The beginning of the week on Wall Street is marked by a growing disparity between market segments. Nasdaq recorded gains thanks to strong demand for companies related to artificial intelligence. Amazon shares jumped 4% after announcing a partnership with OpenAI, and Nvidia and Micron Technology also gained value after a series of high-profile industry deals. At the same time, data center company Iren signed a multi-year $9.7 billion deal with Microsoft, giving the tech company access to Nvidia GB300 graphics processors. It is worth noting that technology companies benefit from high margins, global scale, and access to groundbreaking AI solutions, which continues to drive growth among a select group of leaders.

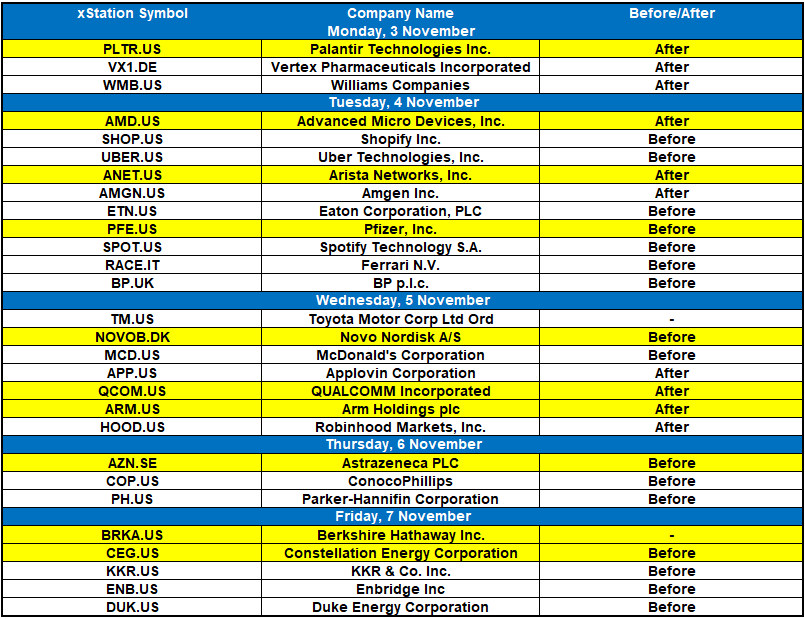

At the same time, broad market indices and industrial companies are lagging behind. Today, more than 400 companies in the S&P 500 are posting declines, and the Dow Jones index is already down nearly 0.8% in value. This deepens the trend of stratification, in which the performance and valuations of the entire market are increasingly dependent on a few technology giants. The poor performance of traditional companies, the high sensitivity of smaller companies to capital costs, and neutral consumer sentiment show that a possible correction in the AI group of companies could have a significant impact on the entire market. The results to be announced this week, including those of McDonald's and Palantir, will be a good opportunity to verify whether market sentiment reflects the real condition of the economy or continues to discount optimistic scenarios related to artificial intelligence.

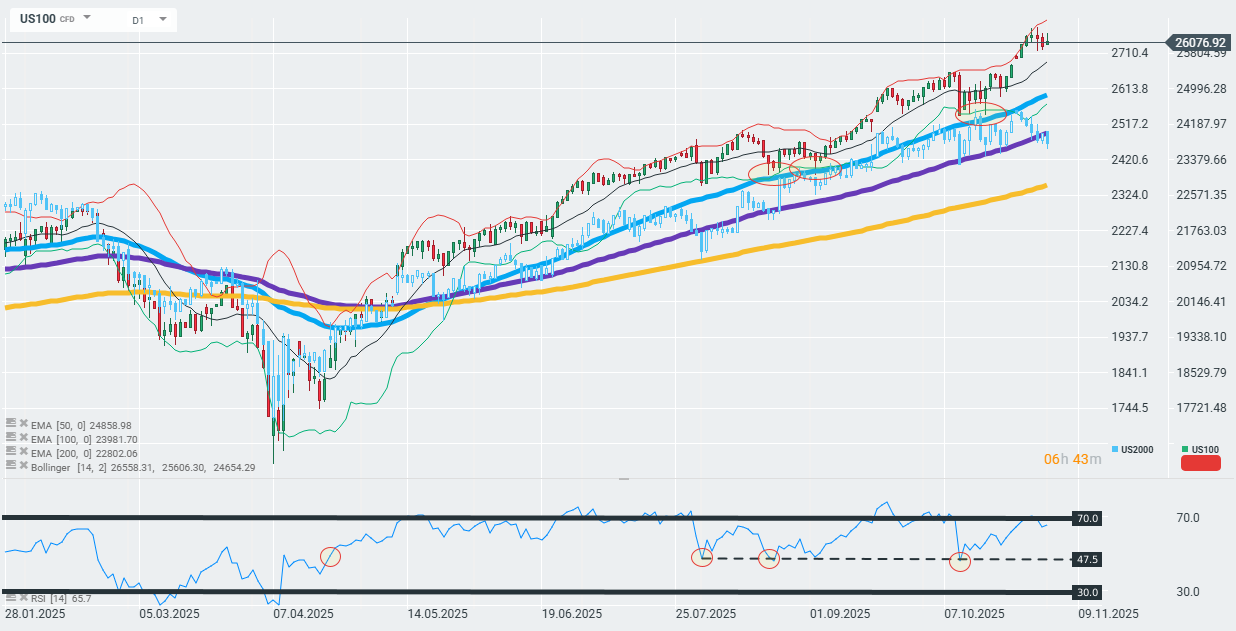

The US100 and US2000 have been following completely opposite paths for nearly two weeks. Importantly, however, both instruments remain above the 50-day EMA. Source: xStation

Company results scheduled for this week. Source: XTB

Daily summary: Cryptocurrencies under pressure; US100 drives Wall Street

BREAKING: EURUSD gains after US ISM data 💡

Chart of the day - OIL (03.11.2025)

BREAKING: PMI data from European countries came in line with expectations 🔎

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.