Choosing the right CFD broker is a critical first step for any trader looking to access the global financial markets. With hundreds of brokers offering similar services, it can be challenging to identify which one truly aligns with your trading goals, experience level, and risk tolerance.

Whether you're a beginner seeking user-friendly tools or an experienced trader demanding tight spreads and advanced platforms, knowing what to look for is essential.

Choosing the right CFD broker is a critical first step for any trader looking to access the global financial markets. With hundreds of brokers offering similar services, it can be challenging to identify which one truly aligns with your trading goals, experience level, and risk tolerance.

Whether you're a beginner seeking user-friendly tools or an experienced trader demanding tight spreads and advanced platforms, knowing what to look for is essential.

1. Regulation and Safety

Why it matters: Regulation ensures that the broker follows financial laws and protects clients uninvested funds.

What to look for:

- Regulatory bodies like the FCA (UK)

- Segregated client accounts.

- Negative balance protection.

XTB is regulated by the FCA, FSC, KNF, CySEC, CNMV, DFSA, FSAS, SCA, PALN offering a high level of regulation for retail clients.

2. Trading Fees and Spreads

Why it matters: Costs affect your bottom line, especially for frequent traders.

What to look for:

- Low spreads and commissions.

- Transparent fee structure (no hidden withdrawal or inactivity fees).

At XTB, transparency is our priority. You can view all account types and associated fees clearly outlined here.

3. Range of Instruments

Why it matters: A good broker should give you access to markets you’re interested in.

What to look for:

- CFDs on stocks, forex, indices, commodities, ETFs

- Depth of market and regional variety.

XTB offers access to over 2,500 CFD instruments, giving you a diverse range of markets to trade, including forex, indices, commodities, stocks, and ETFs.

4. Trading Platform

Why it matters: Your platform should be stable, fast, and easy to use.

What to look for:

- Platforms like MetaTrader 4/5, cTrader, or proprietary platforms.

- Mobile and desktop access.

- Advanced charting and risk management tools.

At XTB we have developed our own trading platform, xStation, to better meet clients' needs.

5. Leverage and Margin Requirements

Why it matters: Leverage amplifies both potential gains and losses.

What to look for:

- Regulated leverage limits (e.g., 1:30 for retail clients under FCA rules).

- The ability to adjust leverage manually.

- Margin call policies and stop-out levels.

In UK/Europe under current regulations, leverage is restricted to a maximum of 30:1 for 'retail classified' clients. Detailed information on leverage for each instrument, for UK residents, can be found here. For EU residents, can be found here.

Remember, leveraged trading with CFDs is high risk and is not suitable for all investors. Please consider the risks involved.

6. Customer Support

Why it matters: You need reliable support when technical or account issues arise.

What to look for:

- 24/5 or 24/7 customer service.

- Live chat, email, and phone support.

- Multilingual service if needed.

XTB offers 24/5 multilingual support and dedicated account managers for active traders.

7. Educational Resources

Why it matters: Quality education helps traders improve and avoid costly mistakes.

What to look for:

- Webinars, tutorials, trading guides, and demo accounts.

- Economic calendars and market analysis tools.

At XTB, we understand that confidence is key to making informed financial decisions. That’s why we offer over 60 hours of educational resources, including articles, YouTube videos, eBooks, and detailed market analysis to help you develop a deeper understanding of investing. We believe that the more you know, the better equipped you are to make the right choices for your financial future. Whether you're just starting out or looking to refine your strategy, we provide the tools to help your money work for you in many ways.

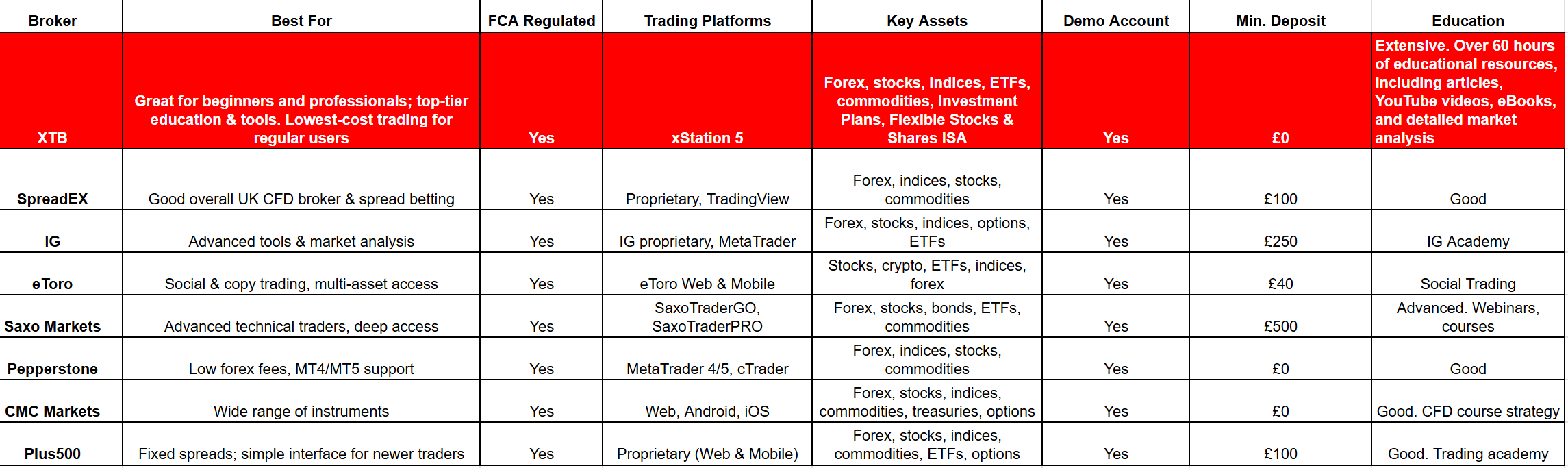

8. UK Online Broker Comparison

Source: XTB Research

Tip: Use a demo account first to test the platform and conditions. You can open a demo account with XTB here.

Conclusion

Choosing the best CFD broker requires research, self-awareness of your trading needs, and a focus on regulation and transparency. Whether you’re a beginner or an experienced trader, finding the right broker can make a huge difference in your performance and safety.

Coffee Trading - Investing in Coffee CFDs

Best Trading Apps in the UK 2026

ETF Trading - What are they and how to invest in Exchange Traded Funds?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.