, the Japanese yen and the US dollar are currently performing best. Significant declines are visible in the Australian dollar and the Canadian dollar (impact of declines in precious metals).

- Interestingly, the yen initially weakened after Prime Minister Takaichi's weekend comments on the benefits of a weak currency for exporters.

Source: xStation

⚠️Gold pares losses

The Week Ahead

Economic calendar: Manufacturing PMI data in focus, Palantir earnings in the background💡

Daily summary: A historic day for precious metals; SILVER loses 30%; USD gains 💡

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.